-

The Treasury secretary highlighted the impacts the bond market has on affordability and previewed regulatory tweaks the administration is eyeing to keep yields stable and credit flowing.

November 12 -

Besides adding 60 days to the partial claim deadline in some cases, the bill also has provisions for buyer agent payments for Veterans Affairs borrowers.

November 12 -

A think tank's analysis of the system that provides banks with financing backed by an implied guarantee arrives amid broader federal efficiency reviews.

November 12 -

Congressmen introduced the Retroactive Renewal and Reauthorization Act to the House Monday, with hopes to backdate the reauthorization of the insurance program.

November 11 -

The Department of Justice told a court that the Consumer Financial Protection Bureau cannot legally request funding from the Federal Reserve System, arguing that the Fed has not turned a profit since 2022 and thus cannot fund the CFPB.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

President Donald Trump downplayed criticism of the potential creation of a 50-year mortgage product, saying it would help more Americans afford monthly payments on homes.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

The bill would provide pay for furloughed government workers, resume withheld federal payments to states and localities and recall agency employees who were laid off during the shutdown.

November 9 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

November 7 -

Federal Reserve Gov. Christopher Waller said there was a popular "misunderstanding" Thursday regarding who can qualify for a "skinny" master account, noting that only firms with a bank charter would qualify for approval.

November 6 -

Industry professionals shared stories of homeowners looking to get out and investors pausing deals, while others cautioned a wait-and-see approach.

November 6 -

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

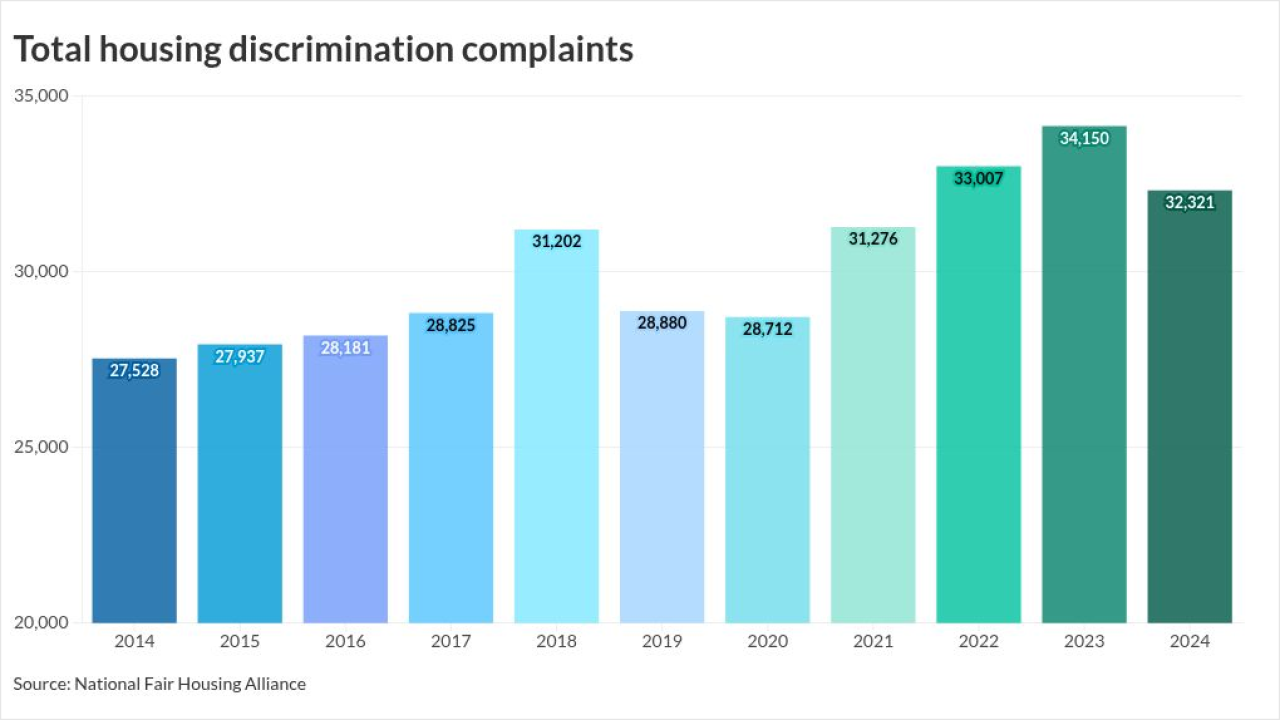

What makes the situation alarming is the government attack on the fair lending enforcement infrastructure, said Lisa Rice of the National Fair Housing Alliance.

November 5 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

Comptroller of the Currency Jonathan Gould said Tuesday that chartering compliant fintechs is "the only way" to level the playing field between banks and nonbanks. His comments come as the Office of the Comptroller of the Currency weighs new trust charters and stablecoin rules.

November 4 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said she wants banks to be competitive in the digital assets space, provided those operations are siloed from the traditional finance side of the business.

November 4