Want unlimited access to top ideas and insights?

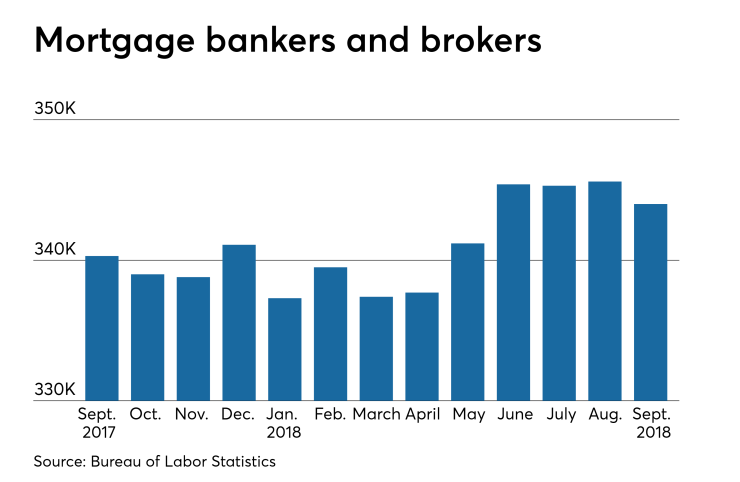

Hiring by nonbank mortgage lenders and brokers fell in September as the housing market prepares to pack it in for the colder months.

Nonbank mortgage brokers and lenders employed 344,000 people in September, according to the Bureau of Labor Statistics, down 1,600 jobs from a month ago. On Friday, the BLS also adjusted its

A number of bank and nonbank mortgage companies have announced job cuts in the face of lower-than-expected demand this year.

While overall figures fell month-over-month in September, industry employment was still up 3,700 jobs from a year. Growing wages and a declining nationwide unemployment rate factored into the increase.

The BLS industry-specific data lags national employment estimates by one month. Overall, employers added 250,000 jobs in October and the unemployment rate remained unchanged at 3.7%.

"In a strong report overall, the big news in this morning's October jobs report was the annual change in wage growth exceeding 3% for the first time since April 2009," Joel Kan assistant vice president of economic and industry forecasts at the Mortgage Bankers Association, said in a press release.

"At 3.1%, the year-over-year increase in average hour earnings followed a similarly strong increase in the wages component of the [Employment Cost Index] released earlier this week. This is a positive for the housing market, for which home price appreciation exceeding wage growth has been an issue in recent years," Kan added.

While rising wages may help consumers with affordability issues,

"We are averaging 212,000 jobs per month in 2018 to date — one of the strongest years for job growth in recent history — and in combination with the low unemployment rate, this will continue to push wage growth higher," Kan explained.

What's more, the trends in unemployment, wages and home prices are expected to continue in the upcoming year.

"We are seeing some deceleration in the rate of home price growth, but believe this is a healthy pause for the market, as it will allow income growth to catch up to the recent run-up in home values," Mike Fratantoni, MBA chief economist, said in a press release. "The unemployment rate will decrease to 3.5% by the end of 2019, which should continue to keep housing demand at a healthy level, ultimately leading to an increase in purchase originations."