-

The move suggests the government bond insurer doesn’t expect to see loan performance return to normal levels until next summer.

September 13 -

The technology could help firms that have had less access to automation and generally have conducted trades used to hedge loan pipelines by phone.

September 10 -

While overall volume was down in August, it remained historically strong, particularly in the securitized market for home equity withdrawal loans made to borrowers age 62 and up.

September 9 -

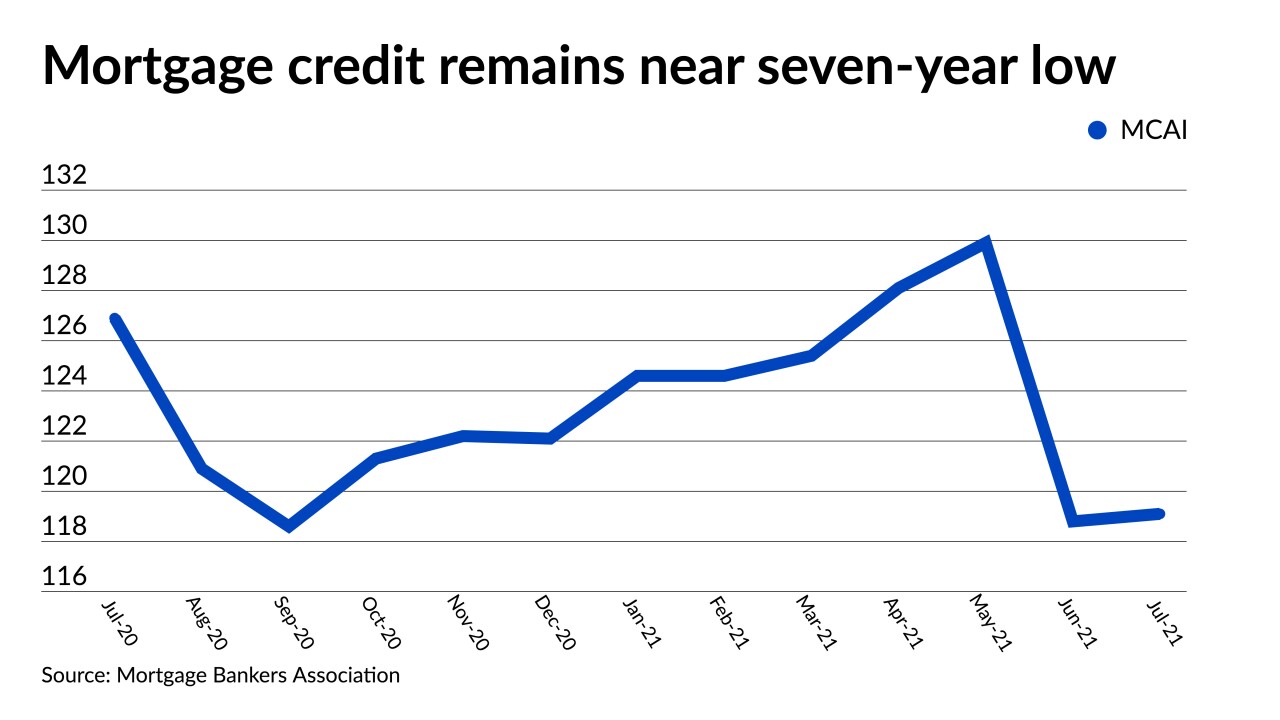

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

The government-sponsored enterprises and their regulator are building on broader efforts by the Biden administration to close racial gaps in homeownership rates.

