Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

A government-sponsored enterprise and companies that sell them are making modern houses more affordable in line with larger public and private market trends.

Mr. Cooper is set to launch a pilot program by midyear, integrating previously released components into a unified platform.

Despite certain pronouncements otherwise, rumors of email's demise have been gravely exaggerated, as recent data shows it's not only still around, it's ubiquitous.

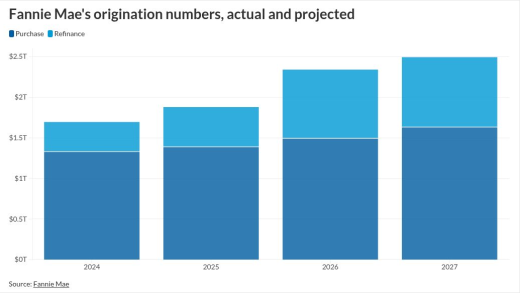

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

-

Refinance retention hit 28% last quarter, the highest percentage in three and a half years, according to ICE Mortgage Technology.

-

The National Defense Authorization Act will be voted on by the House without the housing package that passed through the Senate Banking Committee unanimously.

-

The Consumer Financial Protection Bureau's acting Director Russell Vought has an obligation to request funding for the agency, five former Federal Reserve officials said. Plus, three nonprofits sue Vought and the CFPB.

-

The bond market isn't buying President Donald Trump's idea that faster rate cuts will send bond yields sliding down and, in turn, slash the rates on mortgages, credit cards and other types of loans.

-

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

-

The class action suit doubles down on accusations that the homebuilder and its lending arm are deceiving borrowers about their monthly mortgage payments.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

We need to be doing everything possible to ensure those that needed down payment assistance are able to keep their homes during this crisis and beyond.

-

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

-

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from Matic

- Partner Insights from FormFree

- Partner Insights from DocMagic

- Partner Insights from Cloudvirga