-

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

Homebuilder stocks are slipping after sales of previously owned homes fell more than forecast in March and KBW cut its rating on D.R. Horton shares.

April 23 -

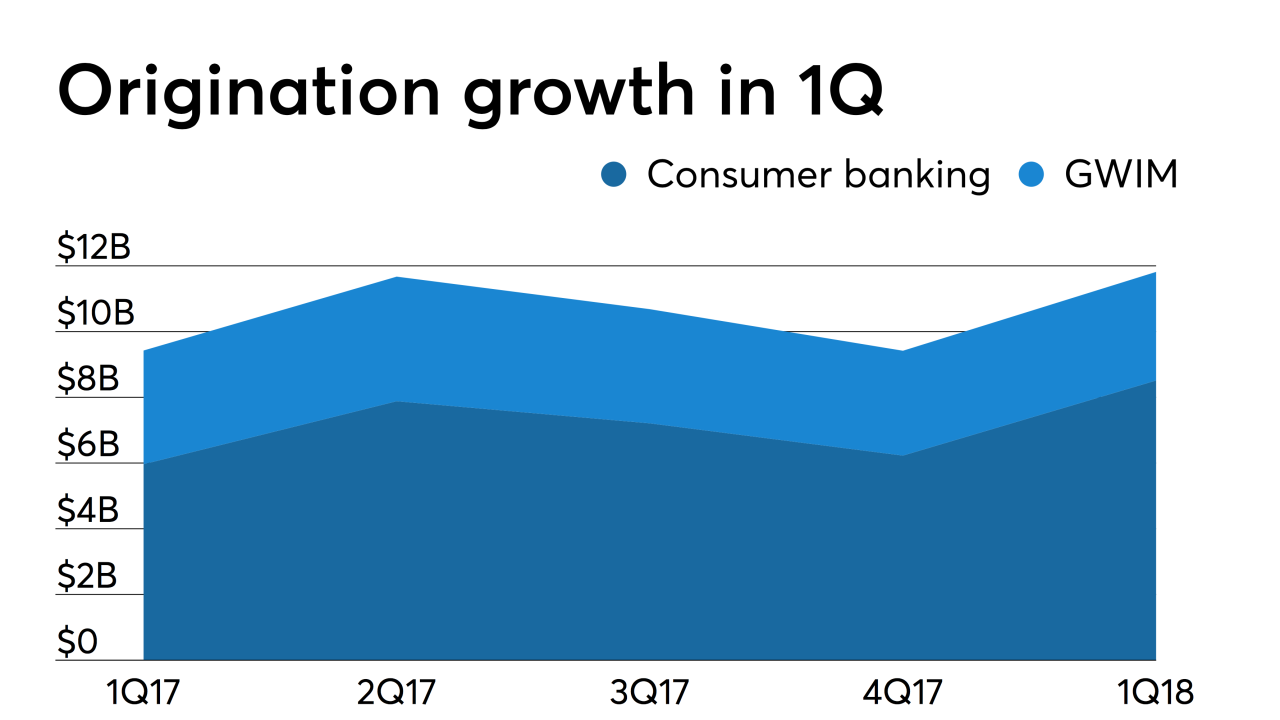

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase could be an early sign of an improving industry.

April 12 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

Two Harbors Investment Corp., which grew its servicing portfolio by 22% in the fourth quarter, priced a common stock offering to raise funds to buy more rights as well as mortgage-backed securities.

March 19 -

Impac Mortgage Holdings saw its shift to predominantly originate non-qualified mortgage loans reduce its fourth-quarter GAAP net loss along with increasing its gain-on-sale margins.

March 15 -

A subsidiary of digital-media company Beta Music Group is linking its origination support technology with Arive's online platform, which connects mortgage brokers to lenders, borrowers and third-party vendors.

March 13 -

Falling interest rates contributed to efforts that helped Hovnanian Enterprises nearly halve its net loss during its fiscal first quarter, when it maintained a strong sales pace by selling more low-priced homes.

March 11 -

New York regulators rejected Fidelity National Financial's acquisition of Stewart Information Services because the combination would have a dominant share of title insurance in the state.

March 6 -

Ocwen Financial reduced the size of its net loss by nearly half during 2018 thanks to cost-cutting measures, and economies of scale from its acquisition of PHH Corp.

February 27 -

CoreLogic's fourth-quarter earnings declined from the previous year because of the slower mortgage origination market and an $8 million impairment charge due to its restructuring plans.

February 27 -

Altisource Portfolio Solutions recorded multimillion-dollar net losses in the fourth quarter and the full year for 2018, due to the reduction of the Ocwen Financial servicing portfolio and other repositioning activities.

February 26 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

Zillow Group Inc., the housing search website that's taken a hit to its stock price as it pursues an ambitious plan to buy homes and originate mortgages, is bringing back its first chief executive officer to lead the transformation.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

Mortgage insurer Radian Group was in takeover talks with an investor group earlier this month including Apollo Global Management and Centerbridge Partners, before discussions stalled over the terms of a potential deal.

February 19 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

Taylor Morrison Home Corp. mortgage volume inched down during the fourth quarter, but is hoping a recently added rate-buydown feature could bolster future lending.

February 13