-

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

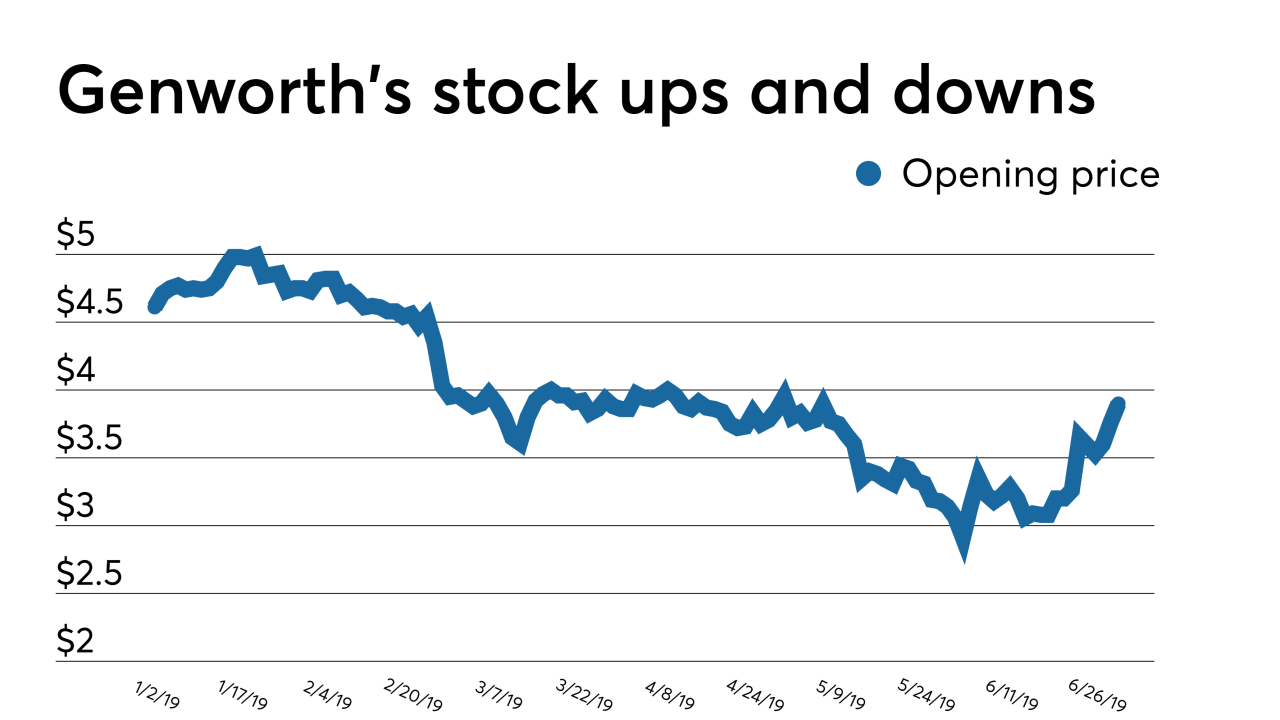

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20 -

The documents and other information needed for a loan application.

May 9 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

Arch Capital Group named Michael Schmeiser president and CEO of its U.S. mortgage insurance business as the former head moved up the corporate ladder.

March 4 -

Arch Capital’s next offering of credit risk transfer notes features heavy exposure to residential mortgages that have been modified by Fannie Mae or Freddie Mac.

March 1 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

Credit risk transfer does more than just reduce exposure to a downturn in the housing market. It also provides them with information about how others view mortgage credit risk.

February 27 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

Mortgage insurer Radian Group was in takeover talks with an investor group earlier this month including Apollo Global Management and Centerbridge Partners, before discussions stalled over the terms of a potential deal.

February 19 -

Genworth's U.S. mortgage insurance unit's adjusted operating income increased over the previous year as the lower corporate tax rate and lower loss ratio overcame a 9% reduction in new insurance written.

February 6 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31