-

A list of upcoming cases published by the high court did not include a challenge to the bureau's constitutionality, but the justices could still decide to review it at a later date.

October 15 -

Maren Kasper, who has led Ginnie Mae in the absence of a permanent president, is leaving the agency on Oct. 18 to pursue an opportunity in the private sector.

October 10 -

Institutions that offer fewer than 500 open-end lines of credit will get another two-year exemption from reporting requirements under the Home Mortgage Disclosure Act.

October 10 -

The two Democrats waded into a court battle over the president's ability to fire a director of the Consumer Financial Protection Bureau.

October 8 -

The Federal Housing Administration chief has already been serving as the acting deputy secretary of the Department of Housing and Urban Development.

October 8 -

By declaring that she has too much statutory power, the agency’s director has potentially opened a floodgate of litigation.

October 1 -

If the court agrees to hear the case, its conservative majority could make it easier for a president to fire a CFPB director, though other outcomes are possible.

September 23 -

The recapitalization of Fannie Mae and Freddie Mac prior to the 2020 election is unlikely even if the net worth sweep ends, according to a Keefe, Bruyette & Woods report.

September 23 -

The proposed reforms of Fannie Mae and Freddie Mac have gotten all the attention, but the administration also wants to scale back the Federal Housing Administration, expand its capital cushion and adopt risk-based pricing. Some of the ideas have former agency officials concerned.

September 19 -

There were signs Kathy Kraninger would continue a rollback of consent orders and investigations, but many observers see an aggressive approach reminiscent of the Obama era.

September 18 -

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

A mortgage industry executive with ties to a firm penalized in a U.S. predatory lending crackdown is being considered by the Trump administration to run Ginnie Mae, according to people familiar with the matter.

September 17 -

Whether Congress and/or the mortgage industry is able to untangle two opposing threads in the Trump administration's plans is anyone's guess.

September 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Supreme Court may be closer to examining a key restraint on a president's ability to change CFPB leadership.

September 12 -

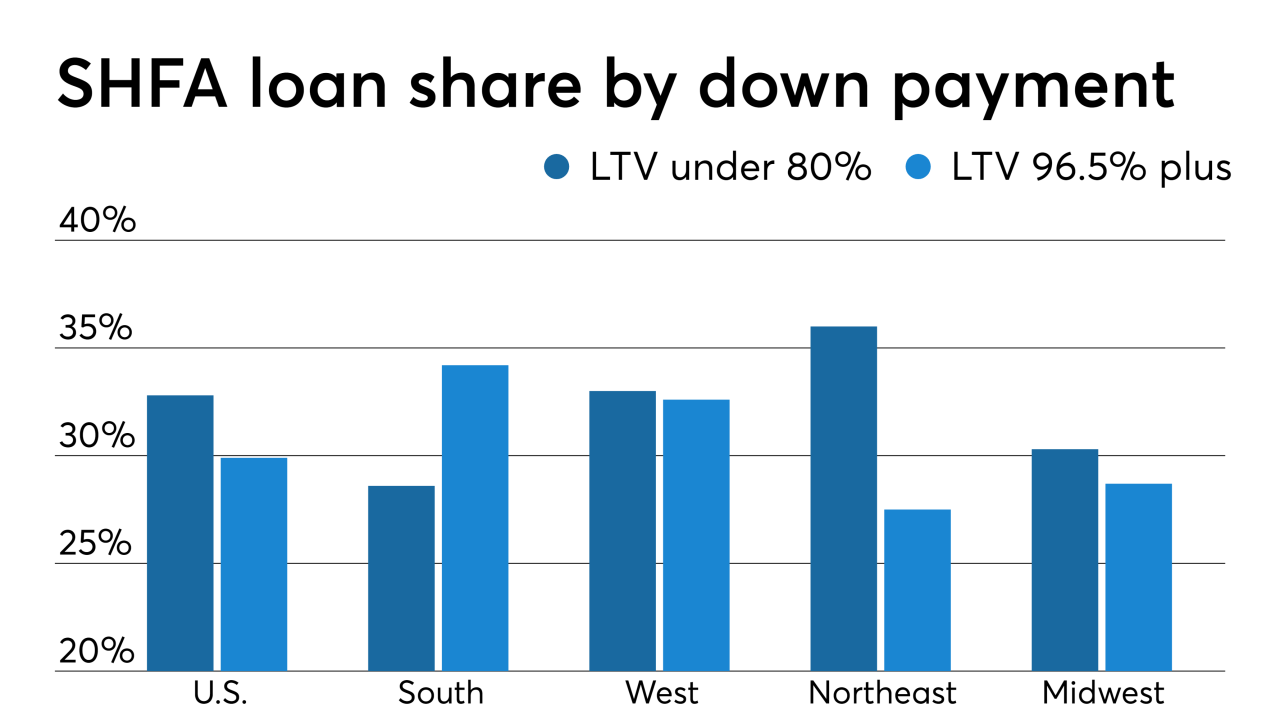

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

Senate Banking Committee members feel urgency to pass a bill dealing with Fannie Mae and Freddie Mac, but the same obstacles that have stalled congressional action for years remain.

September 10 -

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6

-

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5