-

The critical defect rate for closed mortgage loans continued its decline in the second quarter, as lenders benefited from increased loan volume and profitability, an Aces Risk Management study found.

December 19 -

Lender profitability rose to a high not seen since 2012 in the Mortgage Bankers Association's latest quarterly report despite some variability in revenue generated per loan.

November 21 -

Many mortgage servicers are still relying on spreadsheets to manage their tasks, rather than looking to automation as a problem solver.

October 17 Clarifire

Clarifire -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

Independent mortgage banks became profitable again at the start of the year after realizing losses of $200 for each loan they originated in the fourth quarter of 2018, according to the Mortgage Bankers Association.

June 6 -

The moves are part of a plan CEO Rajinder Singh discussed in a conversation with American Banker.

May 17 -

Bank 34 will no longer sell mortgages in the secondary market as it looks to reduce its reliance on volatile revenue streams.

May 7 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17 -

Independent mortgage bankers lost the largest amount for originating a loan in the fourth quarter since this data has been tracked, as costs rose and volume dropped, according to the Mortgage Bankers Association.

March 26 -

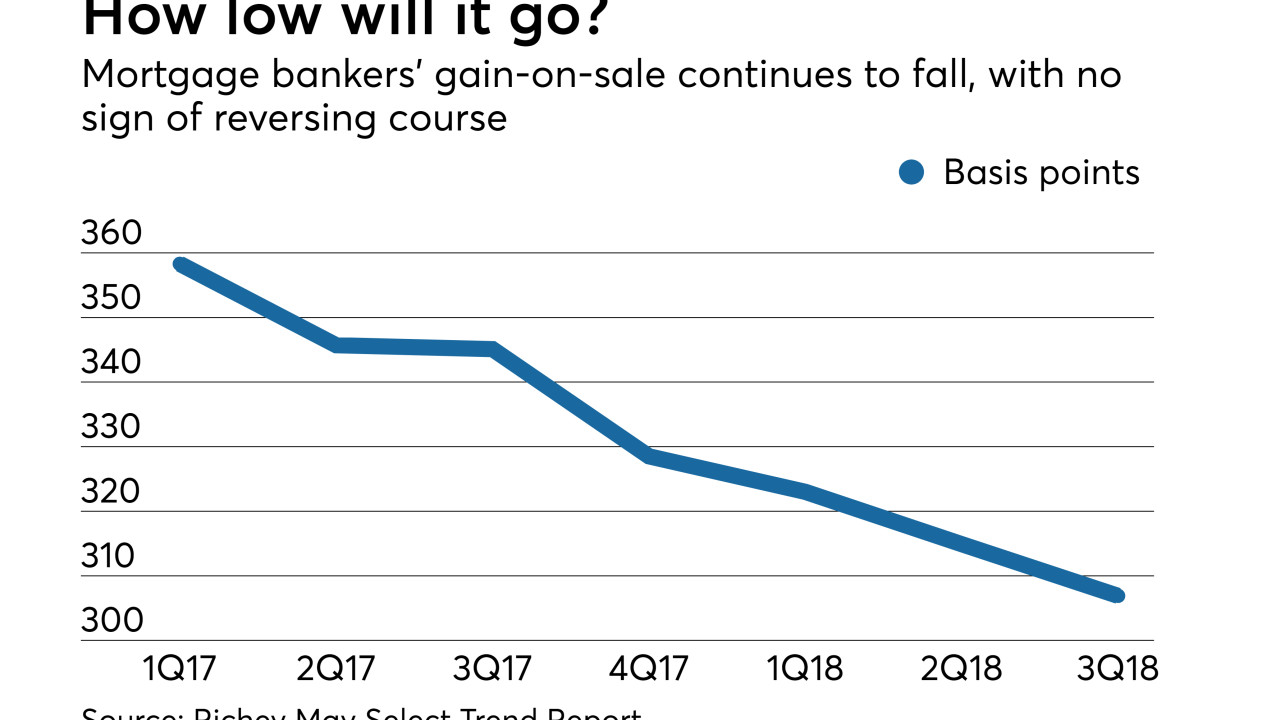

Mortgage lenders' gain on the sale of loans to the secondary market has finally increased after several quarters of declines, according to Richey May.

March 15 -

Financial consultancy Richey May has purchased mortgage business analytics provider Amata Solutions in a deal that will help the acquiring company further build out the technology-consulting division it started last year.

January 24 -

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

With spring homebuying in bloom, the second quarter brought profits to independent mortgage bankers after going negative for the second time ever, according to the Mortgage Bankers Association.

August 29 -

The Seattle company is firing 127 people, or a tenth of its mortgage staff, after enduring months of slow activity.

June 14 -

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

The Tennessee company also set high expectations for revenue opportunities while projecting it will deliver a 15% return on equity in 2019.

December 5 -

Higher costs dampened mortgage lenders' profitability, outweighing near-term gains in origination volume and per-loan revenue during the third quarter, according to the Mortgage Bankers Association's quarterly.

December 1 -

Fee income also surged as the San Francisco bank reached the $100 billion mark in wealth management assets.

October 13 -

The company also seems to be shifting the narrative to operational performance after addressing claims of questionable insider dealings.

March 8