Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

An improved economy, a healthy labor market and the large population of millennials should have accelerated home sales much higher, but all hope for more transactions this year is not yet lost, according to the NAR.

August 20 -

Credit Karma is diving into the mortgage industry with a plan to acquire digital mortgage startup Approved, a provider of consumer-facing online point of sale technology.

August 17 -

Here's a look at the cities where house hunters and sellers have been the busiest during this summer's home buying season.

August 16 -

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

The reliance on nonconventional financing to fund new single-family housing is dropping, with the share accounting for less than a third of the market for the second year in a row.

August 13 -

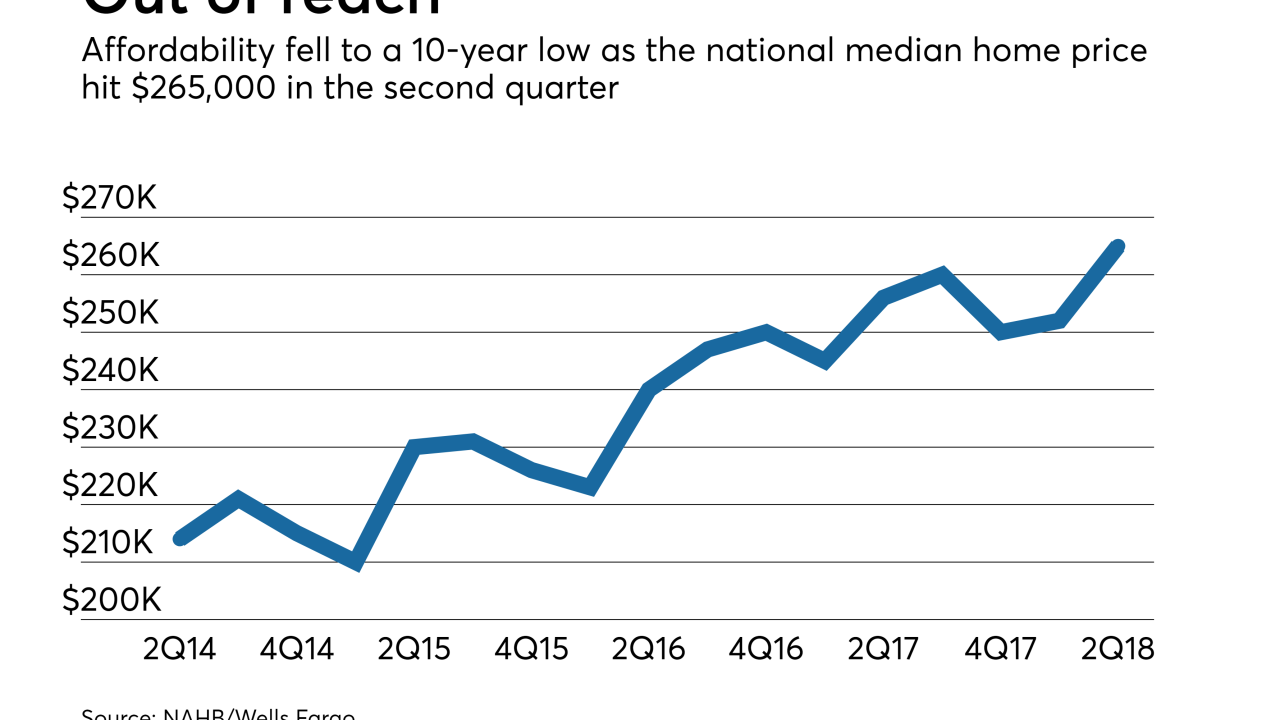

Housing market conditions pushed affordability to a 10-year low in the second quarter, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

August 10 -

From Denver to Pittsburgh, here's a look at the top 10 housing markets where homeowners are taking advantage of home improvement loans.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

