-

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

November 20 -

Frank Cassidy, who is currently principal deputy assistant secretary at the Department of Housing and Urban Development, will soon face a full Senate vote.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

The economy added an unexpectedly robust 119,000 jobs in September, though unemployment edged up to 4.4%. The report, delayed by the federal government shutdown, continues a trend of sluggish job growth in recent months.

November 20 -

Federal Reserve Gov. Stephen Miran argues that banks holding excess reserves are keeping the central bank's balance sheet bigger than it should be, and suggested that regulatory changes could help bring those reserves down.

November 19 -

Travis Hill's nomination to lead the Federal Deposit Insurance Corp. was recommended favorably by the Senate Banking Committee to the full Senate Wednesday morning in a 13-11 party-line vote.

November 19 -

President Trump has nominated Stuart Levenbach, associate director of the Office of Management and Budget, to be the director of the Consumer Financial Protection Bureau. His selection allows acting CFPB Director Russell Vought to remain in place for at least another 210 days.

November 19 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

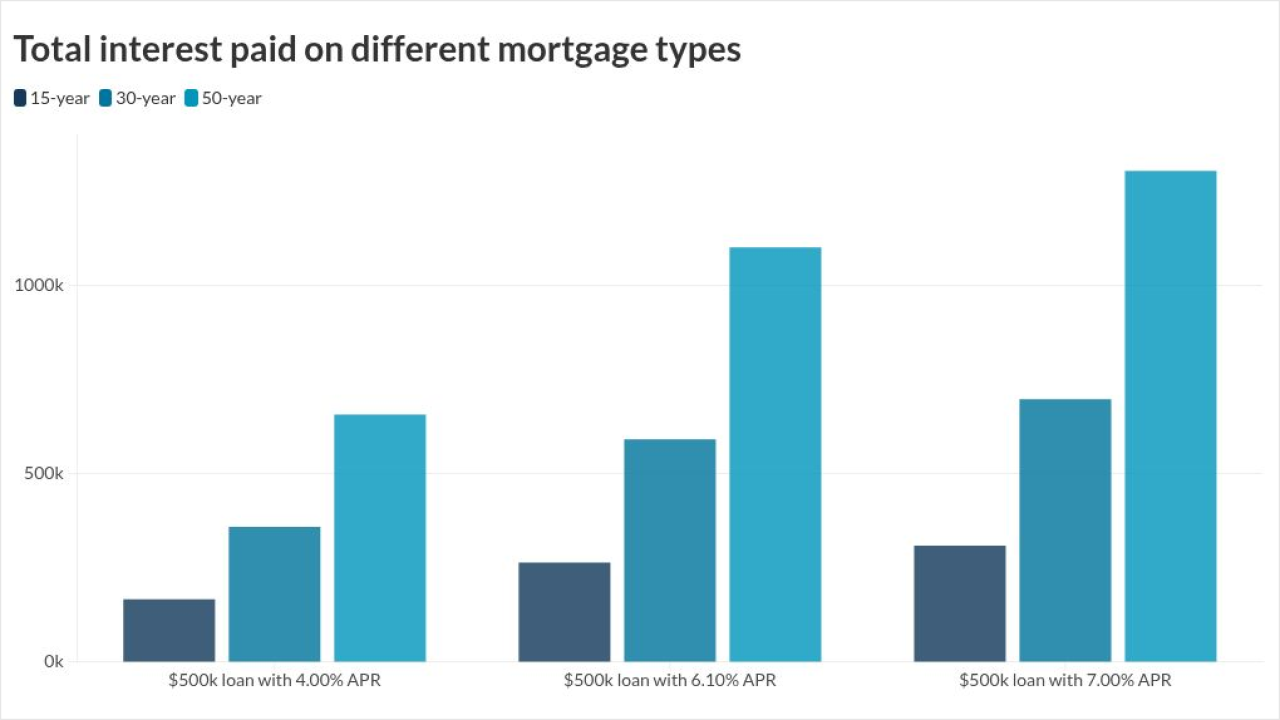

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

The Treasury secretary highlighted the impacts the bond market has on affordability and previewed regulatory tweaks the administration is eyeing to keep yields stable and credit flowing.

November 12 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12 -

A think tank's analysis of the system that provides banks with financing backed by an implied guarantee arrives amid broader federal efficiency reviews.

November 12 -

Congressmen introduced the Retroactive Renewal and Reauthorization Act to the House Monday, with hopes to backdate the reauthorization of the insurance program.

November 11 -

The Department of Justice told a court that the Consumer Financial Protection Bureau cannot legally request funding from the Federal Reserve System, arguing that the Fed has not turned a profit since 2022 and thus cannot fund the CFPB.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

President Donald Trump downplayed criticism of the potential creation of a 50-year mortgage product, saying it would help more Americans afford monthly payments on homes.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

The bill would provide pay for furloughed government workers, resume withheld federal payments to states and localities and recall agency employees who were laid off during the shutdown.

November 9 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9