-

Mortgage loan officer compensation remained level year-over-year as an unexpected surge in originations surprised employers expecting it to be a down year, an LBA Ware report said.

January 17 -

Bank of America's fourth-quarter mortgage origination volume more than doubled on a year-over-year basis, a faster pace of growth than two of its national banking peers.

January 15 -

Fourth quarter gain on sale margin moved in opposite directions at two of the nation's largest banks, falling 9% quarter-over-quarter at JPMorgan Chase, but increasing 25% at Wells Fargo.

January 14 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 7 -

High-grade corporate bonds bested mortgages by a wide margin in 2019 and are likely to outperform them again this year, according to JPMorgan Chase & Co.

January 6 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

Fitch may use a new Structured Finance Association framework aimed at prioritizing only riskier TRID errors to assign grades to loans sold into residential mortgage-backed securities, reducing rating-related compliance burdens.

December 17 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Star investor Jeffrey Gundlach and his team have generated strong returns by focusing on under-followed pockets of the market like mortgage securities, but his success may be hard to replicate.

December 13 -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Lender profitability rose to a high not seen since 2012 in the Mortgage Bankers Association's latest quarterly report despite some variability in revenue generated per loan.

November 21 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

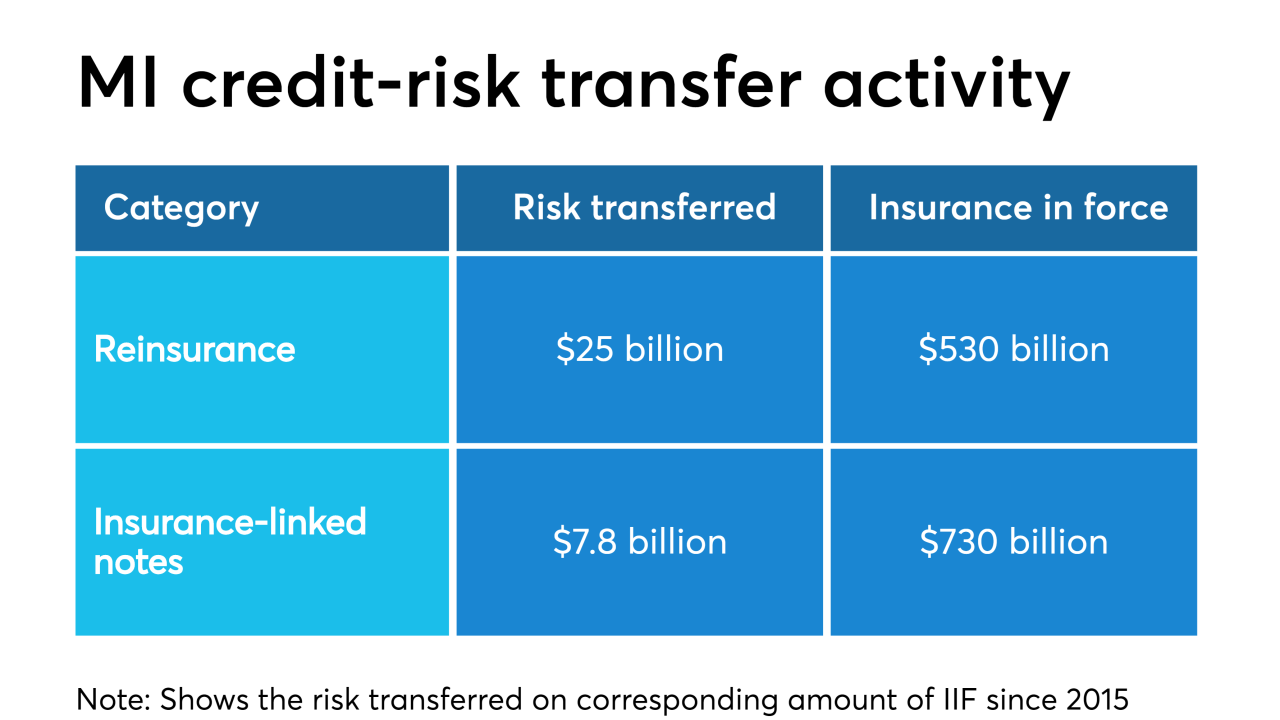

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28