Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

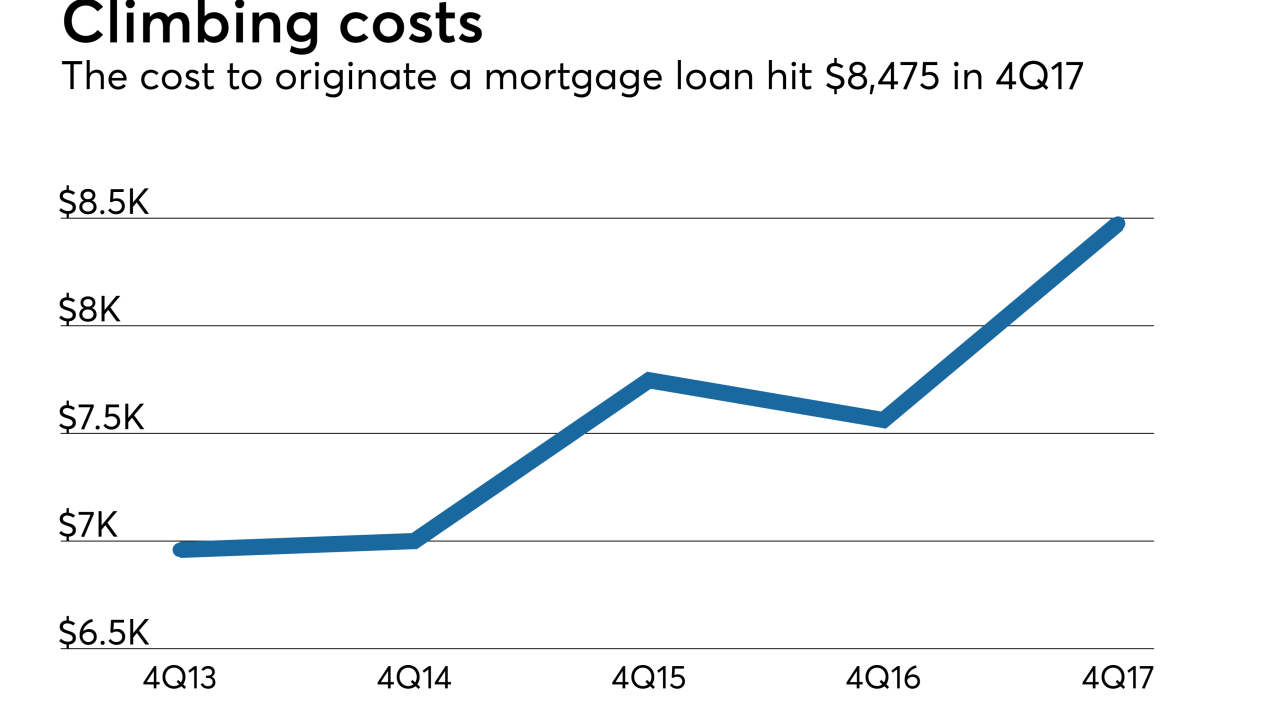

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

Historically, mortgage delinquencies in the month of April have risen 85% of the time, but April 2018 bucked that trend as they fell, according to Black Knight.

June 4 -

While all cities show signs of healthy mortgage competition nationwide, some areas have higher concentrations of lender activity but also face varying degrees of competitiveness based on loan type, according to LendingTree.

June 1 -

Remax Holdings is focused on "what it does best" with its Motto Mortgage business and in facing off against Zillow's new home buying and selling initiative, a company executive said.

May 31 -

While the rate of underwater borrowers continues to decline, many cities still struggle with a deluge of homeowners with so little equity that they have limited incentive or ability to put their homes on the market.

May 30 -

From D.C. to Chicago, here's a look at the 12 cities where homebuyers are getting the best bang for their housing buck.

May 29 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16 -

From location and age to gender and price point, here's a look at how demographic differences influence homebuyer confidence about saving for a down payment.

May 15 -

Despite a healthier economy, growing household income was not enough to make an impact on home sales as the market still suffers from historically low levels of inventory.

May 14 -

While consumer debt is growing overall, borrowers are exhibiting more caution when it comes to mortgage loans, according to LendingTree.

May 11 -

The home buying season is already shaping up to be especially competitive this year, as rising prices and mortgage rates are putting a damper on purchasing power in many once-affordable housing markets.

May 10 -

As the American population migrates to the suburbs and midsize cities, mortgage lenders and real estate professionals must re-examine their customer relationship management and lead generation strategies to better serve potential borrowers.

May 9 -

The mortgage market continued to perform well in the first quarter as delinquencies declined annually for the 19th straight quarter, according to TransUnion.

May 9