-

Finance of America is buying Onity's MSRs and loan pipeline in this niche as PHH retains its role as a subservicer and remains involved in buyout securitization.

November 20 -

A combination of factors, including the rise of retail investing and sound assets, propelled ETF formation, with at least four issuances over the past year.

November 19 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

A think tank's analysis of the system that provides banks with financing backed by an implied guarantee arrives amid broader federal efficiency reviews.

November 12 -

Third-quarter mortgage earnings revealed swings in profitability, but the real story, according to the Chairman of Whalen Global Advisors, is that hedging MSRs is unnecessary for well-managed lenders.

November 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A 50-year mortgage on a median-priced US home could reduce borrower's monthly repayment, but also double the amount of interest the owner pays over the life of the loan, according to UBS Group AG analysts.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

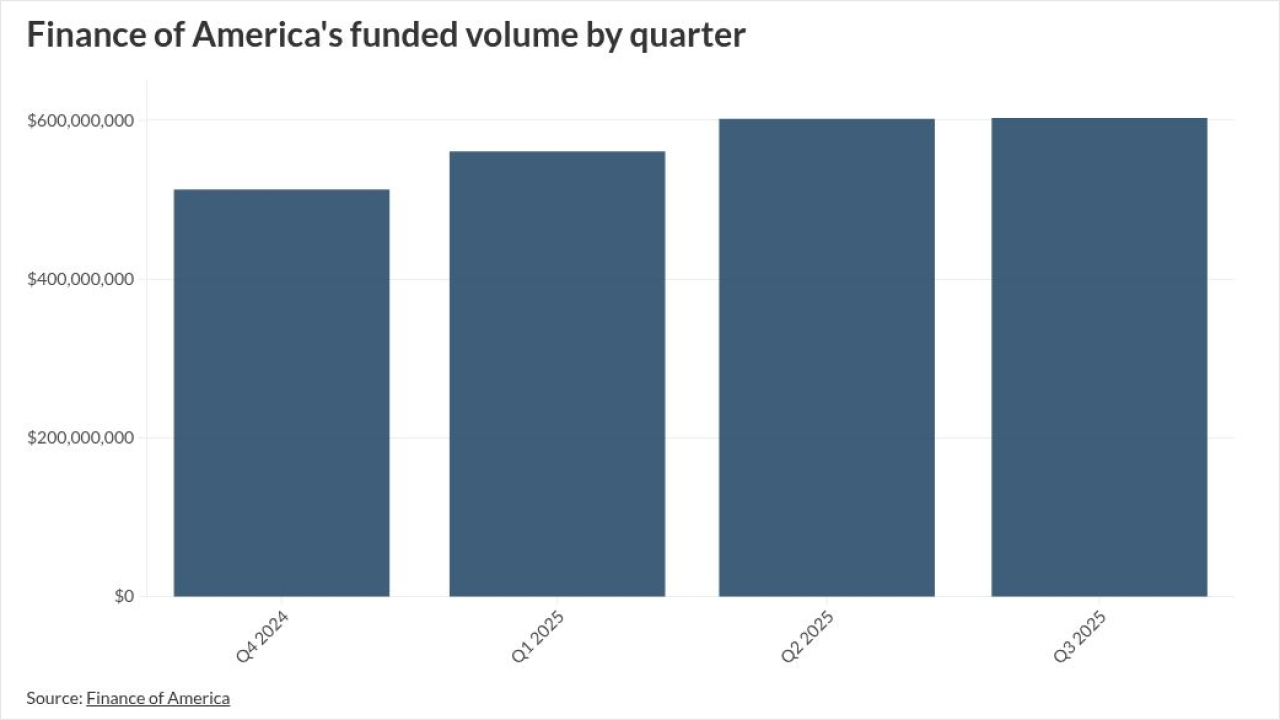

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

October 30 -

The government-sponsored enterprise's bottom line results, like Fannie Mae's, came in above the previous quarter's but below year-ago numbers.

October 30 -

Mortgage groups want GSEs to buy MBS to lower rates, but the Chairman of Whalen Global Advisors writes that the plan is risky, unnecessary, and poorly timed.

October 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Shareholders' equity topped $105 billion as net income rose 16% from the previous quarter and nearly matched year-ago results.

October 29