Regulation and compliance

Regulation and compliance

-

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

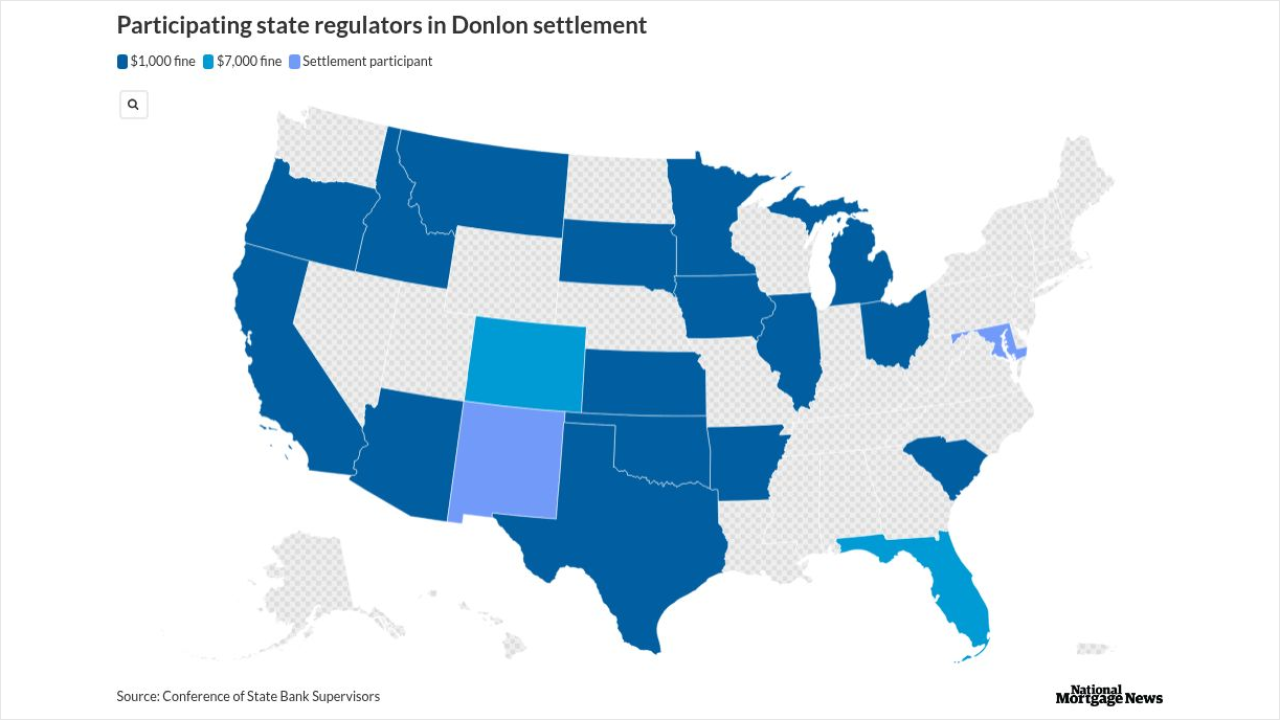

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23 -

A group of 22 Democratic state attorneys general filed a lawsuit against acting Consumer Financial Protection Bureau Director Russell Vought, the bureau and the Federal Reserve, arguing that the administration's position that the CFPB cannot be funded is wrong.

December 23 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

A coalition of mortgagees said the zombie seconds law negatively impacts 1.2 million junior liens statewide, despite just over 500 potential "zombie" loans.

December 18 -

A federal appeals court agreed to have the full bench rehear arguments by the Consumer Financial Protection Bureau's union about whether the Trump administration planned to gut the agency through mass firings.

December 17 -

The Department of Justice wants Federal Reserve Chair Jerome Powell to state if the central bank is profitable again and can, therefore, fund the Consumer Financial Protection Bureau.

December 17 -

The bill's signing comes weeks after one of the most notorious NTRAP providers agreed to legal settlements in two states, nullifying existing contracts.

December 17 -

The threshold regards loans where the annual percentage rate is at least 1.5 percentage points higher than the average prime offer rate on first liens.

December 15 -

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

The House Financial Services Committee discussed allowing banks to experiment with artificial intelligence with a waiver from regulatory penalties, including consumer protection laws, in a hearing.

December 10 -

The Federal Reserve's interest rate-setting committee is widely expected to cut rates by 25 basis points today, but where the central bank goes from here is an open question.

December 10 -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

A federal court cannot modify a preliminary injunction to compel the acting director of the Consumer Financial Protection Bureau to request funding for the agency, the Department of Justice said.

December 9 -

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

December 9