-

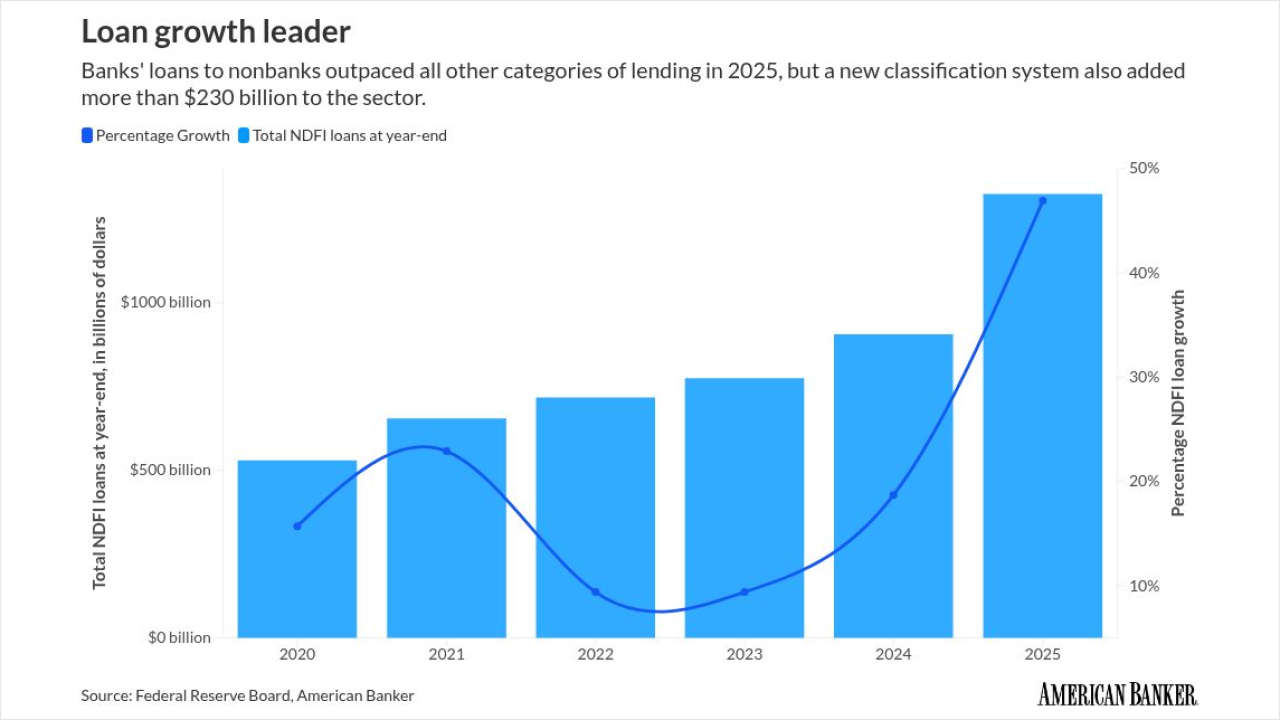

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

Despite certain pronouncements otherwise, rumors of email's demise have been gravely exaggerated, as recent data shows it's not only still around, it's ubiquitous.

December 24 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22 -

Overall satisfaction is highest when customers receive status updates from mobile apps, according to the J.D. Power's 2025 U.S. Claims Digital Experience Study.

December 22 -

The home purchase market, which competes for consumers with rentals, should remain subdued in 2026 because of high mortgage rates and low affordability.

