-

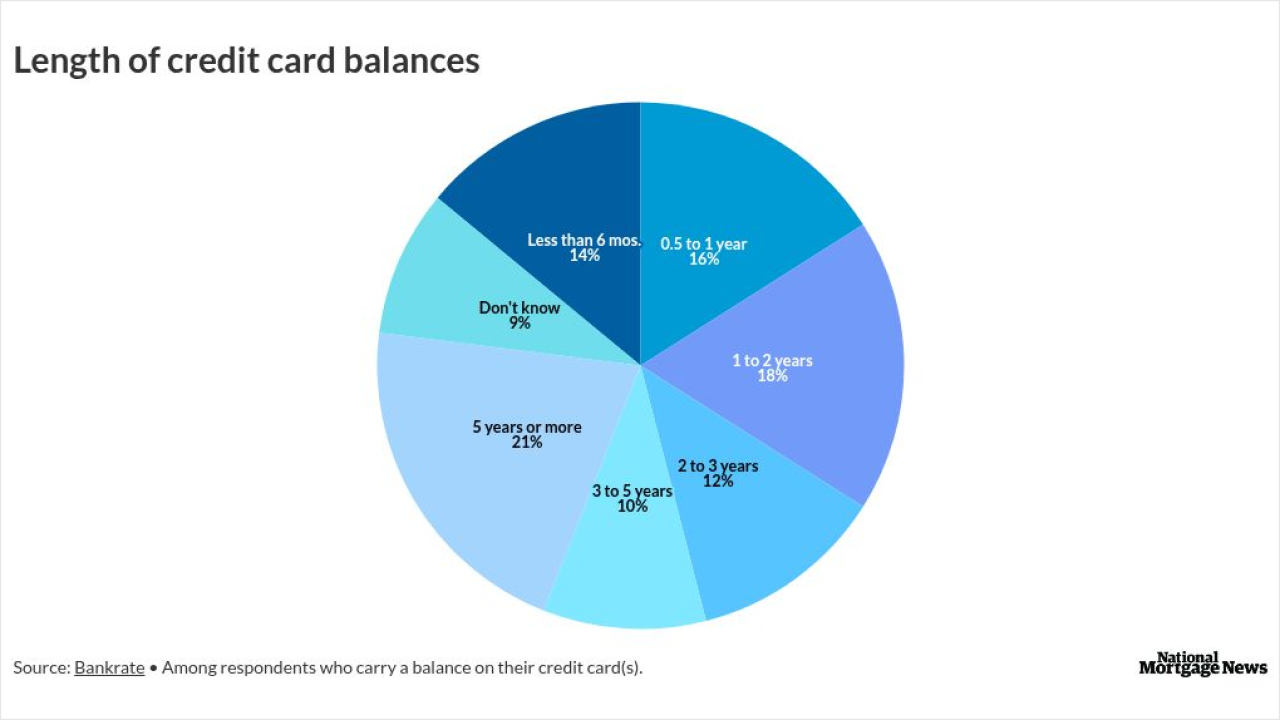

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

While the US military operation in Venezuela didn't hit sentiment on American financial markets, the action reminded investors how tenuous any trading thesis can be in a world undergoing geopolitical changes.

January 6 -

Federal Reserve Bank of Richmond President Tom Barkin said economic uncertainty should ease in the coming year as businesses gain confidence in sustained demand and adapt to the new policy environment.

January 6 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

Mamdani issued several other orders, including one that created a new office devoted to community engagement and three that concern housing and real estate.

January 2 -

A definitive move could occur as early as fiscal year 2026 or take until 2033, depending on what the government is willing to do, according to one analyst.

January 2 -

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

January 2 -

After the ceremony on Thursday, Mamdani announced three executive orders focused on housing affordability to kickstart his agenda.

January 2 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

December 29 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29