-

The Trump administration proposes cutting personnel and other budgetary items at the bureau, while the agency’s director — who controls the purse strings and was hand-picked by the administration — aims to boost spending and hire more employees.

February 20 -

Mike Weinbach will lead consumer lending as part of a reorganization that will change the responsibilities of three longtime bank executives.

February 11 -

Companies that scored highest in this year’s Best Fintechs to Work For (a ranking compiled by our parent company, Arizent) go beyond the basics of strong pay packages, generous benefits and effective leadership to take a more holistic interest in their employees’ lives, according to the data.

February 4 -

Metrics and strategy are key at YCharts. So are mystery-flavored Oreos.

February 4 -

Bank of America's fourth-quarter mortgage origination volume more than doubled on a year-over-year basis, a faster pace of growth than two of its national banking peers.

January 15 -

Fourth quarter gain on sale margin moved in opposite directions at two of the nation's largest banks, falling 9% quarter-over-quarter at JPMorgan Chase, but increasing 25% at Wells Fargo.

January 14 -

Canadian Imperial Bank of Commerce expects its growth in domestic mortgages to be more “market-like” in 2020, after last year’s contraction in home-loan balances, Chief Executive Officer Victor Dodig said.

January 7 -

Denmark’s housing minister says he would find a 10% market decline an acceptable outcome as he tries to alter the law to prevent speculation

December 6 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

In her second day of congressional testimony, Kathy Kraninger took heat from Senate Democrats for weighing in on constitutional questions about her agency and for her enforcement track record.

October 17 -

The majority of first-time homebuyers participating in a recent survey preferred online or phone interactions when receiving counseling that is a prerequisite for some loan programs.

October 3 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

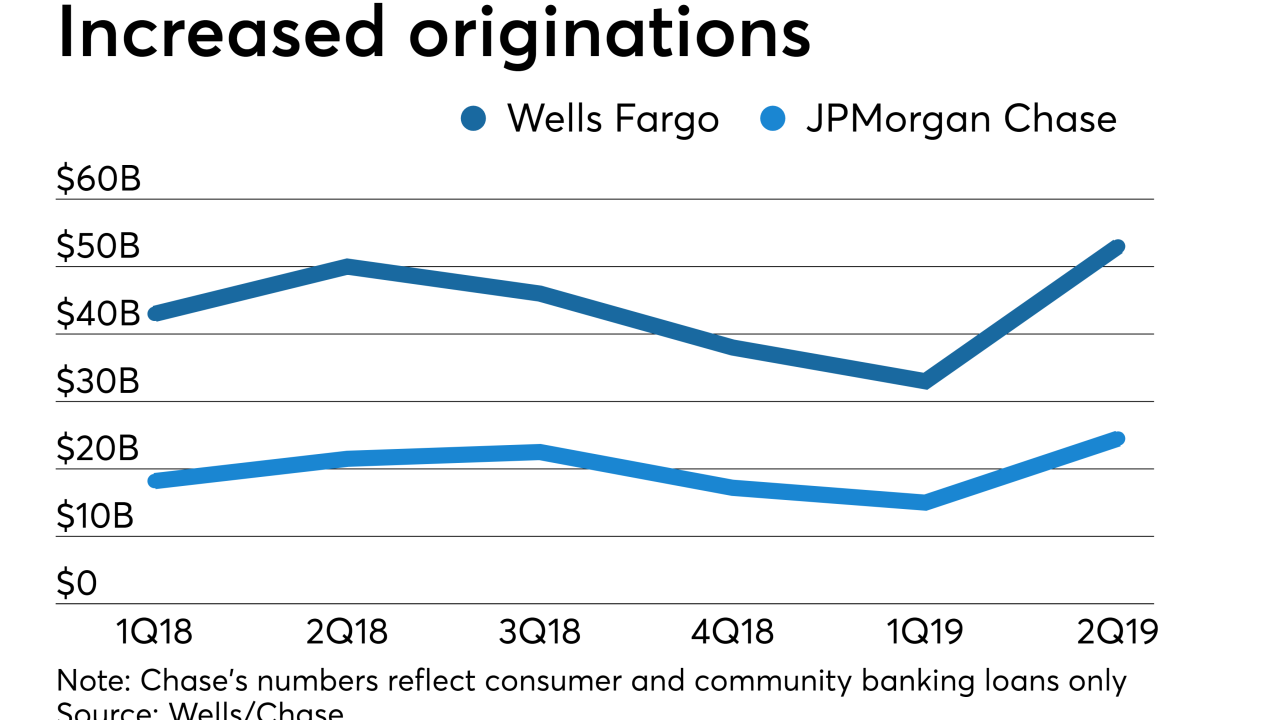

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Almost two-thirds of consumers think they must be debt-free to get home financing when in fact they can have debt-to-income levels as high as 43% or greater, according to Wells Fargo.

July 10 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

In her first four and a half months, Kathy Kraninger met with lawmakers more than twice as often as her predecessor, but her schedule demonstrates willingness to meet with industry and policy stakeholders from various camps.

June 17 -

Sandler and his wife, Marion, built a small California thrift into a powerhouse before selling it to Wachovia prior to the housing collapse, but were heavily criticized for engaging in some of the same practices that caused the financial crisis.

June 5 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

With Sen. Elizabeth Warren's cancellation plan to alleviate student debt, millennials would save up for mortgage down payments three years sooner, according to Redfin.

May 31