This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list,

The fourth quarter results integrated the operations of both Redfin and Mr. Cooper into Rocket Cos., with the deals likely contributing to the full year loss.

The sector has specialized data that experts can help with and may mitigate cyclical risk, but costs and customers are considerations, an industry veteran says.

-

The former two-time head of the Federal Housing Administration is an industry consultant since he left government service following Pres. Trump's first term.

-

The company also revealed more about the impacts of its data breach, and said it doesn't consider the development likely to materially affect its results.

-

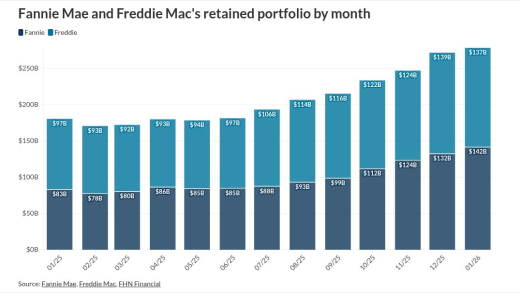

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

-

While overall delinquencies eased in January, foreclosure starts jumped to their highest point since early 2020, signaling growing strain among late-stage borrowers despite steady mortgage performance.

-

Senate Majority Leader John Thune, R-S.D., moved to consider the housing package next week, but it's not clear what version of the bill senators will be voting on as the House, Senate and White House are still negotiating priorities.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

War headlines failed to lift Treasuries; rates sold off, resistance held, and hedging beat rate bets, according to the Head of Correspondent Business Development at AD Mortgage.

-

Bond yields tested key resistance as markets largely shrugged at the data, according to the Head of Correspondent Business Development at AD Mortgage.

-

Bowman's Basel III relief may ease MSR capital but won't bring banks back; risk weights and economics still favor nonbanks, according to the Chairman of Whalen Global Advisors

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

-

Judges on the U.S. Court of Appeals for the District of Columbia struggled to find a resolution to an injunction issued last year that halted reductions-in-force by the Consumer Financial Protection Bureau.

-

The CFPB is in an existential legal brawl against it's own acting director, Russell Vought, and President Donald Trump, whose confirmed goal is to kill the agency.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-