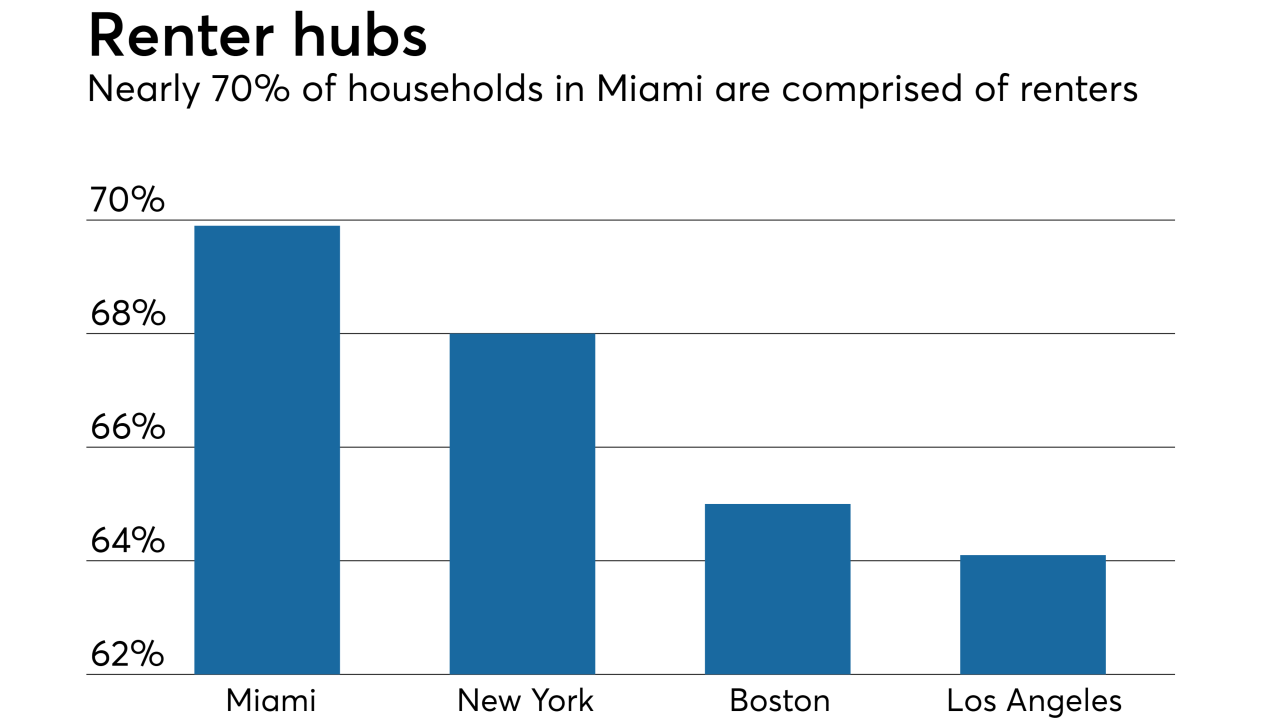

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

Growth in home prices continued wearing down affordability at the start of the season, preventing first-time buyers from entering the housing market.

August 7 -

From Washington to Baltimore, here's a look at the 12 best housing markets for homebuyer purchasing power, where median house values and mortgage rates are more favorable.

August 6 -

The 55+ housing market showed continued strength in the first quarter on healthier economic conditions, but high lumber prices are causing hurdles for homebuilders trying to keep up with consumer demand.

August 3 -

Housing markets with the strictest land-use regulations saw home price appreciation shoot up by more than double the rate of those with lighter regulations, despite similar job growth, according to Zillow.

August 2 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

CoreLogic has updated its Risk Quantification and Engineering tool amid California wildfires to include U.S. Wildfire and U.S. Severe Convective Storm models to support the mortgage and insurance industries in better assessing natural disaster risk.

July 31 -

Homebuilding industry leaders are pledging to train more laborers as part of an executive order from President Trump, marking an important step forward for the residential construction sector.

July 30 -

International activity in the U.S. real estate market plummeted as foreign homebuyers are competing with domestic purchasers for a limited supply of homes, according to the National Association of Realtors.

July 27 -

Tight home supply remains a top challenge for house shoppers, but the slowing pace in which inventory is declining could signal more favorable conditions for homebuyers.

July 26 -

As regulators move forward with policy changes designed to curb so-called refinance churning of Department of Veterans Affairs-insured mortgages, concerns have surfaced about the fate of loans originated during the transition period.

July 25