-

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

Built launched Draw Agent Tuesday, which can process thousands of construction loan draws monthly.

November 5 -

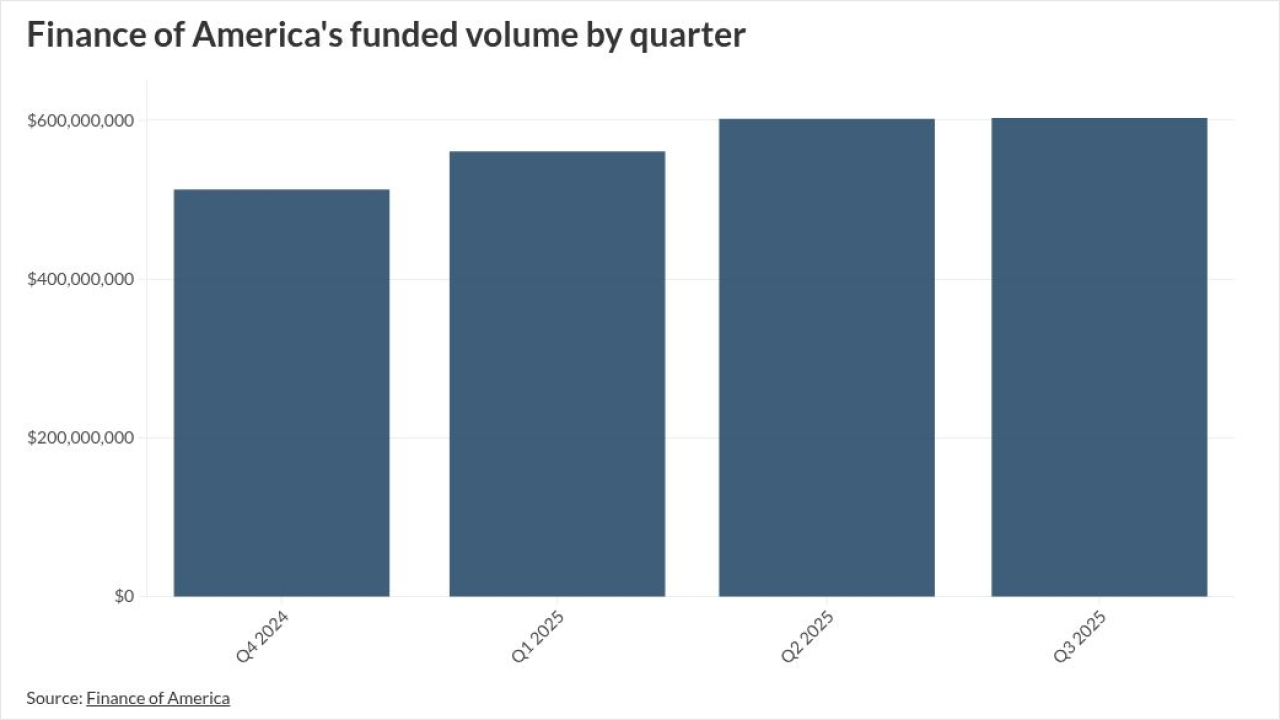

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

Newer automation that can serve as a wraparound to existing technology can cut servicing costs in a competitive industry, according to fintech executives.

November 4 -

The agreement, if approved by a federal judge, would end litigation over two distinct cybersecurity incidents in 2021 which affected over 2 million customers.

November 3 -

The Consumer Financial Protection Bureau has seen a rapid drop in the effectiveness of its cybersecurity program, according to a new report from the Fed's Office of Inspector General.

November 3 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

The new president, a 35-year industry veteran, explains the value every lender, vendor and regulator can get by participating in the standards organization.

November 3 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30