-

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

Freedom Mortgage is being punished by a government-owned mortgage guarantor amid concerns that the Mount Laurel, N.J.-based company is helping to enable unnecessary refinances of veterans' loans.

June 4 -

Commercial mortgage bonds are getting stuffed with the lowest-quality loans since the financial crisis by one measure, according to Moody's Investors Service.

June 1 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

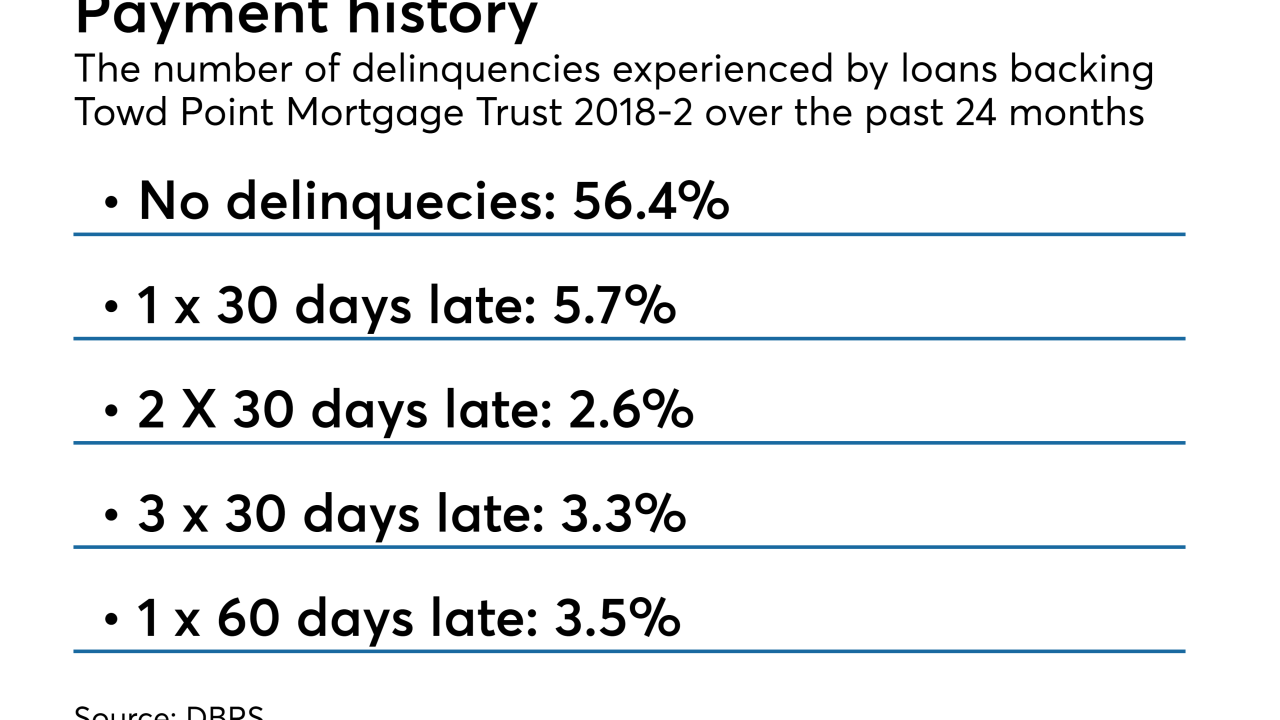

The $1.56 billion Towd Point Mortgage Trust 2018-2 also features higher exposure to loans on investment properties, in some cases loans backed by single-family homes in more than one state.

May 22 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

Requiring solar panels for all newly constructed residences is good news for investors who finance these systems, if only because it will help keep developers afloat, according to Moody’s Investors Service.

May 15 -

After originating more than $1 billion in loans outside the ability-to-repay rule's Qualified Mortgage safe harbor last year, Angel Oak is planning to originate at least twice that in 2018.

May 14 -

Royal Bank of Scotland said it reached a tentative agreement to pay a $4.9 billion penalty to resolve a long-running U.S. probe into its packaging and sale of mortgage-backed securities before the 2008 financial crisis.

May 9 -

Capital One Financial Corp. plans to repurchase shares following the sale of $17 billion in mortgages to a Credit Suisse subsidiary.

May 8 -

Despite the entrance of several large players over the past several years, financing to small-time landlords is still inefficient, executives say.

May 8 -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

A former Cantor Fitzgerald managing director was cleared of charges that he defrauded customers by lying about prices of mortgage-backed securities.

May 3 -

A federal jury is poised to determine whether a former Cantor Fitzgerald managing director's tactics in trading mortgage-backed securities constitute securities fraud.

May 1 -

After less than a week of trial, prosecutors rested their case against a former Cantor Fitzgerald trader accused of lying to his customers about bond prices.

April 30 -

A portfolio manager for an investment firm allegedly defrauded by a former Cantor Fitzgerald managing director said he might still work with a trader who lied to him — depending on the circumstances.

April 27 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27