-

States warn that eliminating the BRIC program could leave rural areas vulnerable to extreme weather.

July 16 -

While congressional leaders fight over what to include with the $12 billion slated for FEMA, others feel that the reliance on FEMA and the federal government for disaster relief may begin to change.

September 6 -

A congressional hearing on reforming the National Flood Insurance Program focused on whether mortgage companies need to disclose incremental risks even if a homeowner lives outside a federally designated floodplain.

June 17 -

The Buffalo, N.Y., bank will pay a $546,000 penalty, which will be passed on to the National Flood Insurance Program to help offset costs.

October 15 -

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28 -

Shannon King, a single mother, left the Bay Area a decade ago as housing costs soared, hoping to find an affordable place to live in southern Oregon.

September 21 -

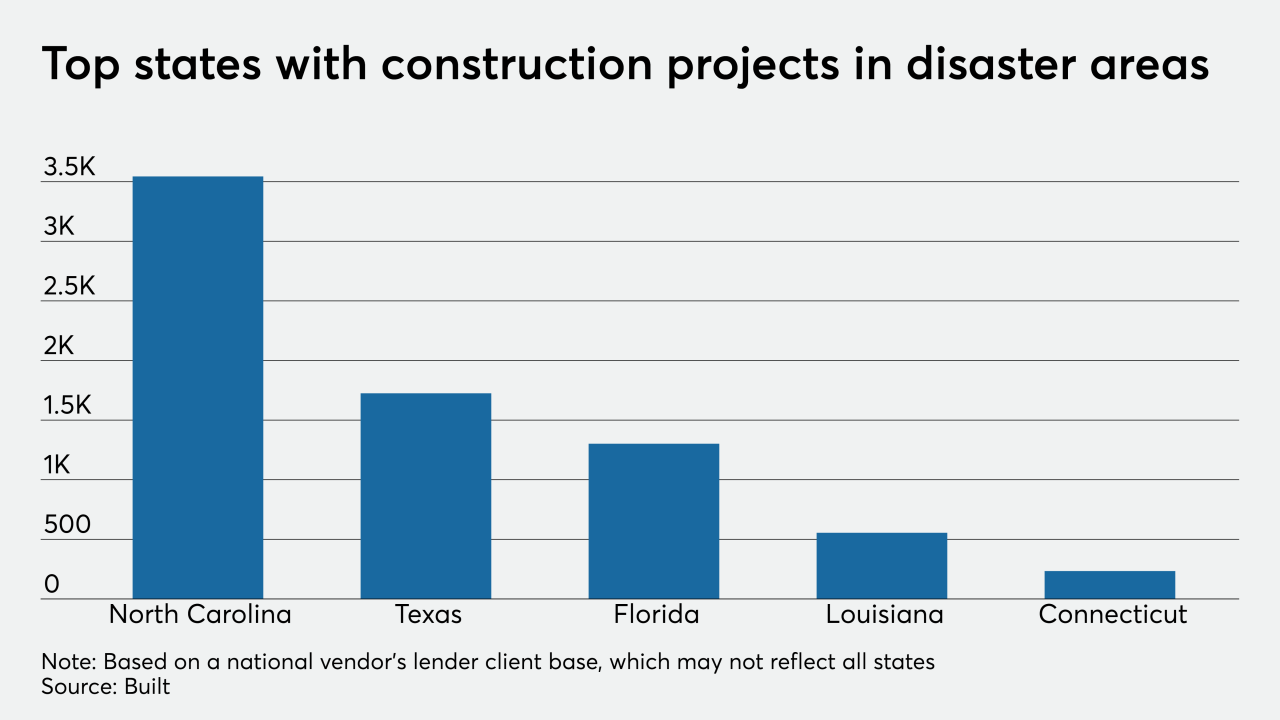

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

Columbus, Ohio, has nearly triple the number of properties at risk of flooding than are currently reflected on federal flood-plain maps, according to a new modeling tool.

June 30 -

County homeowners may be eligible for federal assistance in the form of low-interest loans rather than grants.

May 25 -

Scores of homes destroyed or badly damaged by Memorial Day tornadoes still sit vacant and abandoned, creating new blight and safety concerns in neighborhoods.

December 30 -

A group of 64 House lawmakers is pushing congressional leadership to incorporate premium caps and address a new methodology for assessing risk in flood insurance reform legislation.

November 1 -

Florida courts have held that a home seller must disclose anything about the property that could have a "substantial impact" on its value, but it's unclear if that ruling could apply or has ever been applied to flood hazards.

October 24 -

As the climate crisis worsens, more Americans will be forced from their homes. Many won't be able to afford it, and the U.S. isn't prepared for a massive, government-subsidized migration away from flood-prone areas.

October 9 -

Lori Rittel is stuck in her Florida Keys home, living in the wreckage left by Hurricane Irma two years ago, unable to rebuild or repair. Now her best hope for escape is to sell the little white bungalow to the government to knock down.

September 20 -

Damage from Hurricane Dorian's storm surge has the potential to affect 668,052 homes, according to CoreLogic's latest analysis. Reports estimate a worst-case total of $144.6 billion in reconstruction cost value.

August 30 -

Black Knight created a pair of tools for its MSP servicing system in order to help mortgage services identify loans in their portfolio tied to areas affected by natural disasters.

July 22 -

The House Financial Services Committee debated legislation Wednesday to reform and reauthorize the National Flood Insurance Program, but no clear solution emerged.

March 13 -

With a number of affected borrowers, Freedom Mortgage has assembled a team dedicated to providing assistance for homeowners struggling to make mortgage payments.

January 14 -

The announcement rescinded the agency's earlier guidance issued to industry partners to suspend sales operations as a result of the current lapse in funding from Congress.

December 31 -

Lawmakers and industry groups were caught off guard when FEMA said it wouldn't issue flood insurance policies during the government shutdown, despite an extension passed last week.

December 27