-

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

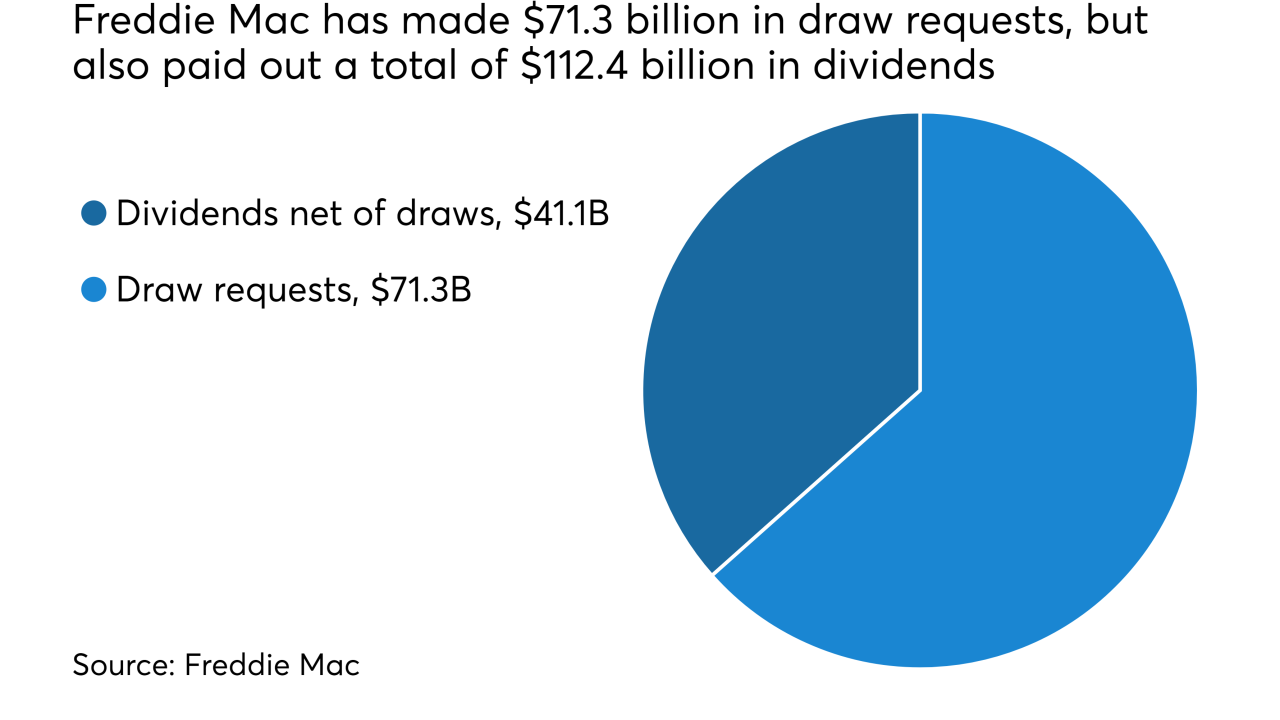

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

CoreLogic has updated its Risk Quantification and Engineering tool amid California wildfires to include U.S. Wildfire and U.S. Severe Convective Storm models to support the mortgage and insurance industries in better assessing natural disaster risk.

July 31 -

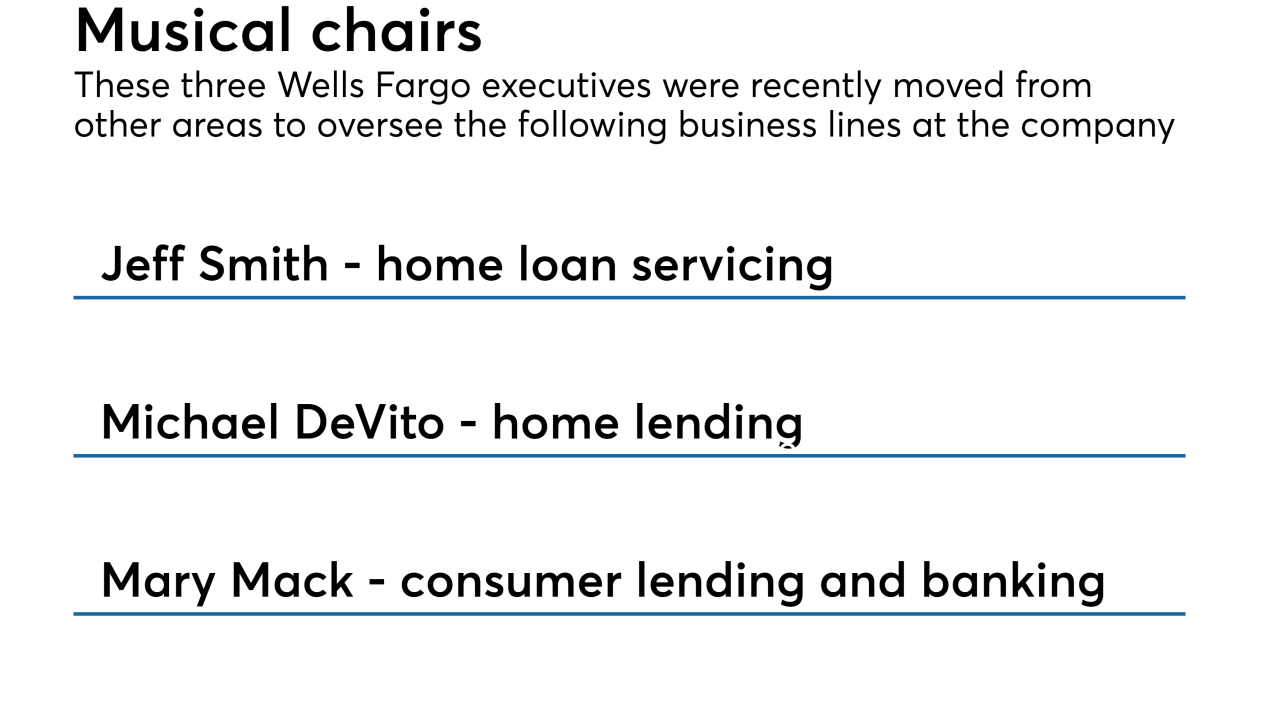

Wells Fargo has named Senior Vice President Jeff Smith to succeed Perry Hilzendeger as head of home loan servicing following Hilzendeger's earlier appointment to head of retail home lending.

July 26 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

The high cost of preparing for both CFPB and state exams has a disproportionate impact on small independent mortgage banks that don't have the compliance economies of scale of larger lenders.

July 19 MLB Residential Mortgage

MLB Residential Mortgage -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

Blue Lion Capital, which is upset with the Seattle company's growth strategy, also wants to replace two of the company's directors.

February 26 -

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Servicers that handle loans in the government's Making Home Affordable program could face more enforcement at the urging of the Special Investigator General for the Troubled Asset Relief Program.

February 1 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29