-

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Three executives from Vanguard Funding are facing fraud charges related to their alleged misuse of nearly $9 million in warehouse lending funds.

September 18 -

Redwood Trust is raising $225 million in a debt offering with the proceeds to be used to repay borrowings that come due next year.

August 14 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

Home Point Financial Corp. has formed an Institutions Group to bring the correspondent, capital markets and warehouse lending teams under one umbrella.

June 22 -

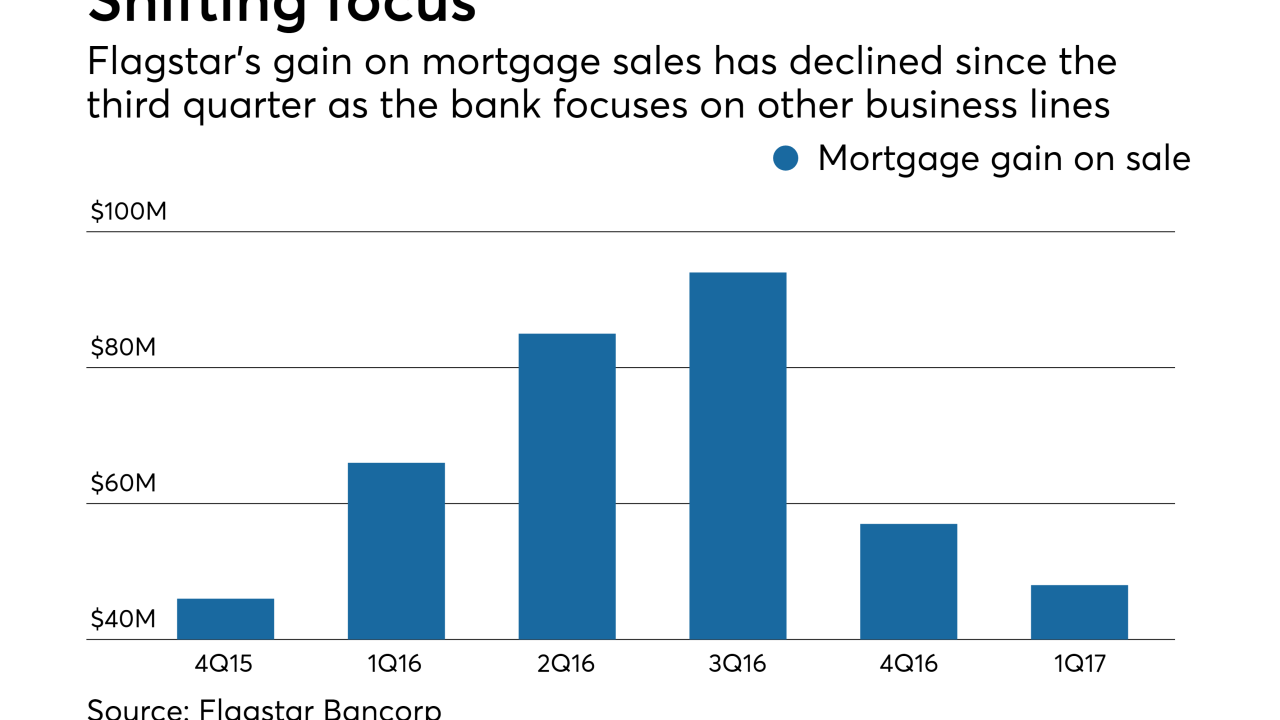

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Deutsche Bank is finding that there just isn't enough soured U.S. mortgage debt anymore.

March 29 -

High origination volume and increased nonbank participation fueled another banner year for warehouse lenders, according to The Reynolds Group.

February 21 -

Home Point Financial Corp. will buy Stonegate Mortgage Corp. in an all-cash deal valued at roughly $211 million.

January 27 -

Seattle-based online real estate brokerage Redfin is creating a mortgage bank subsidiary in a bid to offer end-to-end real estate services.

January 27 -

Jefferies Group has added a third lender to its latest securitization of a mortgage warehouse facility.

January 27 -

BankUnited said that its fourth-quarter earnings increased 12% from the same period in 2015, to $63.3 million, as strong gains in interest income more than offset rising expenses and a sharply lower gain on sales of loans.

January 25 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

Ginnie Mae, at the urging of the mortgage industry, has revised the wording of the acknowledgment agreements necessary to finance servicing rights. It hopes the move improves Ginnie MSRs' liquidity.

December 21 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19 -

The surge in mortgage rates since the November election is expected to offset the increase to lenders' short-term funding costs following the Federal Open Markets Committee's 25-basis-point increase to the federal funds rate.

December 14 -

The rise of digital mortgages and increasing lender consolidation are just two reasons mortgage brokers should make the transition to mortgage banking sooner rather than later.

December 7 Click N' Close

Click N' Close -

Real estate franchisor Re/Max Holdings is getting into the mortgage brokering franchise business with its new unit Motto Mortgage.

October 25 -

Comerica is gaining momentum after a rough start to 2016.

October 18 -

Impac Mortgage Holdings has released the pricing of an upcoming follow-on stock offering.

September 16