Want unlimited access to top ideas and insights?

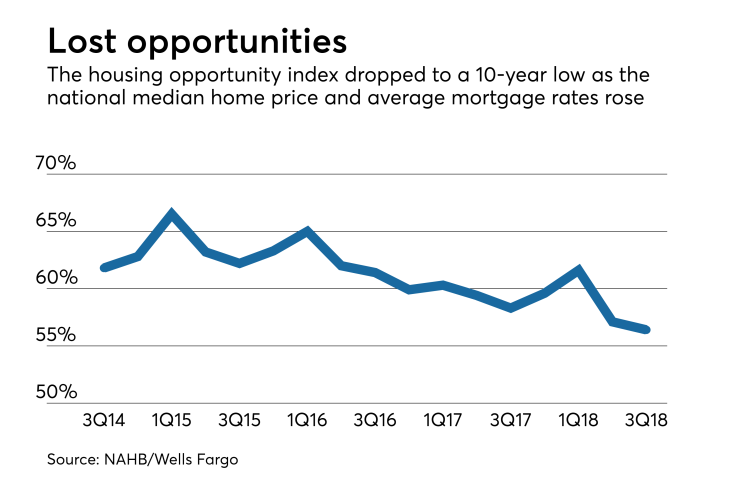

Rising median home prices and climbing mortgage rates pulled down affordability in the third quarter, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

The study found 56.4% of new and existing homes sold between the beginning of July and end of September were affordable to families earning the U.S. median income of $71,900. That's down from

The ongoing limited inventory combined with rising demand are pushing up home prices. Those factors, plus increasing interest rates strained affordability.

"Continuing home price appreciation and rising interest rates coupled with persistent labor shortages are contributing to housing affordability concerns," NAHB Chairman Randy Noel, a custom homebuilder from LaPlace, La., said in a press release. "Builders are increasingly focusing on managing home construction costs so that they do not outpace wage gains."

The national median home price jumped to $268,000, from $260,000 year-over-year, and rose from $265,000 in the second quarter. It's the highest median price since NAHB and Wells Fargo began recording this data in 1991. Mortgage rates also grew to 4.72%, the highest level since the third quarter of 2010. It's a year-over-year spike from 4.10% and a quarter-over-quarter gain from 4.67%.

"Ongoing job and economic growth provide a solid backdrop for housing demand amid recent declines in affordability," said NAHB Chief Economist Robert Dietz. "However, housing affordability will need to stabilize to keep forward momentum from diminishing as we move into the new year."

Syracuse, N.Y., was the most affordable major housing market in the U.S. for the second-consecutive quarter, with 88.2% of all new and existing homes sold were affordable to families earning the metro area's median income. Conversely, San Francisco was the least affordable for the fourth-straight quarter, with only 6.4% of sold homes affordable to median income families.