-

The company plans on trading on the New York Stock Exchange under the ticker symbol BLND

June 21 -

Investors appear to support the notion that lending to borrowers who don’t have traditional incomes could be a growth engine for lenders as other sources of volume weaken.

June 17 -

While the company did notify the public and regulators in May 2019, executives were not aware at the time that there was previous knowledge of the security vulnerability within the company.

June 15 -

The alternative minimum tax would challenge at least one influential nonbank and big depositories, according to a new Keefe, Bruyette & Woods report.

June 7 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

After the spinoff and a concurrent private sale to Bayview Asset Management, Genworth Financial will still own 80% of the rebranded Enact.

May 4 -

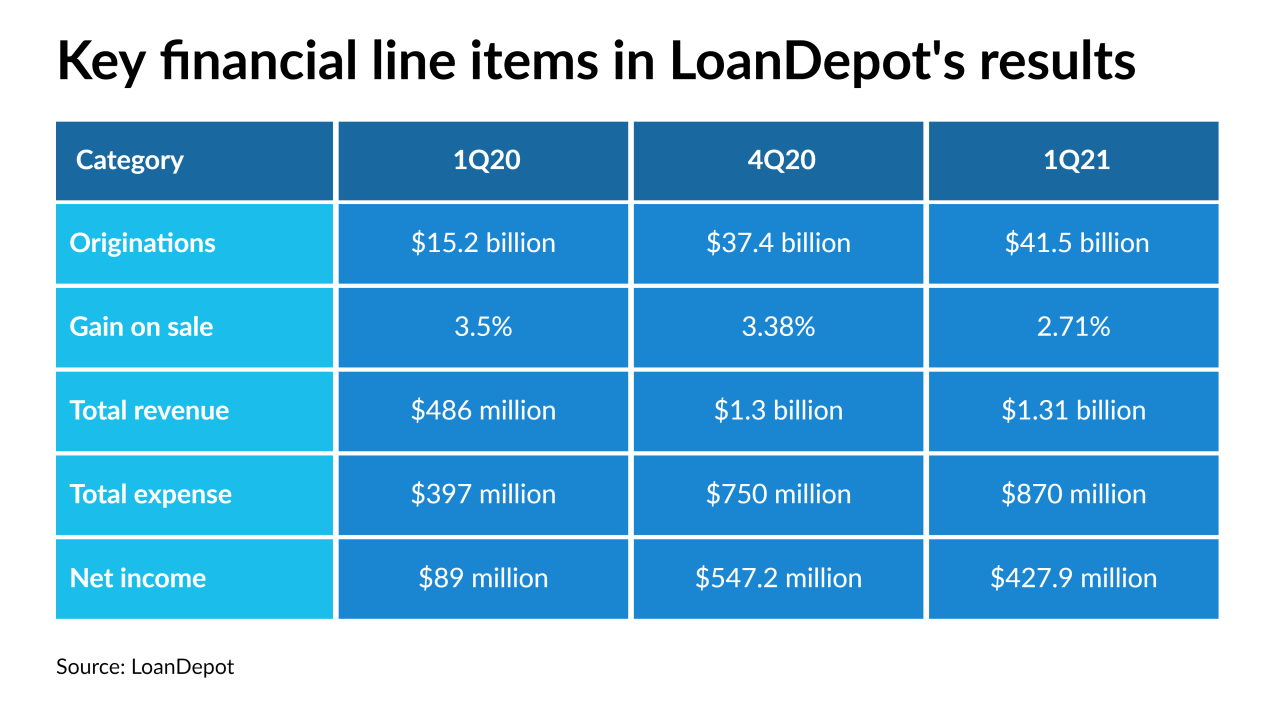

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

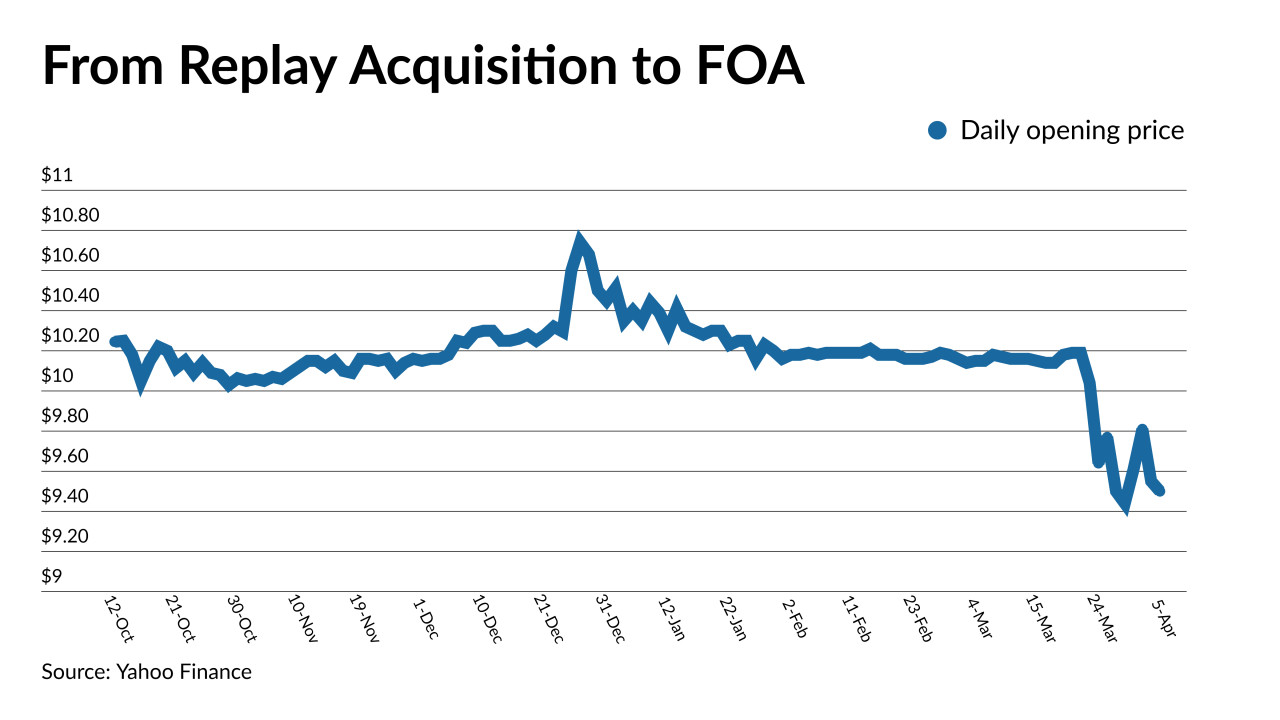

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4