Mortgage prepayment speeds may rise with the strong U.S. rate rally, and that may be cause for alarm for mortgage investors.

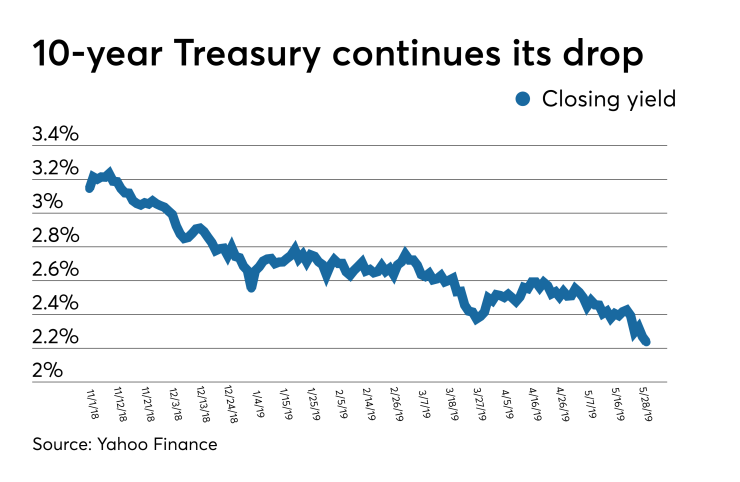

Aggregate prepayment speeds for the Fannie Mae 30-year universe have risen by 10%, 25% and 24% over the last three reports. Now, a rally that has pushed U.S. 10-year Treasury yield to 2.21%, its lowest level since September 2017, and a Freddie Mac 30-year mortgage rate lower for four consecutive weeks may spark more refinancings if sustained.

Every 12.5 basis points drop in headline mortgage rates pushes another $200 billion of conventional mortgages into having at least 50 basis points of refinancing incentive, Scott Buchta, head of fixed-income strategy at Brean Capital, wrote in a client note. He expects convexity hedging flows to pick up substantially should primary mortgage rates fall below 4%.

It isn't all bad news for mortgage investors. Bondholders already long specified pools that are designed to protect from a spike in refinancings would benefit from a sustained rate rally, which may help those securities maintain or increase in price. That is especially the case for 30-year conventional 4% and 4.5% pools. That is where the highest risk for a surge in prepayments is thought to be concentrated.

In addition, delivered 3.5% 30-year conventional TBA sported a gross WAC of 4.48%, according to a May 17 report from Wells Fargo & Co., putting them on the cusp of the refinancing window.

The higher ability to refinance is reflected in the Bloomberg Barclays U.S. MBS index duration. It now sits at 3.64 years, down from a recent high of 4.47 on April 22 and at its lowest level since November 2016, according to data compiled by Bloomberg. Its trailing one-year average is 4.92 years.

Duration, a measure of a security’s price sensitivity to a change in interest rates, will drop on the assumption that principal payments on a given bond will be received earlier than expected. That's what happens with mortgage-backed securities. As rates decline homeowners are expected to refinance into lower rates and pay off their previous loans.