-

In the New Jersey case, MV Realty and its principals agreed to pay $28 million in fines and restitution for these "Homeowner Benefit Agreements."

December 2 -

In a relatively mild oversight hearing in the House Financial Services Committee Tuesday morning, regulatory heads at the Federal Reserve, Office of the Comptroller of the Currency, National Credit Union Administration and Federal Deposit Insurance Corp. outlined plans for reduced capital requirements and debanking enforcement.

December 2 -

Recent high-profile ethics violations by senior Federal Reserve officials, including new revelations concerning stock trades by former Fed Gov. Adriana Kugler, have sparked debate over the effectiveness of the central bank's oversight, even as some observers stress such cases remain rare.

November 26 -

House Democrats argue that HUD's cut to the Continuum of Care Program could push 170,000 people to homelessness.

November 26 -

Swalwell alleges Pulte obtained and used the lawmaker's personal mortgage records in violation of US privacy laws and constitutional protections for political expression.

November 25 -

The Federal Reserve, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. issued a final rule Tuesday that softens leverage demands for the biggest and most systemically risky banks and lowers the community bank leverage ratio to 8%.

November 25 -

The new cap of $88 billion per company tops this year's $73 billion limit, but keeps pace with multifamily mortgage volume growth in recent months.

November 25 -

The Justice Department subpoenaed a key witness in the case, questioning the conduct of Bill Pulte and Ed Martin.

November 25 -

A federal judge threw out the criminal charges against former FBI Director James Comey and New York Attorney General Letitia James, ruling that the prosecutor who brought the cases had been illegally appointed.

November 24 -

The average premium increase is 64% or $600 a year more, and in some states the rate would go up by more than $1,000, the comparison shopping platform found.

November 21 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20 -

Federal Reserve Gov. Lisa Cook, citing several studies, outlined her concerns Thursday that generative AI could be used to manipulate markets, and regulators have not yet thought through how to police such activity.

November 20 -

Frank Cassidy, who is currently principal deputy assistant secretary at the Department of Housing and Urban Development, will soon face a full Senate vote.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

The economy added an unexpectedly robust 119,000 jobs in September, though unemployment edged up to 4.4%. The report, delayed by the federal government shutdown, continues a trend of sluggish job growth in recent months.

November 20 -

Federal Reserve Gov. Stephen Miran argues that banks holding excess reserves are keeping the central bank's balance sheet bigger than it should be, and suggested that regulatory changes could help bring those reserves down.

November 19 -

Travis Hill's nomination to lead the Federal Deposit Insurance Corp. was recommended favorably by the Senate Banking Committee to the full Senate Wednesday morning in a 13-11 party-line vote.

November 19 -

President Trump has nominated Stuart Levenbach, associate director of the Office of Management and Budget, to be the director of the Consumer Financial Protection Bureau. His selection allows acting CFPB Director Russell Vought to remain in place for at least another 210 days.

November 19 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

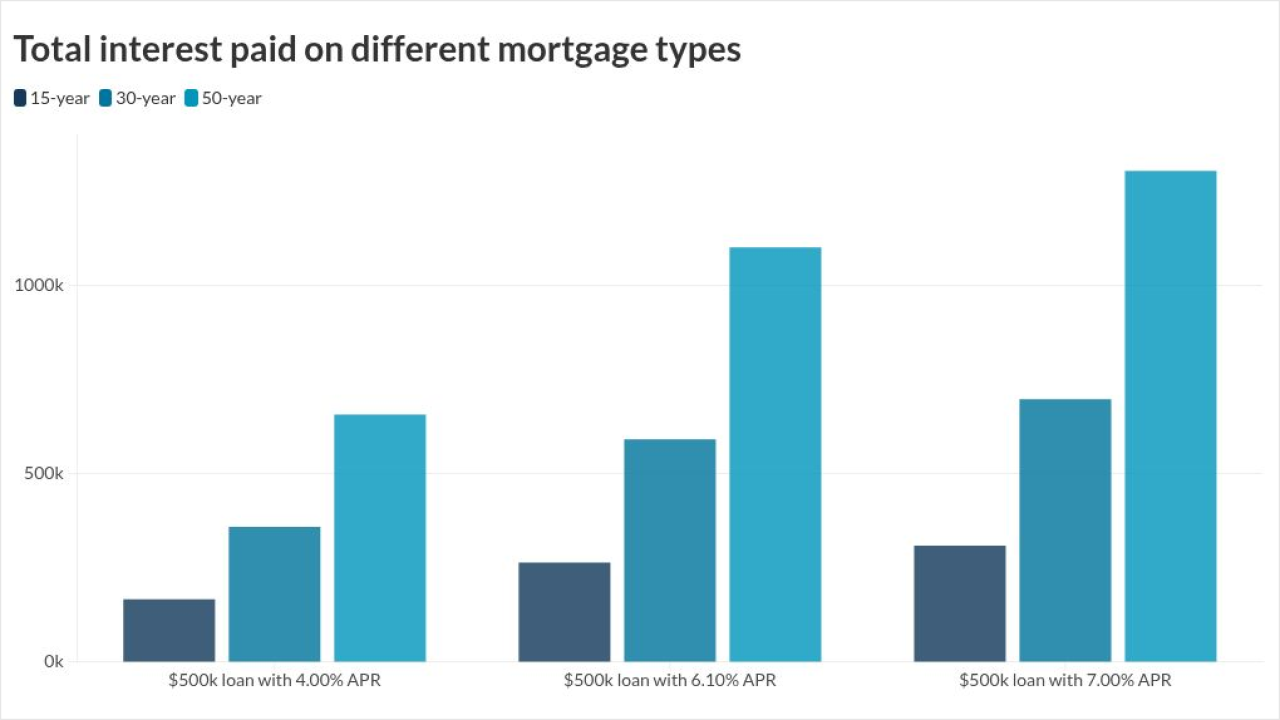

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13