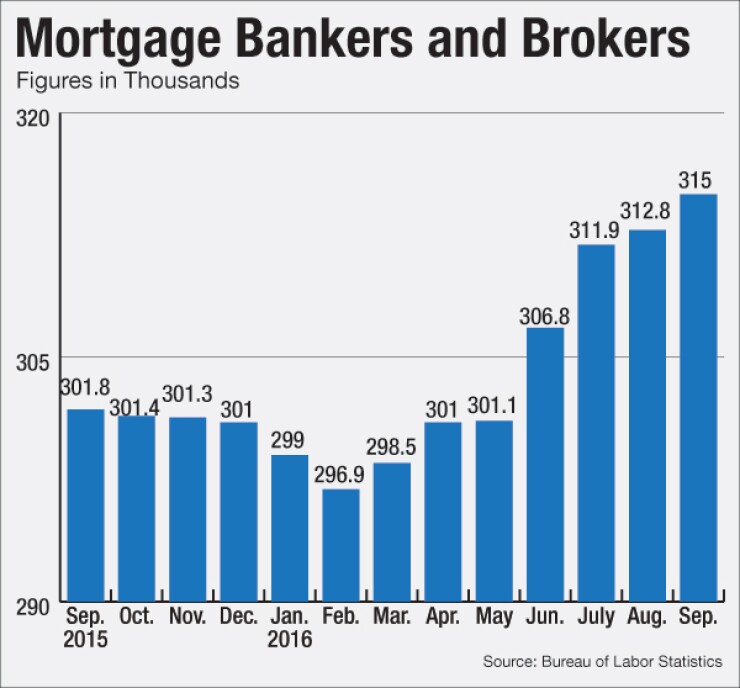

Hiring by independent mortgage firms accelerated in September after a slowdown in the prior month.

Nonbank mortgage lenders and brokers added 2,200 full-time employees to their payrolls in September,

This hiring comes at a time when forecasters are expecting a significant drop in refinancing activity next year, while home purchase originations are expected to rise by another 10% in 2017.

Lenders generally need more boots on the ground to compete in a purchase mortgage environment, as opposed to a refinancing environment, where borrowers will call their lender to ask about a refi. The Mortgage Bankers Association is forecasting a 40% drop in refinancing activity in 2017.

However, economic conditions will continue to favor new and existing home sales, according to MBA Chief Economist Michael Fratantoni.

"Strong household formation coupled with further job growth, rising wages and continuing home price appreciation will drive strong growth in purchase originations in the coming years," Fratantoni said in a press release.

Meanwhile, the U.S. economy created 161,000 jobs in October, compared to an upwardly revised 191,000 jobs in September, the BLS reported. The U.S. unemployment rate for October was unchanged at 4.9%.

The positive job news may finally give the Federal Reserve Board the gumption to raise interest rates, predicts Fannie Mae Chief Economist Doug Duncan.

"We believe that today's firm jobs report seals the deal for a rate increase in December," Duncan wrote in a note.

"The ammunition for a rate hike includes a solid job gain in October, meaningful upward revisions for the prior two months, and the biggest annual wage gain since June 2009," he said.

Only 156,000 new jobs were created in September, the BLS reported last month. There is a one-month lag in BLS reporting of mortgage industry jobs data.