-

The majority of first-time homebuyers participating in a recent survey preferred online or phone interactions when receiving counseling that is a prerequisite for some loan programs.

October 3 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

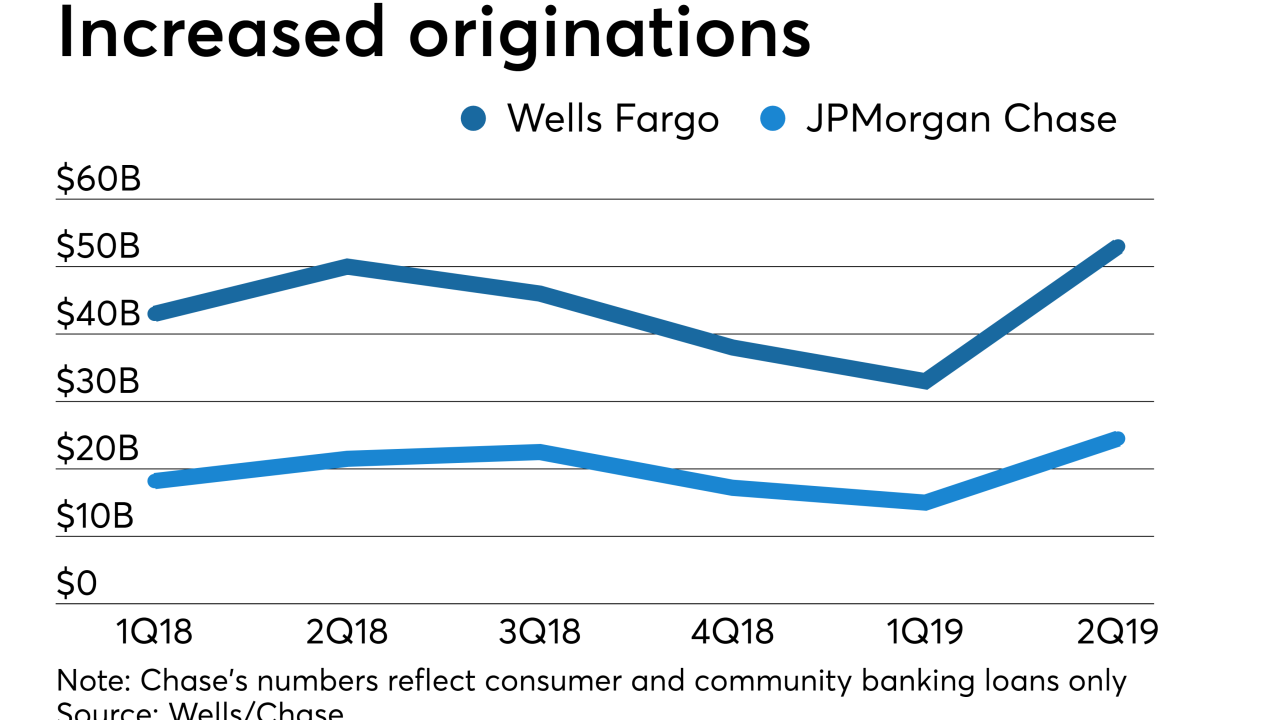

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Almost two-thirds of consumers think they must be debt-free to get home financing when in fact they can have debt-to-income levels as high as 43% or greater, according to Wells Fargo.

July 10 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

In her first four and a half months, Kathy Kraninger met with lawmakers more than twice as often as her predecessor, but her schedule demonstrates willingness to meet with industry and policy stakeholders from various camps.

June 17 -

Sandler and his wife, Marion, built a small California thrift into a powerhouse before selling it to Wachovia prior to the housing collapse, but were heavily criticized for engaging in some of the same practices that caused the financial crisis.

June 5 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

With Sen. Elizabeth Warren's cancellation plan to alleviate student debt, millennials would save up for mortgage down payments three years sooner, according to Redfin.

May 31 -

Meridian Corp. may have breached sales agreements after originating nearly $100 million in loans in a state where it lacked a license.

May 16 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

The 2020 budget would add the Consumer Financial Protection Bureau and FSOC to congressional appropriations, charge lenders for FHA upgrades and require universities to have skin in the game on student loans.

March 11 -

Employees at Carson Group love the outdoors and regularly participate in events like the Spartan Race, a course filled with treacherous obstacles.

February 24 -

When Redtail Technology moved into its new building 18 months ago, CEO Brian McLaughlin ensured it had homey touches, like comfortable seating, a basketball court and slides.

February 24 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

American homeownership has been on the decline, and Federal Reserve researchers point to the high cost of college as one culprit.

January 16 -

Late payments on mortgages are expected to keep dropping and credit is expected to remain strong next year, in part because housing prices remain healthy in most areas, according to TransUnion.

December 13