-

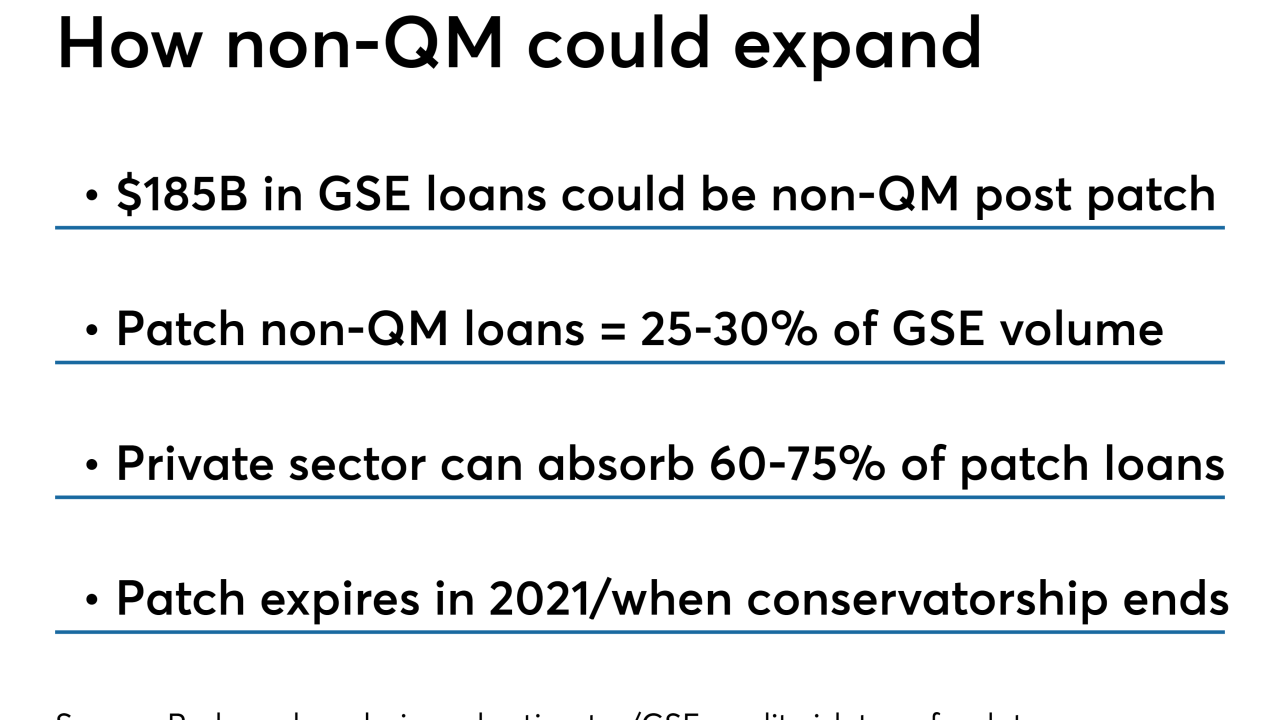

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Despite the benefits of going to a fully or hybrid digital mortgage process, some lenders still hesitate to adopt it as fast as expected.

May 22 -

The Federal Housing Administration and Ginnie Mae will use their lagging digital mortgage positions to their advantage as they put an emphasis on building their technology.

May 21 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

PIMCO Mortgage Income Trust tabled plans to launch an initial public offering this week following a steep stock market decline Monday.

May 15 -

Investors can now exchange certain existing Freddie Mac bonds for to-be-announced uniform mortgage-backed securities in preparation for the full launch of UMBS next month.

May 8 -

Recapitalizing the GSEs by cutting off returns to the government would essentially be buying the GSEs from the taxpayers with money that belongs to the taxpayers.

May 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

Independent mortgage bankers lost the largest amount for originating a loan in the fourth quarter since this data has been tracked, as costs rose and volume dropped, according to the Mortgage Bankers Association.

March 26 -

Lenders must do more to address the safety of borrowers' personal information as digital mortgage strategies spread and regulatory scrutiny increases.

March 25 -

Starting March 26, Senate Banking Committee Chairman Mike Crapo will hold two days of hearings on his plan for returning Fannie Mae and Freddie Mac to private ownership.

March 25 -

Ohio has become the latest state to start including mortgage servicing rights holders in its increased regulation of nonbank servicers.

March 20 -

Manufactured and modular home lender Tammac Holdings is using $60 million in debt and equity financing from its new majority owner to fund construction loans.

March 19 -

Mortgage lenders' gain on the sale of loans to the secondary market has finally increased after several quarters of declines, according to Richey May.

March 15