-

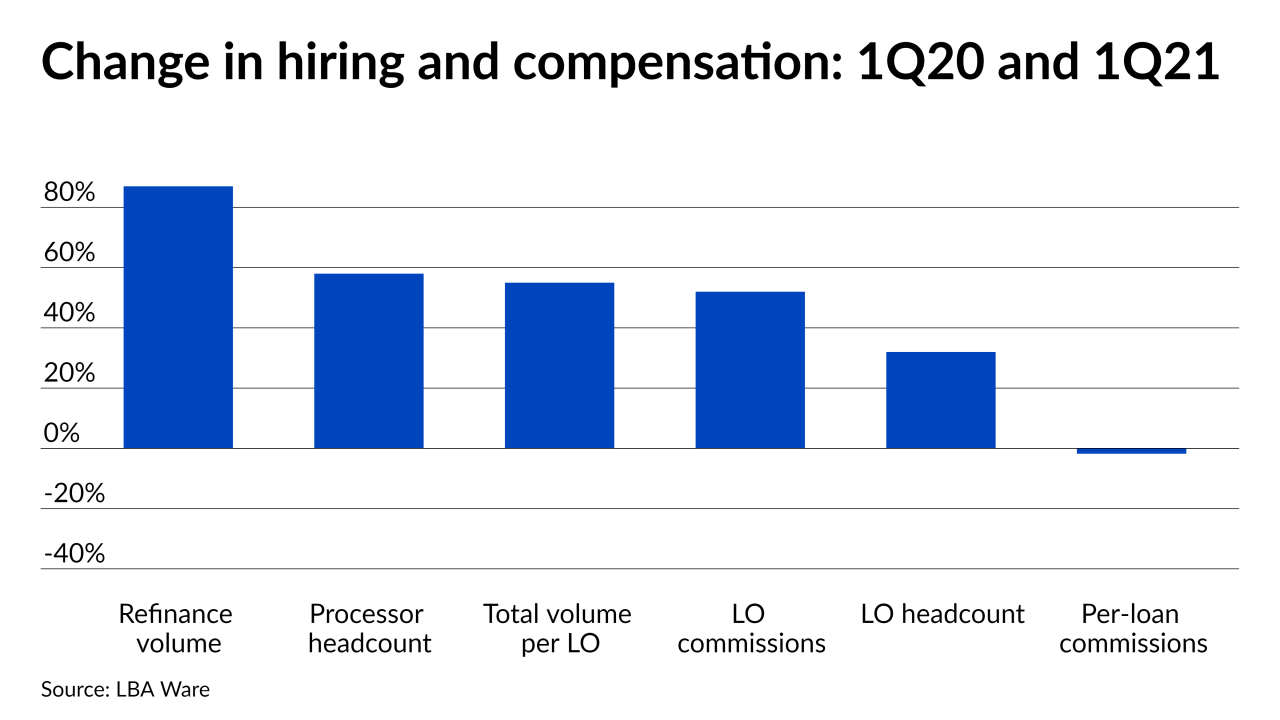

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

There are only a handful of servicers who have unlocked the secret to achieving high retention rates, and they are performing over 3x better than the industry average of 18%. How are they doing it? It’s all about the data, writes the head of consumer finance at Jornaya.

May 5 Jornaya

Jornaya -

There is no doubt 2020 was a year of contactless transactions. But what implications do contactless payments present when it comes to security?

May 4 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

People want their payments to be quicker, safer, and more readily available across a wider range of channels. How are industry leaders leveraging data to build stronger relationships with their clients?

April 29 -

A total of 480,000 customers may have been affected by the duplicate drafts and so far it looks like far fewer than 1% of them incurred non-sufficient funds fees, Mr. Cooper said Tuesday.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

The incident points to a risk mortgage companies should be aware of as they shift to digital servicing strategies.

April 26 -

The lender will expand certain mortgage products, like its HomeRun program, which requires lower down payments and removes mortgage-insurance requirements for lower-income borrowers.

April 26