Many consumers without traditional credit scores are nevertheless creditworthy and could qualify for mortgages, according to recently released research.

Millions of people considered unscoreable by conventional standards have credit profiles nearly identical to those with access to mainstream credit, the report claims.

The white paper comes from VantageScore, developer of the alternative credit scoring model that competes with the FICO score. The company has been trying unsuccessfully for a decade to persuade the government-sponsored enterprises, and more recently, their regulator, the Federal Housing Finance Agency, to approve the VantageScore model for use by mortgage lenders.

"I made my first call on Fannie Mae in October 2006," Barrett Burns, president and CEO of VantageScore Solutions, recalled in an interview.

Today, the alternative model is used by lenders, landlords, utility companies, telecom firms and other to determine the creditworthiness of otherwise unscoreable customers. Over the years, the model has scored about 35 million consumers who typically could not have been scored by conventional methods without reducing standards.

But Fannie Mae, Freddie Mac and more importantly, the FHFA, have yet to

In September, Fannie Mae began

Burns is hoping the white paper will "show why the FHFA needs to support" his company. "It puts to rest the notion that VantageScore is too high-risk," he said.

"Over 8 billion scores in one year is testament to lender recognition of the VantageScore model's predictive power, and its consistency across all three credit bureaus without lowering credit standards," he said.

The white paper demonstrates that many unscoreable consumers "are not outliers at all, but rather creditworthy, whose access to credit is unduly restricted" by the reliance on a conventional scoring model, Burns said.

The study analyzed a random sample of 5 million consumers representative of the U.S. population. It compared those with credit files that met the conditions required to obtain a conventional score with people who were excluded from conventional scoring because of the status of their credit files, but whose files were sufficient to obtain a VantageScore.

The study found that when additional demographic and financial information was used in conjunction with the Vantage model, those with thin or no credit files were "as creditworthy" as those with scoreable files.

Those who scored above 620 using the VantageScore "exhibited profiles of sufficient quality to justify mortgage loans on par with those of conventionally scoreable consumers," Burns said.

The research also showed that unscoreable consumers are often assessed as high risk, despite the possibility that they have strong financial foundations but are simply conservative users of credit. It also found that 76% of those with scores above 620 at the beginning of a two-year study period maintained scores above 620, and 7% with scores below 620 at the outset raised their scores above that level by the end of the study period.

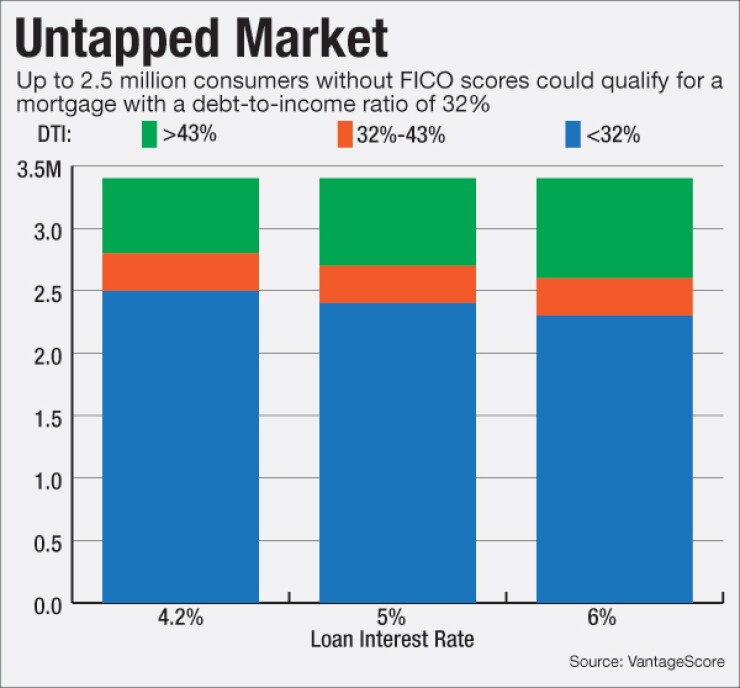

The FICO and Vantage credit scores are both based on a range of 300 to 850, but the readings are not identical because of the proprietary modeling that each company uses to generate consumers' scores. Using the Vantage model to assess the mortgage affordability of the unscoreable population in the study, 2.3 to 2.5 million — a majority of the 3.4 million people categorized as potentially eligible for a home loan — had sufficient income to support a mortgage is their particular geographic area, the company said.

The assumption that unscoreable consumers are too high risk to qualify for credit or don't need it "is false," said Sarah Davies, senior vice president of analytics at VantageScore. She called the study a "wake-up call" for lenders the need to choose their scoring model carefully "to ensure they see all creditworthy potential borrowers."

The average income of the expanded population is two-thirds of that of conventional consumers, the study found. And in light of their occupational profile, it said, those in the expanded group showed reasonable capacity for repaying debt in terms of income and income generation.

When people in the expanded population obtain mortgages, their average loan amount is about 12% below the average loan amount obtained by conventionally scored borrowers, the study also found. And the average loan term, 29 years, is in line with that of loans to regular borrowers, 27 years.