September 7 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

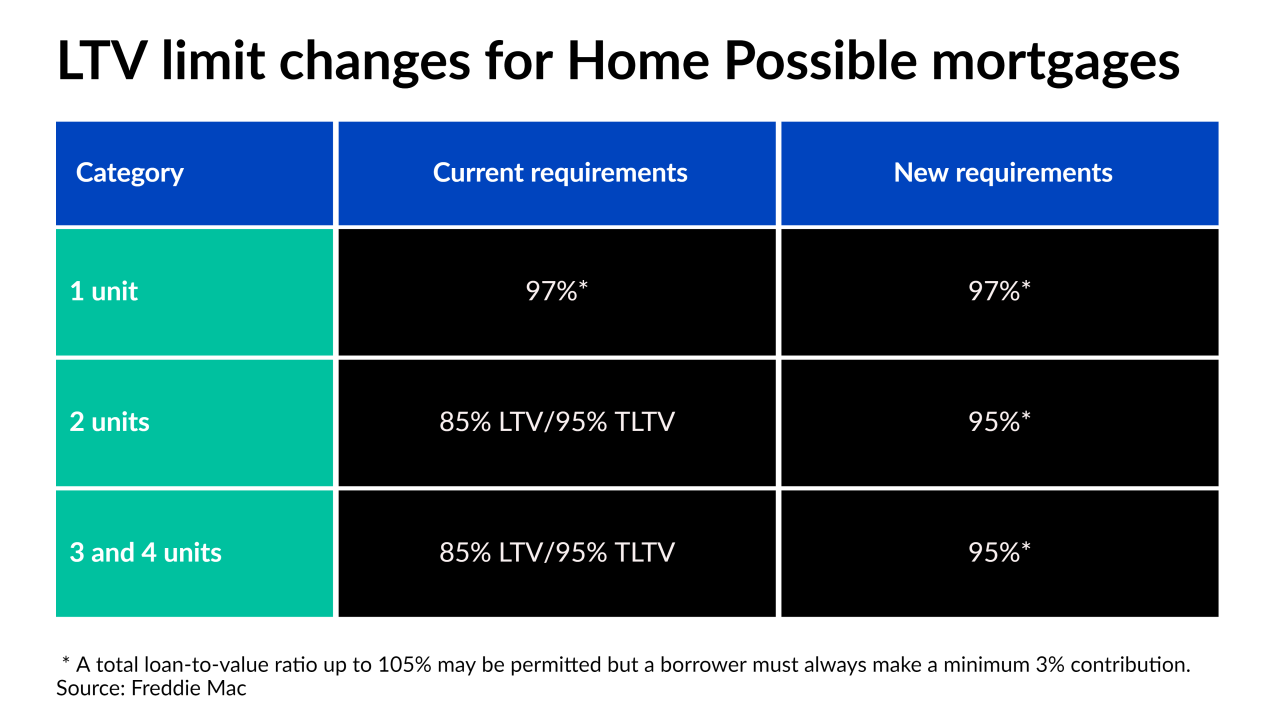

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

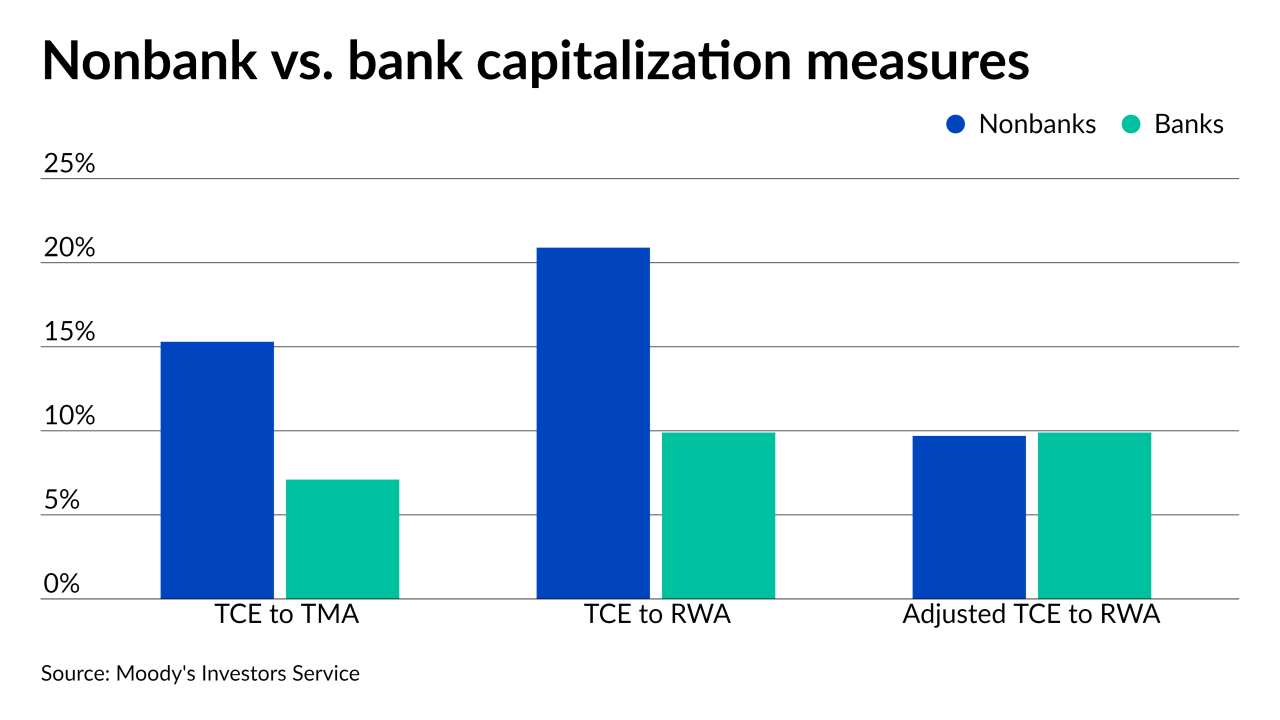

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

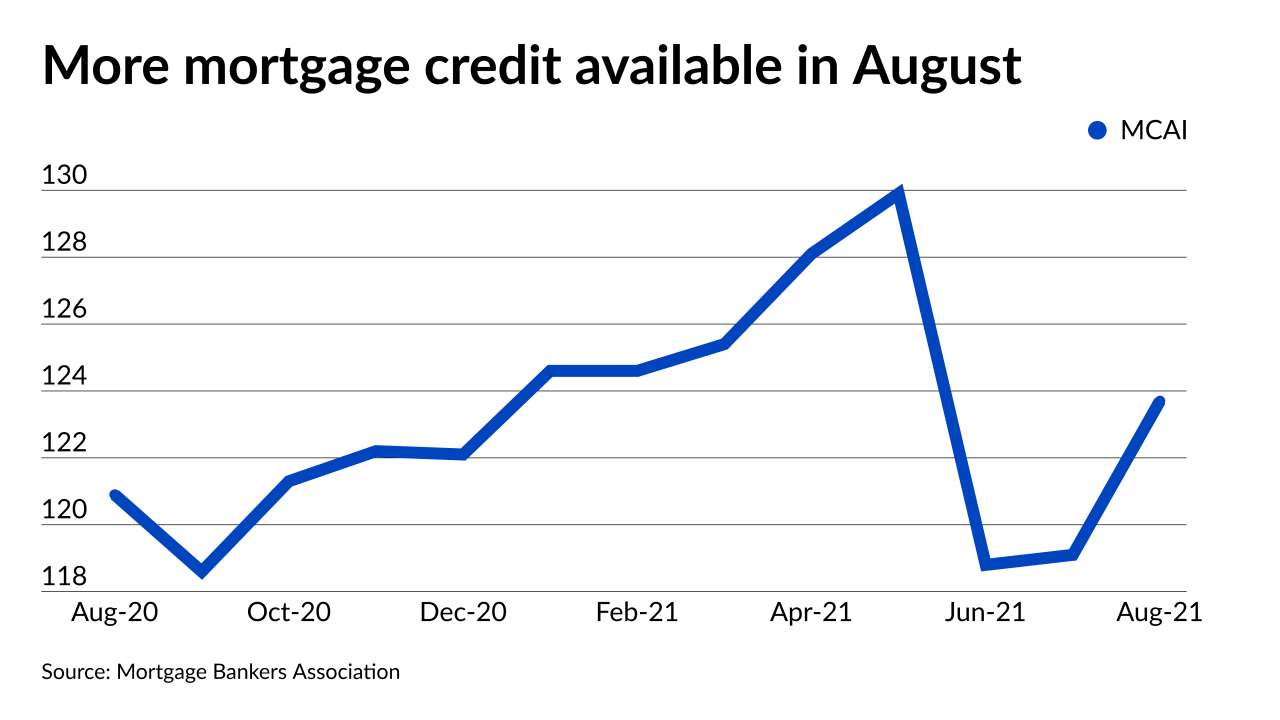

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The company’s results included some transitory revenue sources, including early buyouts of loans in forbearance from securitized pools, but executives plan to maintain growth over time through economies of scale.

July 29 -

The MISMO protocols are aimed at ensuring nothing is lost in translation when information about billing, late payments and related processing moves to a new system.

July 28 -

The acquirer will use the liquidation of a residential mortgage company’s assets to move several notches up in the rankings.

July 26