Regulation and compliance

Regulation and compliance

-

There were signs Kathy Kraninger would continue a rollback of consent orders and investigations, but many observers see an aggressive approach reminiscent of the Obama era.

September 18 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

Lower rates and signs that more affordable housing inventory is being built drove Fannie Mae's 2019 origination numbers higher in its latest forecast.

September 17 -

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

Deutsche Bank is cooperating with the Justice Department's antitrust investigation into whether several of the largest global banks conspired to rig trading in unsecured bonds issued by Fannie Mae and Freddie Mac.

September 12 -

The Supreme Court may be closer to examining a key restraint on a president's ability to change CFPB leadership.

September 12 -

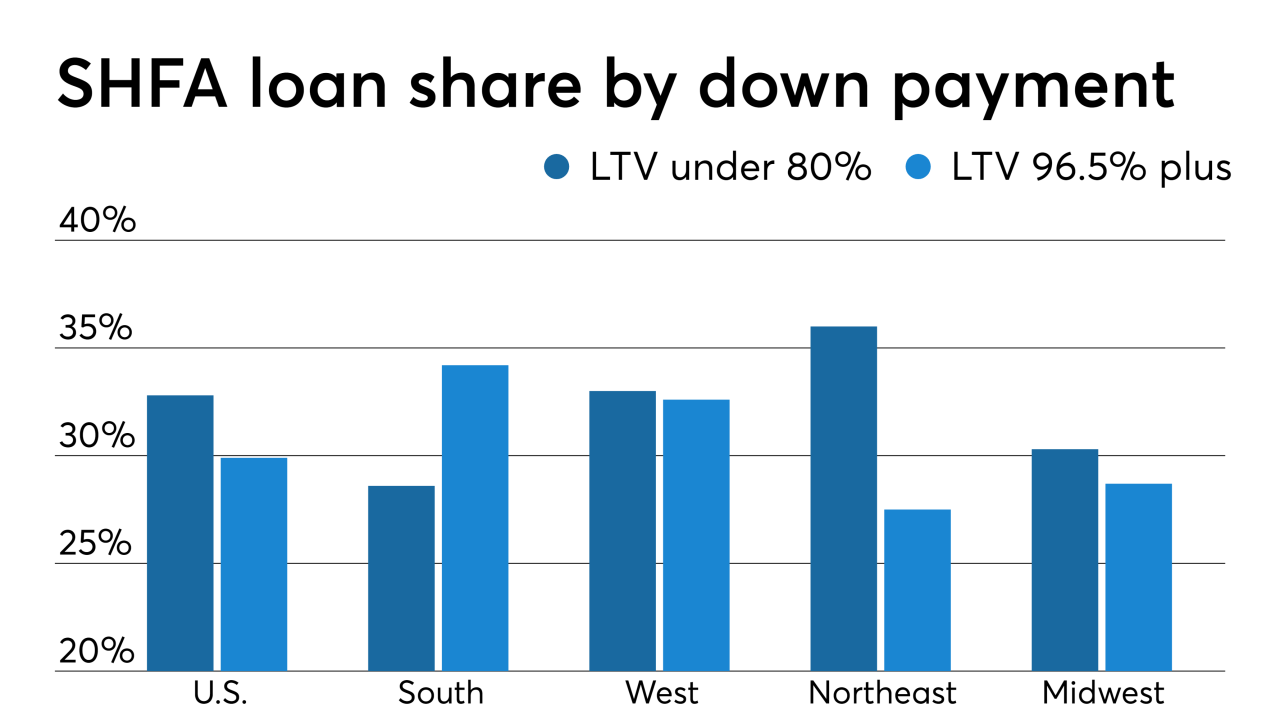

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The regulator for Fannie Mae and Freddie Mac suggested that a finalized capital framework for the two mortgage giants could be published by the end of the year.

September 11 -

A West Chicago, Ill., property developer is accused by federal authorities of operating a Ponzi scheme that defrauded more than 300 investors in 32 states of at least $41.6 million.

September 11 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

Federal appeals court judges in New Orleans on Friday appeared to back claims by investors that Treasury's "net worth sweep" is illegal.

September 10 -

Senate Banking Committee members feel urgency to pass a bill dealing with Fannie Mae and Freddie Mac, but the same obstacles that have stalled congressional action for years remain.

September 10 -

Stewart Information Services has decided to make some big changes at the top following the dissolution of a planned merger with Fidelity National Financial.

September 10 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

A Pinellas County, Fla., Realtor with a controversial past faces possible revocation of his real estate license.

September 10 -

When the former vice president and Massachusetts senator appear together in Houston, they could present two contrasting visions of financial policy within the presidential field.

September 9 -

Public orders are an effective way to discourage violations of consumer protection law, the bureau's director said at a credit union conference.

September 9 -

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

September 9