December 15 -

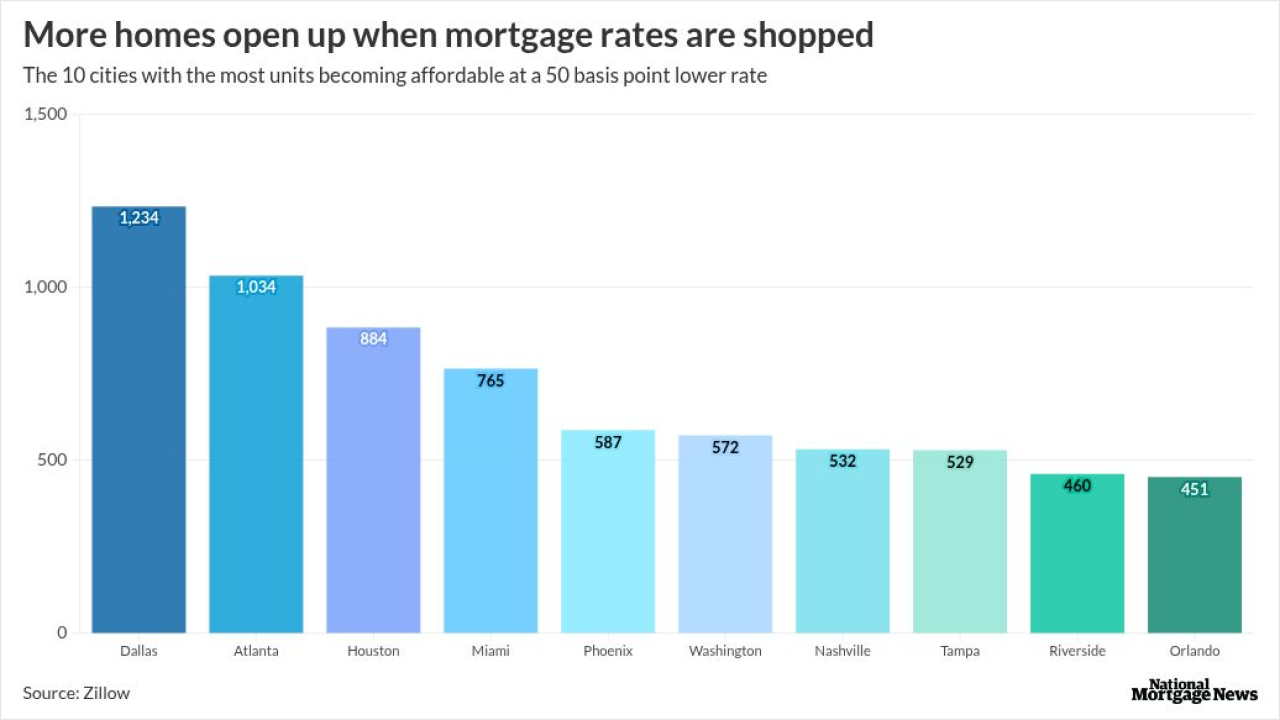

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

The all-stock acquisition of Mountain Commerce Bancorp in Knoxville marks the Arkansas-based company's first M&A foray since 2022.

December 8 -

Bank of America was the leader in this study, with Rocket as the only nonbank mortgage lender which got a score higher than the industry average.

December 4 -

Planet Home Lending, helped by growing recapture and distributed retail volume, did 64% more originations in the third quarter than one year prior.

December 1 -

Recent high-profile ethics violations by senior Federal Reserve officials, including new revelations concerning stock trades by former Fed Gov. Adriana Kugler, have sparked debate over the effectiveness of the central bank's oversight, even as some observers stress such cases remain rare.

November 26 -

The credit card will provide borrowers points for making their normal monthly mortgage loan payments and for the purchase of home products and services.

November 21 -

A Georgia resident filed the suit after receiving two unsolicited calls from the lender in October even though her number appeared on the Do Not Call registry.

November 12 -

While Rocket increased 15 points, it slipped to 11th overall as other mortgage lenders had higher customer service score growth, J.D, Power said.

November 12 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

While Rocket Mortgage's satisfaction score improved by 4% versus 2024, the industry as a whole dropped 1%, with credit unions outpacing banks and IMBs.

October 28 -

The Long Island-based bank hasn't been profitable in eight quarters, but executives maintain that it's on the right path, citing more loan book diversity, lower expenses and an improved margin.

October 24 -

Kin, a direct-to-consumer insurance provider, has started a mortgage broker in Florida which also takes loan applications through a call center or online.

October 21