Flagstar Bancorp is interested in buying a small-to-midsized independent nonbank mortgage banker as part of a strategy to boost its retail origination volume.

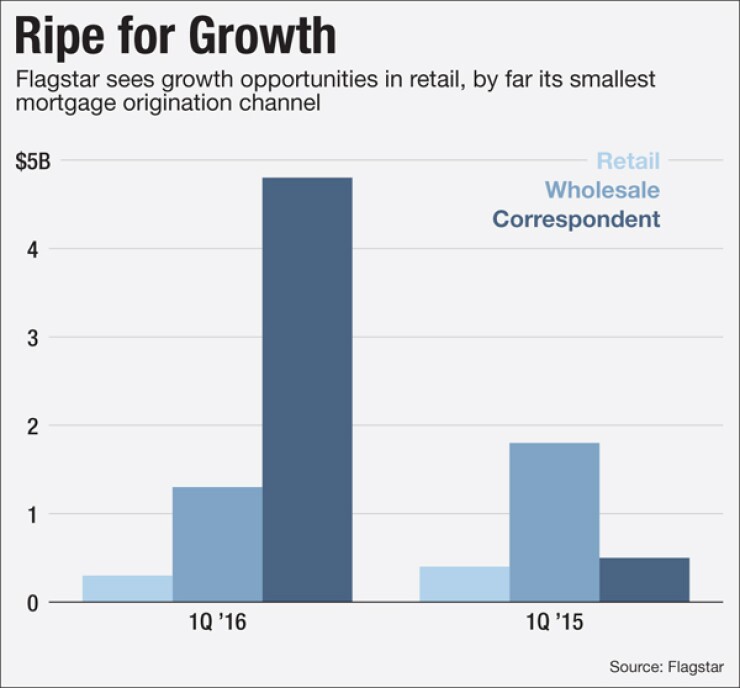

Retail is by far the smallest of the three production channels for the bank, just $300 million in volume for the first quarter, compared with $4.6 billion for correspondent and $1.3 billion in wholesale. The first-quarter retail production was flat compared to the fourth quarter of 2015 and down from $400 million in the first quarter of 2014.

But if Flagstar looked to grow the third-party originations business, "we are competing against ourselves. If we were to grow in third party, we have to cut our margins and I don't want to do that," said Flagstar's President and CEO Alessandro DiNello at an investor conference on Wednesday in New York.

Furthermore, in December, the Troy, Mich.-based bank said the TILA/RESPA integrated disclosure implementations are driving it to

Growing retail production makes more sense as purchase mortgage originations are expected to increase. It allows Flagstar to have "more pricing flexibility" on its production, he said during his presentation. And the company is looking to grow the retail channel both organically and through an acquisition.

Flagstar is operating under an Office of the Comptroller of the Currency

However, acquiring an independent mortgage banker is considered an asset purchase by the regulator and all Flagstar would need from OCC is a non-objection letter, DiNello explained after the presentation.

On the organic side, the company has been adding retail loan officers in recent months. Bank mortgage loan officers are

TRID had its biggest impact on Flagstar's mortgage broker channel, as originations went from $1.9 billion in the third quarter of last year to $1.4 billion in the fourth quarter and $1.3 billion in the first quarter. (In comparison, Flagstar's broker channel did $1.5 billion in both the third and fourth quarters of 2014 and $1.8 billion in the first quarter of 2015.) While there has been some recovery in broker originations, DiNello said "it is not a channel we are trying to actively grow."

But this does not mean Flagstar is turning away from the TPO business. Because of TPO, Flagstar has "1,200 originators who are partners of ours," with many having long-term relationships with the bank, he said.

Those that sell Flagstar their loans get their best execution for their product, although the company is not as aggressive on its pricing of jumbo mortgages as some of its