-

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Lender profitability rose to a high not seen since 2012 in the Mortgage Bankers Association's latest quarterly report despite some variability in revenue generated per loan.

November 21 -

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

The Federal Housing Finance Agency has extended its deadline for investor comments on a proposal aimed at better aligning pooling practices for loans in uniform mortgage-backed securities.

November 19 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

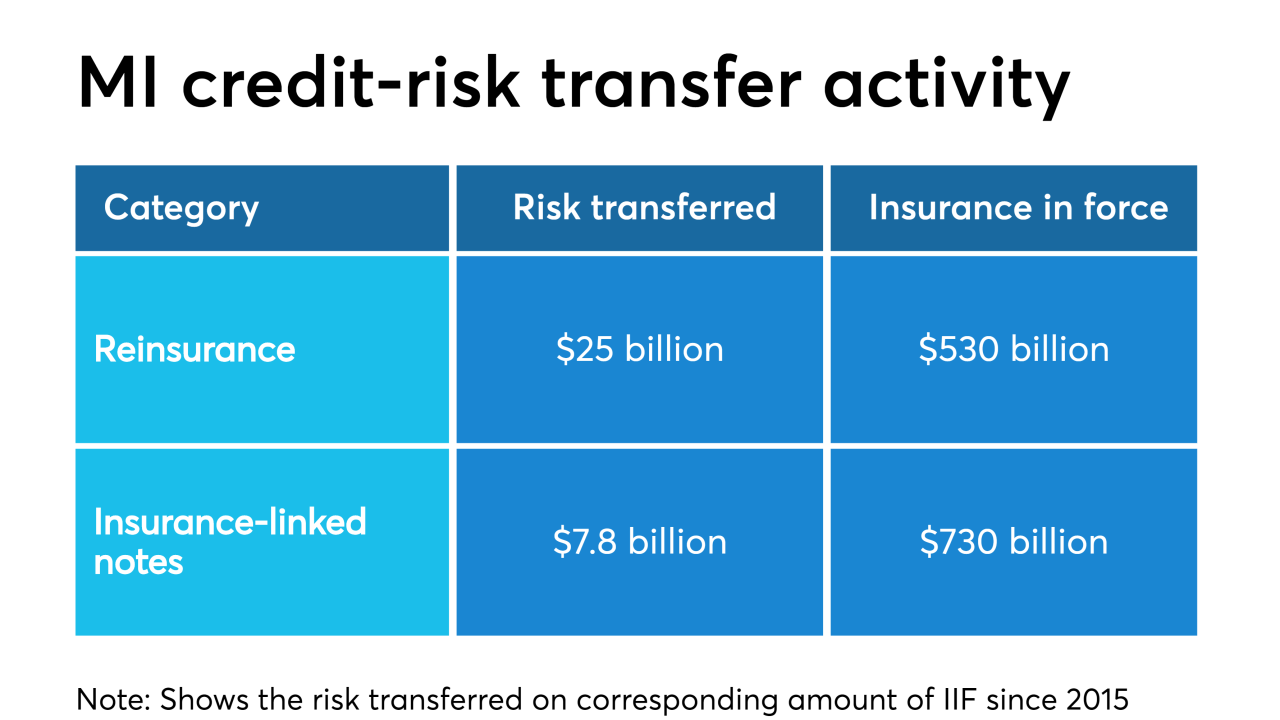

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

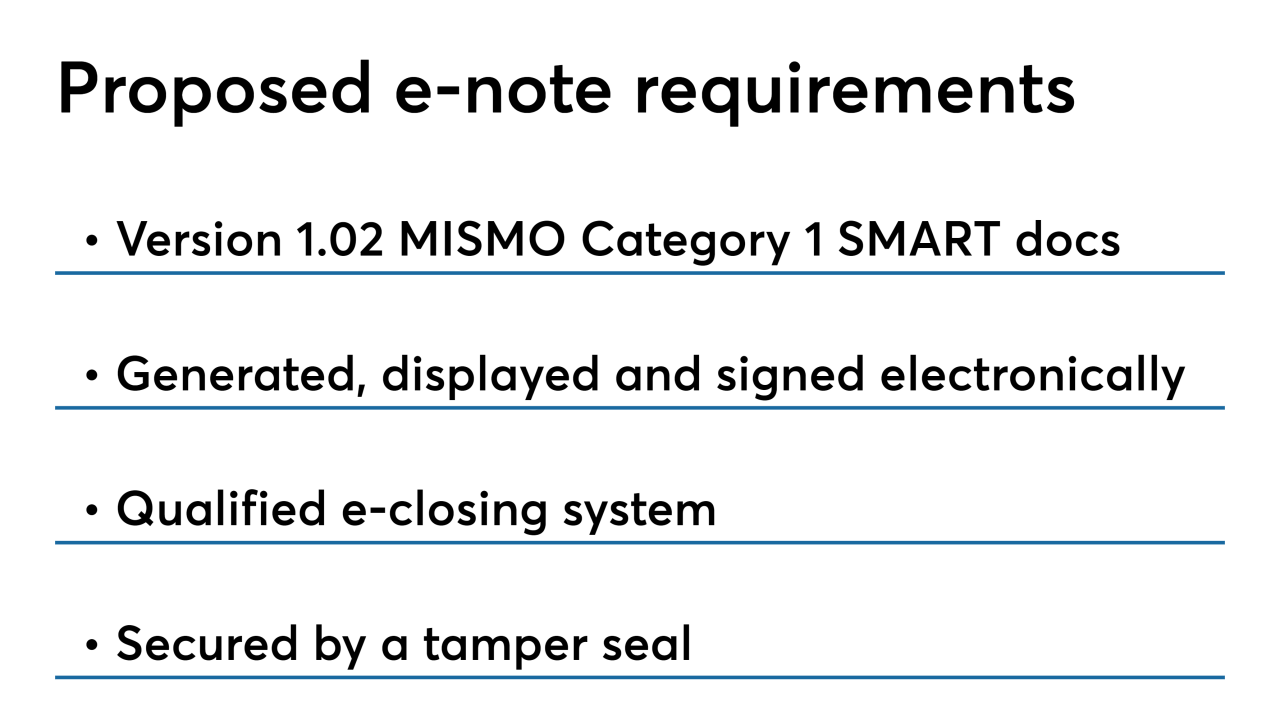

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

For the mortgage industry, the question of whether the Fed can control its target range for interest rates is crucial for managing volatility.

October 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Origination volumes continued to drift upward at JPMorgan Chase and Wells Fargo in the third quarter as mortgage servicing rights values fell more sharply than some analysts expected.

October 15 -

The ways in which hedging can be improved by a digital process are more often than not presumed versus proven by industry practice.

October 11 Vice Capital Markets

Vice Capital Markets -

Maren Kasper, who has led Ginnie Mae in the absence of a permanent president, is leaving the agency on Oct. 18 to pursue an opportunity in the private sector.

October 10 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

David Lowman, executive vice president of the single-family business at Freddie Mac, has informed the company he will be stepping down from his position on or about Nov. 1.

October 8 -

Ginnie Mae's stress testing model was based on large issuers, and does not appear to adequately reflect important qualitative differences between larger and smaller issuers.

October 1 Hallmark Home Mortgage

Hallmark Home Mortgage -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

The Federal Housing Finance Agency is ending a Freddie Mac pilot that posed a competitive threat to the private market for mortgage servicing rights financing.

September 19 -

The spike in overnight repurchase agreements may prompt the Federal Reserve to expand its balance sheet.

September 18