-

Kraninger's nomination was lauded by industry groups, but vigorously opposed by consumer groups and Democratic lawmakers.

December 6 -

A motion to limit debate on the nominee to run the consumer bureau passed along strictly party lines, setting the stage for her to be confirmed as early as next week.

November 29 -

Kathy Kraninger, who may get a confirmation vote as early as this week, has suggested a similar vision to that of the agency’s current acting chief. But some see signs she could bring a different approach to the job.

November 27 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

Regulators typically write rules before applying them. But the CFPB is attempting the reverse.

November 11 -

Several Senate, House and gubernatorial battles are of interest to financial firms. Here is a spotlight on specific contests, with updates as they become available.

November 6 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

The battle gaining the most attention Tuesday night will be which party controls the House next year. But other key races will help determine the makeup of the Senate Banking Committee.

November 4 -

Protecting consumers from intrusive cold calls and fax-spamming is having adverse effects on the mortgage industry as the Federal Communications Commission fails to reasonably interpret language under the Telephone Consumer Protection Act, according to the Mortgage Bankers Association.

October 25 -

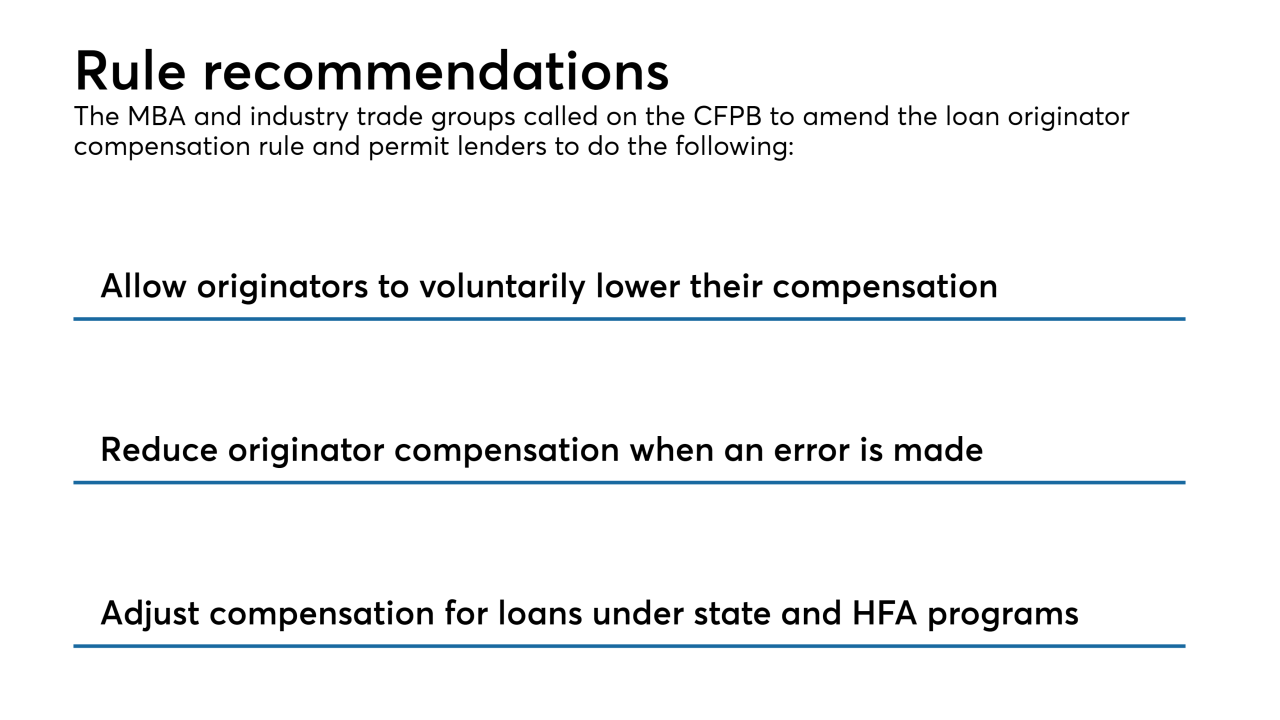

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

In its proposed “disclosure sandbox,” the bureau has eased restrictions on firms seeking a safe harbor from liability.

September 17 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

The central bank, which received broad authority after the crisis to supervise big banks, is expected to get more attention from lawmakers over its discretion to ease banks’ burden.

September 10 -

Kathy Kraninger has been tight-lipped about her plans for the consumer bureau, but some point to signs that she could curb the agency's power by reducing staff and other costs.

September 4 -

The Consumer Financial Protection Bureau issued an interpretive rule Friday to clarify changes made to the Home Mortgage Disclosure Act that were mandated by President Trump's regulatory relief law.

August 31 -

A new law exempts small lenders from expanded mortgage data reporting, but regulators are signaling that banks no longer have to collect the data either.

August 2 -

The House Financial Services Committee chair also acknowledged that his capital-formation bill still faces a potentially tough Senate vote.

July 25 -

The Federal Housing Finance Agency is suspending its ongoing review of new credit scoring models and will instead move forward with creating a regulatory framework for providers of alternative credit scores to apply and be evaluated for use by Fannie Mae and Freddie Mac.

July 23 -

The federal bank regulators are considering roughly a dozen new rulemakings in response to the bill rolling back certain sections of Dodd-Frank.

July 20