Home equity lenders are putting more loans on the books, thanks to increasing property values, according to new research unveiled at CBA Live in Phoenix. But utilization rates are falling, not increasing, and older loans are paying off at a faster clip than lenders can replace them.

Housing values are the "primary drive" of increasing production in both home equity lines of credit and home equity loans, Shaun Richardson, senior vice president of the Icon Advisory Group, said in leading a discussion of the latest research by the Consumer Bankers Association's Home Equity Committee.

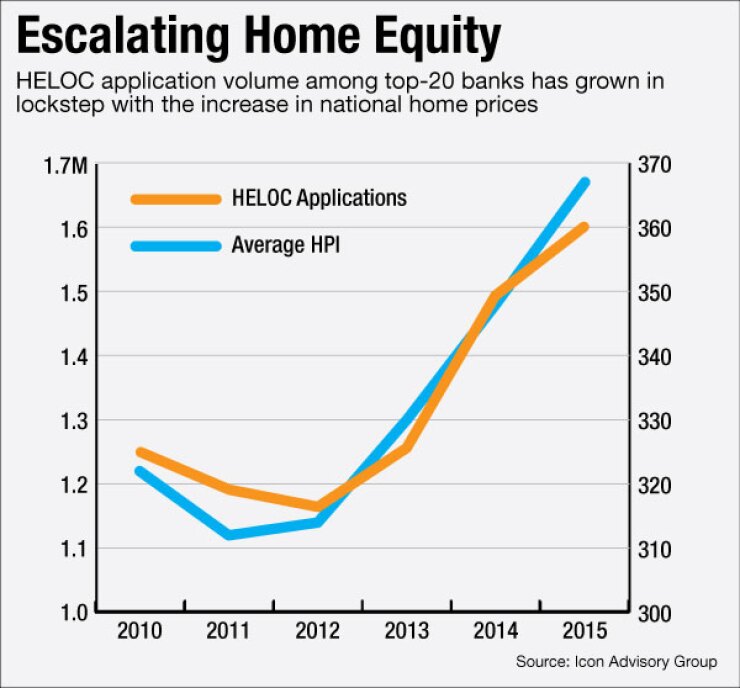

Applications are rising "just about in lockstep" with increases in the HPI, said Richardson. Icon Advisory Group operates the consortium that consists of bankers from 32 institutions who meet on a monthly basis. "Every 1% increase in the HPI leads to a 2.1% increase in applications."

The committee reported that despite increased volumes, the "runoff" of older loans has been between $1 billion and $2 billion a month between 2013 and 2015. "Loans paying down are not being offset by new originations," Richardson reported.

According to the report, the 2005-2008 vintage of loans represent 58% of lines of credit balances. But since 2008, 53% have been paid in full.

"We're trying to retain as much as we can, but it is challenging," commented committee member Thomas Parrish, head of retail lending product management at BMO Harris Bank.

Another challenge: Loans are not coming on at the same utilization rate as they once did, Parrish said. Consequently, despite higher balances at the outset, loans are paying down at a faster rate, meaning balances are lower at the end of the year, the committee said.

The panel also said average cycle times continue to climb, largely because there has been increased demand for appraisals "but fewer appraisers."

In 2011, it took roughly 34 days from the time an application was received until a loan was put on the books. Now, it takes an average of 56 days for a home equity loan and up to 80 days for a line of credit.

"A few loans can be done in 20 to 30 days," said Parrish. "But so many factors contribute to increased cycle time that the question becomes, 'How do we manage?'"

Panel member Sean Andrews, vice president and senior manager of consumer credit product at KeyBank, said one way his institution tries to lessen the time is to "engage" the borrower up front "at the time they become new customers" to obtain as much paperwork as possible in advance.

Commented another committee member, Jonathan Giles, senior vice president of mortgage and home equity product management at Wells Fargo & Co: "We all have to get better" at cutting cycle times. "Our customers will demand it."

The panelists said the largest increase in home equity lending demand has been for loans above $100,000 — 39% — followed by a 35% jump in loans between $51,000 and $100,000. Demand for loans at $50,000 or less hasn't increased at all, however.

"We'd like to see an increase at the low-end," said Giles. "I think it is another opportunity for all of us."

The committee reported that home equity borrowers have "very strong" credit profiles, with 78% having credit scores above 740.

Of the growth in lending, 87% have scores above 740 and 91% have combined loan-to-value ratios below 80%.

Parrish of BMO Harris and Andrews of KeyBank both said that while it is not a huge opportunity, their respective institutions are looking to fill in around the edges.

"Do applicants who don't quite fit the box go elsewhere?" asked Andrews. "These are our customers. If they are going to do business with someone else, what can we do to keep them?"

The panelists also decried the