-

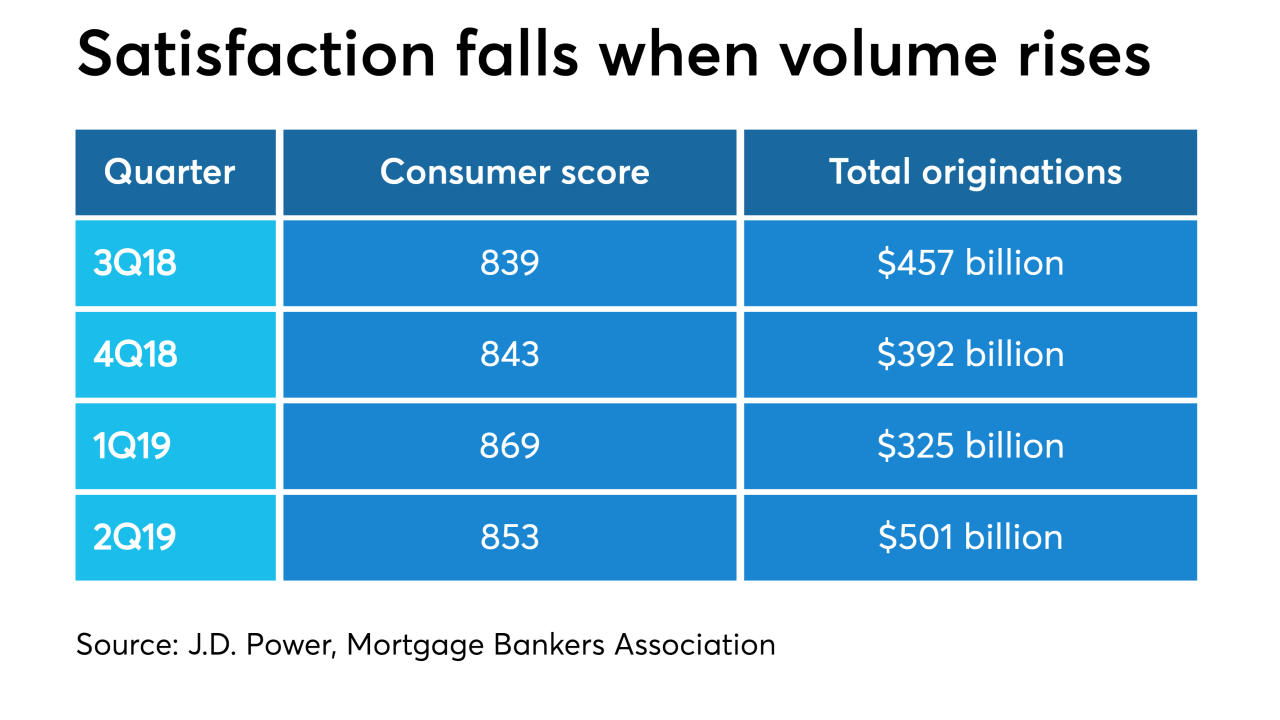

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

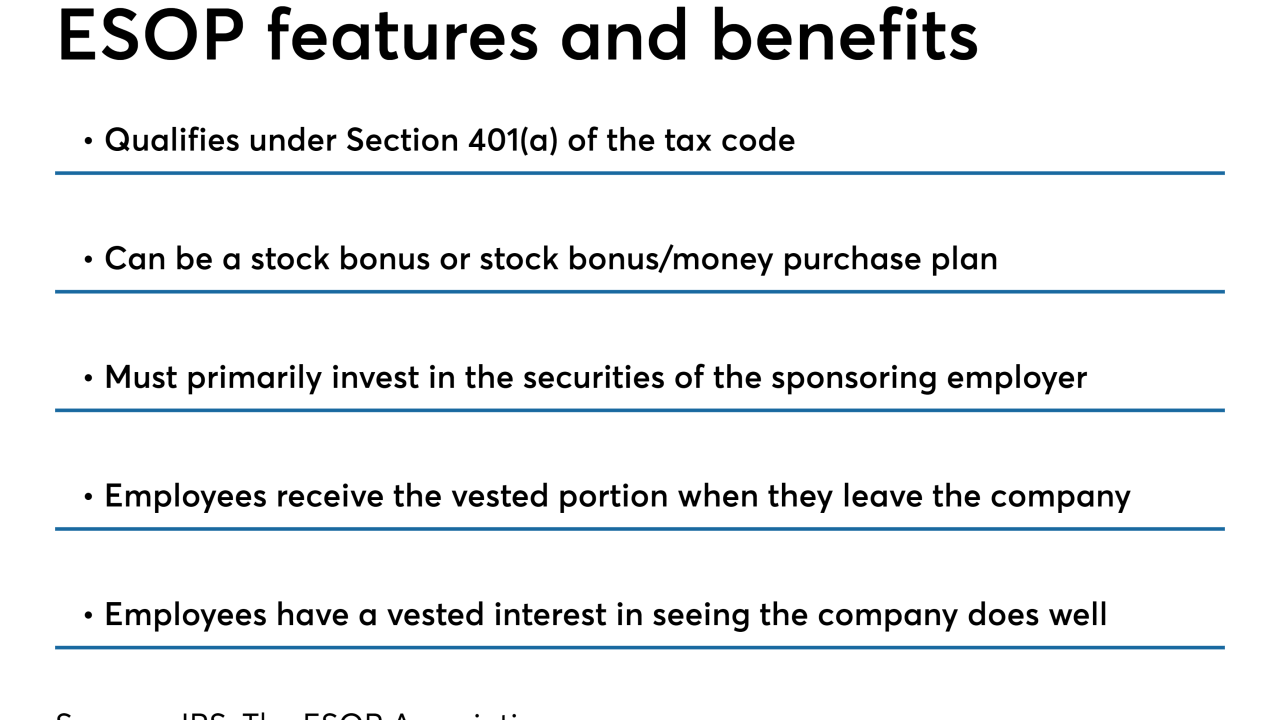

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

IndiSoft will continue to support the distressed-borrower assistance platform formerly known as Hope LoanPort after the nonprofit that runs it winds down operations at the end of this year.

November 11 -

In the latest example of a new wave of mortgage-related fintech investment, Snapdocs will boost its artificial-intelligence capabilities with its new $25 million funding round.

November 7 -

Brent Chandler of FormFree, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans share their Digital Mortgage 2019 highlights

November 7 -

Rick Lang of Freddie Mac, Tim Mayopoulos of Blend and Tamra Rieger of Evergreen Home Loans discuss the key objectives – from customer experience to system integrations – that mortgage companies are pursuing through digitalization.

November 7 -

Aaron King of Snapdocs, Brent Chandler of FormFree, Tim Mayopoulos of Blend, and Chris Backe of Ellie Mae talk about system fragmentation, data access issues, personnel management and other hurdles that still stand between the industry and comprehensive digitalization.

November 7 -

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

The Mortgage Bankers Association's annual convention rolled through Austin, Texas, this year, leaving behind important announcements and implications for the future of the mortgage industry.

October 30 -

Startups are increasingly expanding into new areas with their bank partners in an effort to broaden their customer base and bring products to market faster.

October 29