The stock market's volatility during December helped to improve the potential for existing-home sales, although housing's performance remains well below its capacity, First American Financial said.

December's potential for existing-home sales increased to a seasonally adjusted annualized rate of 6.15 million, up by 0.3%

The report was released on Jan. 21, the day before the

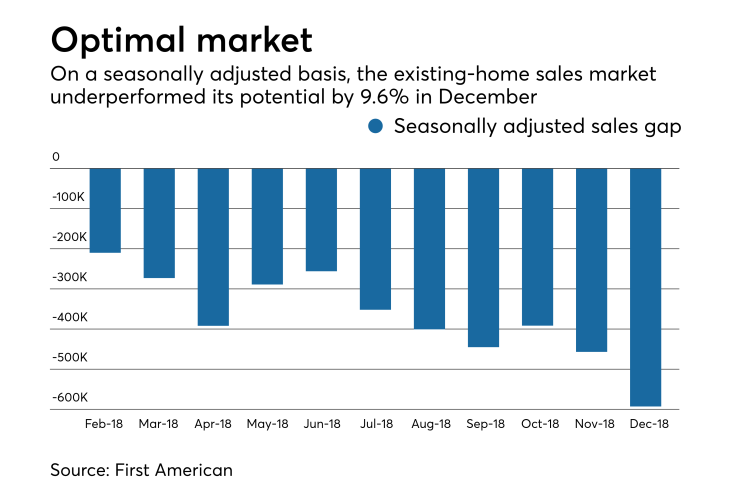

But existing-home sales are underperforming their potential by 9.6%. "Month-over-month, the gap between actual existing-home sales and the market potential for home sales narrowed by 2.1%, but the housing market still has the potential to support more than 593,000 additional home sales at a seasonally adjusted annualized rate," First American Chief Economist Mark Fleming said in a press release.

December's stock market volatility contributed to

"When the economy is doing well, investors prioritize investing in securities over bonds, driving higher longer-term Treasury yields, which also tends to increase mortgage rates," Fleming said. "In December, the opposite happened. A steep sell-off in U.S. stocks caused by investors seeking safe haven from

"In fact, the average 30-year, fixed-rate mortgage in December fell 23 basis points compared with the previous month. The decline in mortgage rates is a welcome relief to prospective homebuyers who have mostly experienced a year of rising rates and

Declining interest rates are not expected

"Uncertainty regarding world economic events and global trade agreements may lead to a further sell-off in equity markets, adding more downward pressure on mortgage rates. If this occurs, we can expect the market potential for existing-home sales to rise further," Fleming said.