-

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

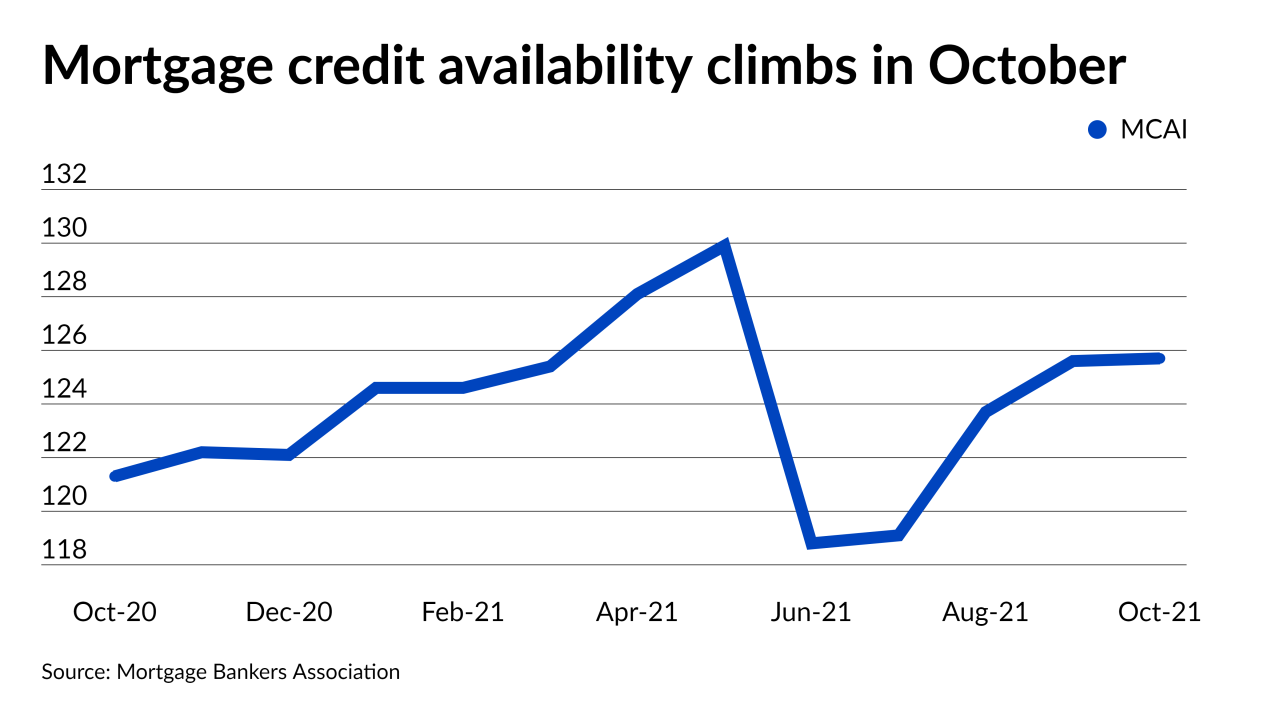

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

The seasoning clock for securitization eligibility restarts when a modification takes place, the government agency said.

November 4 -

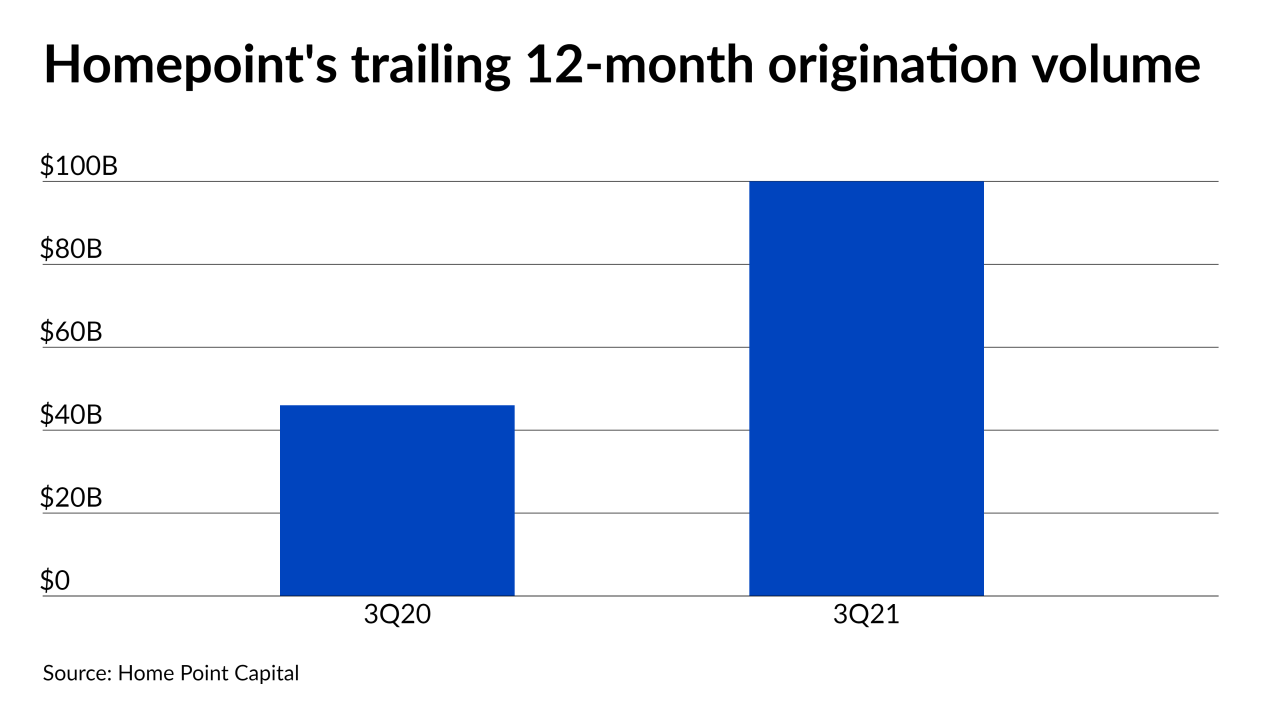

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

The Fed said it would reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of the program aimed at shielding the economy from Covid-19.

November 3 -

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29