A Maryland judge temporarily halted mass layoffs of probationary employees at multiple agencies, citing legal violations and harm to states' ability to respond to unemployment needs.

The combined companies, which originated three or fewer loans in the state last year, saw minor growth year-over-year, against an overall 41% drop in volume statewide.

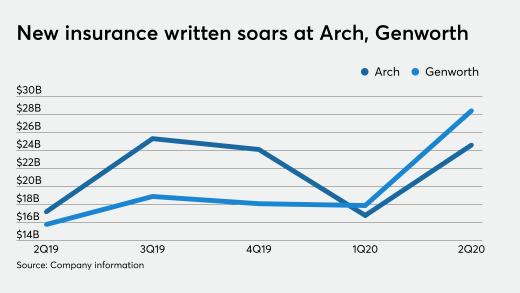

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

Rocket Companies confirmed it had reduced its workforce following the completion of its Redfin merger. The company also plans to discontinue Rocket Card on Sept. 8.

Choppy market conditions, including mortgage rates which remain elevated, had an impact on profitability at four of the nation's homebuilders in the quarter.

-

Mortgage delinquency rates improved during the month, but the share of borrowers late 90 days or more grew as FHA credit quality deteriorated.

-

Homebuilding industry CEOs said tariff impacts would likely be felt in the back half of the year, but affordability concerns are applying pressure now.

-

Sen. Dick Durbin, the Senate's No. 2 Democrat, announced he will not seek reelection in 2026, concluding more than four decades in Congress. The Illinois lawmaker leaves behind a notable imprint on U.S. financial policy, particularly regarding swipe fees.

-

The president said he had "no intention" of firing the Federal Reserve chair and promised that tariffs against Chinese imports would be lowered "substantially."

-

Federal Reserve Gov. Adriana Kugler said tighter monetary policy has proved to be less impactful on nonbank lenders during the post-pandemic era.

-

Long-maturity Treasury yields tumbled Wednesday as part of a broader rally in dollar-denominated risk assets, after US President Donald Trump said he wasn't inclined to fire the head of the Federal Reserve and suggested tariffs on Chinese imports could drop.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Often ignored is what the cost of additional oversight under the Consumer Financial Protection Bureau means to the consumer.

-

Bliss Sawyer is finally taking action on her idea to send birthday reminders to Realtors.

-

After insulting plumbers for a couple of weeks, I experienced a bit of karmic justice when I arrived home from my last round of travel.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland