-

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8 -

American Mortgage Consultants has acquired title search outsourcer String Real Estate Information Services as part of ongoing efforts to support all the services secondary-market clients need to conduct trades.

March 4 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Ginnie Mae should not overreact in supervising smaller, more diversified mortgage bankers, but rather scale its approach in line with the concentration of risk that different-sized servicers pose.

February 13 Community Home Lenders of America

Community Home Lenders of America -

Wells Fargo and JPMorgan Chase had reduced mortgage-related earnings in the fourth quarter as home loan activity continues to fall short of expectations.

January 15 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

The mortgage industry faces myriad questions and challenges in 2019. Here's a look at 12 executives who will be behind the waves being made this year.

January 8 -

Falling mortgage rates have reached the point where they are spurring speculation about a possible resurgence in refinancing.

January 2 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

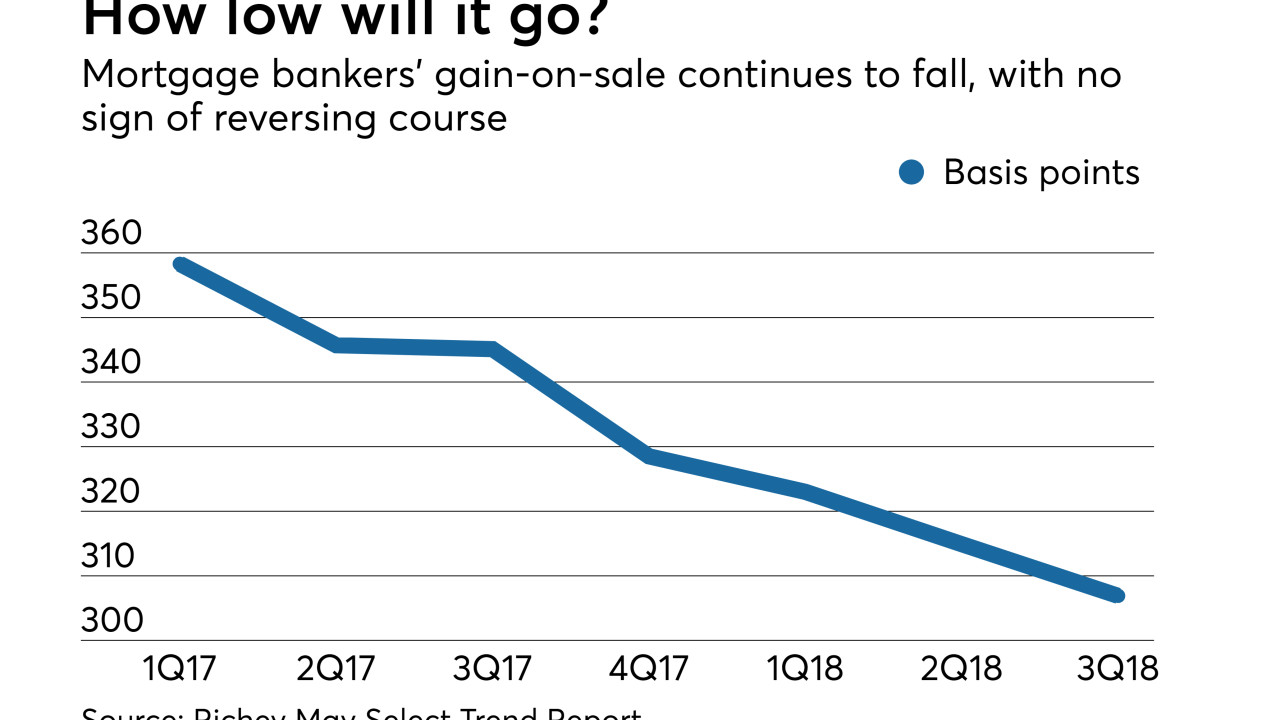

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

Returns on mortgage-backed securities in October lagged Treasuries by 37 basis points, the most since November 2016.

November 5 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2