-

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

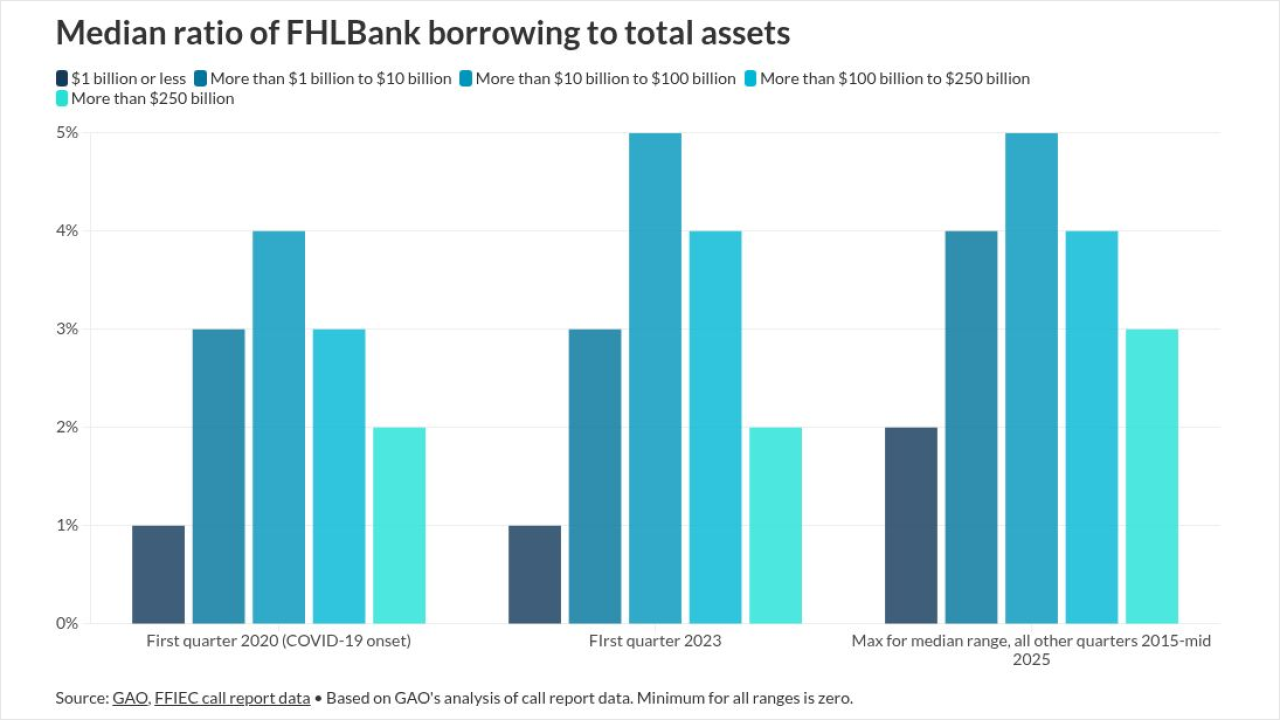

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

December 23 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

The Federal Reserve said in a statement that its "understanding of innovation products and services have evolved" since the initial guidance was published in 2023.

December 18 -

A markup of the bipartisan Housing for the 21st Century Act was passed by a 50-to-1 margin by the House Financial Services Committee earlier this week.

December 18 -

Further mortgage payment reductions and other "aggressive" changes to federal policy impacting homeowners are on the roadmap for the coming year.

December 18 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

December 12 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

December 11 -

On Thursday, prosecutors unsuccessfully tried again to ask a grand jury in a different Virginia court to return an indictment.

December 11 -

The House Financial Services Committee discussed allowing banks to experiment with artificial intelligence with a waiver from regulatory penalties, including consumer protection laws, in a hearing.

December 10 -

The Federal Reserve's interest rate-setting committee is widely expected to cut rates by 25 basis points today, but where the central bank goes from here is an open question.

December 10 -

Sen. Hassan sent letters to corporate owners of manufactured housing communities, looking for answers on affordability and living conditions for their residents.

December 10