-

National foreclosure activity is at an 11-year low, but some cities have yet to fully recover.

April 28 -

For the third time in recent years, the city of Owensboro, Ky., has launched what it calls a "mass foreclosure," taking aim at 33 properties to satisfy unpaid property taxes and property maintenance liens.

April 6 -

A decade ago, a home in Connecticut could be sold to another party about 12 months after a borrower stopped paying a mortgage.

March 27 -

Modification activity increased slightly in January over December as servicers worked their way through the remaining Home Affordable Mortgage Program applications.

March 20 -

Bank of America has completed its legal settlement obligation with the Department of Justice to provide $7 billion in consumer relief nearly two years ahead of schedule.

March 20 -

HSBC has met the consumer relief requirements set out under the National Mortgage Settlement, according to the latest report from the settlement's monitor.

March 14 -

Two former executives of the failed GulfSouth Private Bank in Destin, Fla., and another man have been indicted on federal charges of defrauding the Troubled Asset Relief Program of $7.5 million.

December 19 -

A regulatory 2017 scorecard for Fannie Mae and Freddie Mac calls on the firms to transfer a significant portion of credit risk to third-party private investors on at least 90% of unpaid principal balance of newly acquired single-family mortgages.

December 15 -

During the third quarter, the negative equity rate dropped to 10.9%, representing roughly 5.3 million homeowners, from 13.4% a year before, Zillow reported.

December 15 -

Millions of consumers' credit reports will no longer reflect past mortgage problems, which could open up borrowing opportunities for many of them.

October 27 -

Loan modification activity fell again on a monthly basis, but there are still several states where borrowers need assistance, according to the Hope Now alliance.

September 15 -

Bank of America is approaching the consumer-relief target set in its mortgage settlement with the Department of Justice and six states, according to the settlement's monitor.

September 1 -

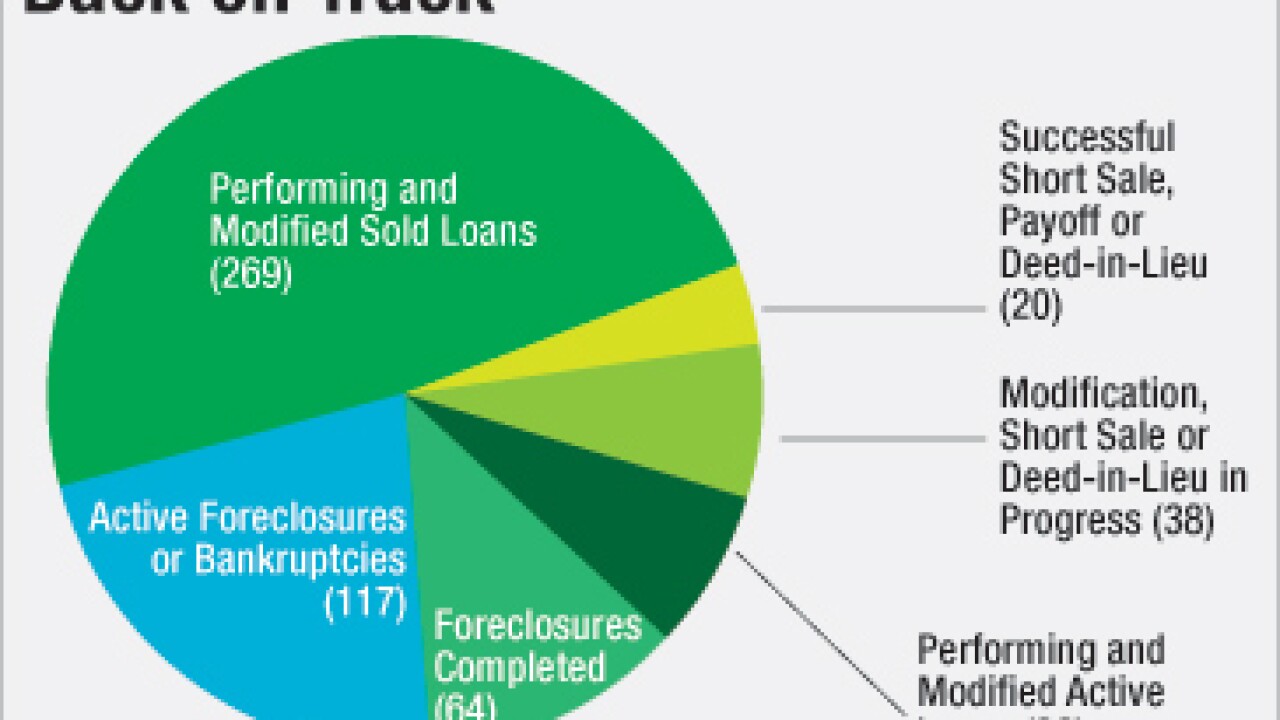

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

There was a decline in loan modification activity in May both for year-over-year and month-to-month comparisons, according to the Hope Now alliance.

July 18 -

Millions of Americans lost their homes to foreclosures or short sales during the housing crisis. Fortunately for the economy, time heals most wounds and credit reports.

July 7 -

The Dec. 31 expiration of the Home Affordable Modification Program will have a limited negative effect on residential mortgage-backed securities from 2008 or earlier, according to Moody's Investors Service.

July 6 -

The number of loan modification made in April dropped 4% from the previous month, according to the Hope Now alliance.

June 21 -

The Department of Housing and Urban Development issued a proposal Wednesday to codify recent changes to its reverse mortgage program and to provide additional protections for seniors, including a cap on annual interest rate increases.

May 18 -

It's taken nine years, but the number of U.S. homes in foreclosure has fallen to a level not seen since before the 2008 housing crisis.

April 26 -

Appraisal management company Solidifi has acquired Linear Title & Closing, a provider of national title searches and mortgage closing services.

April 1