JPMorgan Chase has nearly stopped making home loans insured by the Federal Housing Administration.

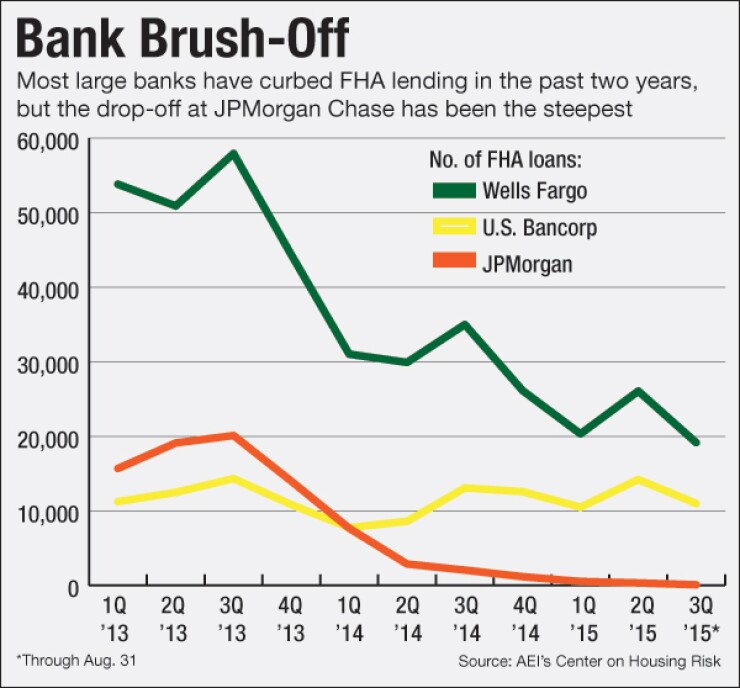

Most large banks have curtailed FHA-backed loans in the past two years because of concerns about credit and legal risks, and JPMorgan's 98% drop-off in that period puts an exclamation mark on the trend.

The $1.8 trillion-asset bank's FHA market share was a mere 0.2% at June 30, compared with 12.2% just two years earlier, according to government data crunched by the American Enterprise Institute's International Center on Housing Risk.

The rollback among big banks follows harsh penalties meted out by the Justice Department , which accused many banks of putting FHA on the hook for shoddy loans in the years leading up to the mortgage meltdown. Market shares at BB&T, Bank of America, Fifth Third Bancorp, Flagstar Bank, M&T Bank, Regions Financial and Wells Fargo have all declined in the past two years, the data shows.

Nonbanks have stepped into the void, and that shift is not expected to reverse until bank executives feel more comfortable with the credit profiles of many FHA borrowers and determine the odds of further federal prosecutions have fallen.

"The banks have ceded this share voluntarily," said Ed Pinto, co-director of the AEI center, and a former chief credit officer at Fannie Mae.

Nowhere is that reality clearer than at JPMorgan Chase.

Chairman and Chief Executive Jamie Dimon warned last year that the risks of FHA lending were just too great.

"The real question for me is should we be in the FHA business at all," Dimon said on a conference call with analysts in July 2014. "Until they come up with a safe harbor or something, we are going to be very, very cautious in that line of business."

He meant it.

In the second quarter, JPMorgan Chase originated just 340 FHA loans, compared with 19,111 FHA loans in the second quarter of 2013. Meanwhile, the bank's overall home lending business is booming. JPMorgan originated $29.3 billion of home loans in the second quarter, up 74% from a year earlier.

Figures were not yet available for the full third quarter, but JPMorgan originated 97 FHA loans in July and August, according to the center's data.

JPMorgan is trying to reduce the risks of lending to borrowers with low credit scores and potentially greater chance that the loans will go bad.

Amy Bonitatibus, a spokeswoman for JPMorgan, said the company has significantly reduced FHA lending over the last year due to "the litigation risks, high costs to service and high delinquency rates."

"We offer products that meet the needs for people across the credit spectrum with a focus on sustainable homeownership," she said. "This is part of our ongoing strategy to simplify our mortgage business and focus on high quality originations."

FHA lending is a particularly thorny issue not just because of the high penalties for mistakes on FHA-insured loans. Any pullback in lending to FHA borrowers with lower credit scores invokes concerns that credit could be restricted to minority groups.

Earlier this month, Wells Fargo, the largest U.S. home lender, tightened credit score requirements on FHA loans. Wells raised minimum credit scores to 640 in its retail channel, up from 600. Wells did so after the FHA recently proposed to keep its current policy on loan-level certification when many in the industry were hoping for changes.

Banks maintain that the FHA's proposal did not go far enough in limiting the government's use of the False Claims Act, a Civil War-era law that allows the Justice Department to collect triple damages if a bank has violated the FHA's underwriting standards.

The proposal requires that lenders perform a so-called "pre-endorsement review" of all FHA home loans and certify that each loan submitted for FHA insurance contains no defects. Mortgage lenders have long tried to limit their liability only to material defects on FHA-insured loans. But as the proposal now stands, inaccuracies, inconsistencies or even minor mistakes can still result in substantial fines and penalties.

"The view of lenders is that the proposal leaves in place the current standard of strict liability, so that any mistake whatsoever can trigger a False Claims Act liability," said Jim Parrott, a senior fellow at the Urban Institute and owner of Falling Creek Advisors, a consulting firm in Chapel Hill, N.C.

Parrott, a former senior advisor to the National Economic Council, said banks like Wells are saying that "we can't take the risk anymore and we're pulling back."

B of A, Citigroup, JPMorgan and U.S. Bancorp have all settled claims that they improperly approved FHA-insured loans that did not meet the agency's underwriting standards.

But plenty of others, including Wells Fargo, Quicken Loans, PNC Financial Services Group, Regions and BB&T still have outstanding investigations of FHA loans, according to company filings.

Wells Fargo's FHA market share has fallen by more than half in the past two years. Wells' share fell to 15% in the second quarter, from 32.4% in the same period in 2013. U.S. Bancorp was one of the few banks to see an increase in its FHA market share during the two-year period ended June 30, to 8.2% from 7.9% two years ago; however, its number of FHA loans and market share fluctuated considerably during that time period.

Both B of A and Citi group have less than 1% FHA market share, though they had not been big players before.

Overall, large banks' share of FHA-insured purchase-only home loans has dropped sharply since February. Large banks originated 23.5% of FHA loans in August, down from 29.6% in February and 65.4% in November 2012, when AEI first began tracking the data.

However, nonbank rivals have stepped into the void.

Nonbanks' share jumped to 68% in August, up from 62.2% in February and 26.8% in November 2012, virtually replacing the share ceded by large banks.

Meanwhile, credit quality has improved. FHA's serious delinquency rate fell to 2.91% in the second quarter, from 3.5% a year earlier, according to the Mortgage Bankers Association.

What could reinvigorate banks' interest in FHA loans? Perhaps the answer is greater legal clarity or rewards for demonstrating prudent lending.

"The FHA should create policy where lenders have an incentive to control for their False Claims Act liability through better underwriting, not less lending," Parrott said.