Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Monday morning that the central bank will introduce two capital proposals that she said are aimed at boosting banks' role in the mortgage market.

Submit your production volume from last year to be considered among the top in your field. The deadline for submissions is Feb. 27, and the clock is already running.

From water damage to regulatory fines, learn the key risks facing vacant properties and how mortgage lenders can protect their real estate assets.

-

Toll Brothers Inc. fell short of analysts' estimates for quarterly orders, signaling that fewer people are signing contracts to build homes as high prices and economic uncertainty hold some buyers back.

-

Federal Reserve Chair nominee Kevin Warsh has several paths toward reducing the central bank's $6.6 trillion balance sheet but the process will be costly and lengthy, Wall Street strategists say.

-

Company veteran Austin Niemiec is running the wholesale arm after the departures of Fawaz, a prominent broker advocate, and general manager Dan Sogorka.

-

An index of market conditions from the National Association of Home Builders and Wells Fargo, in which below 50 means more builders see conditions as poor than good, edged down in February to 36, the lowest level since September.

-

An ugly legal dispute between two San Diego credit unions offers a warning about what can go wrong when careful relationship-building doesn't precede a marriage.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Treasuries rallied and broke key levels, but stubborn 5-year resistance still caps momentum and rate-cut expectations remain unchanged, the CEO of IF Securities writes.

-

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities.

-

Mortgage tech's speed is undermined by flawed credit data, causing costly fallout. Lenders must treat data accuracy as a pipeline risk, not a peripheral issue, according to the founder of Consumer Attorneys

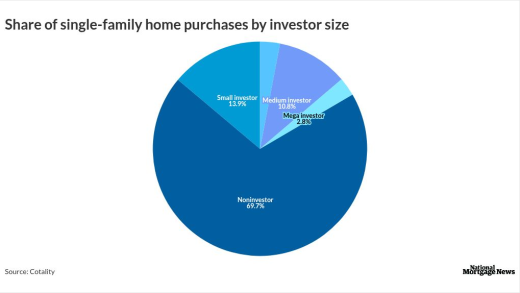

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-