Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

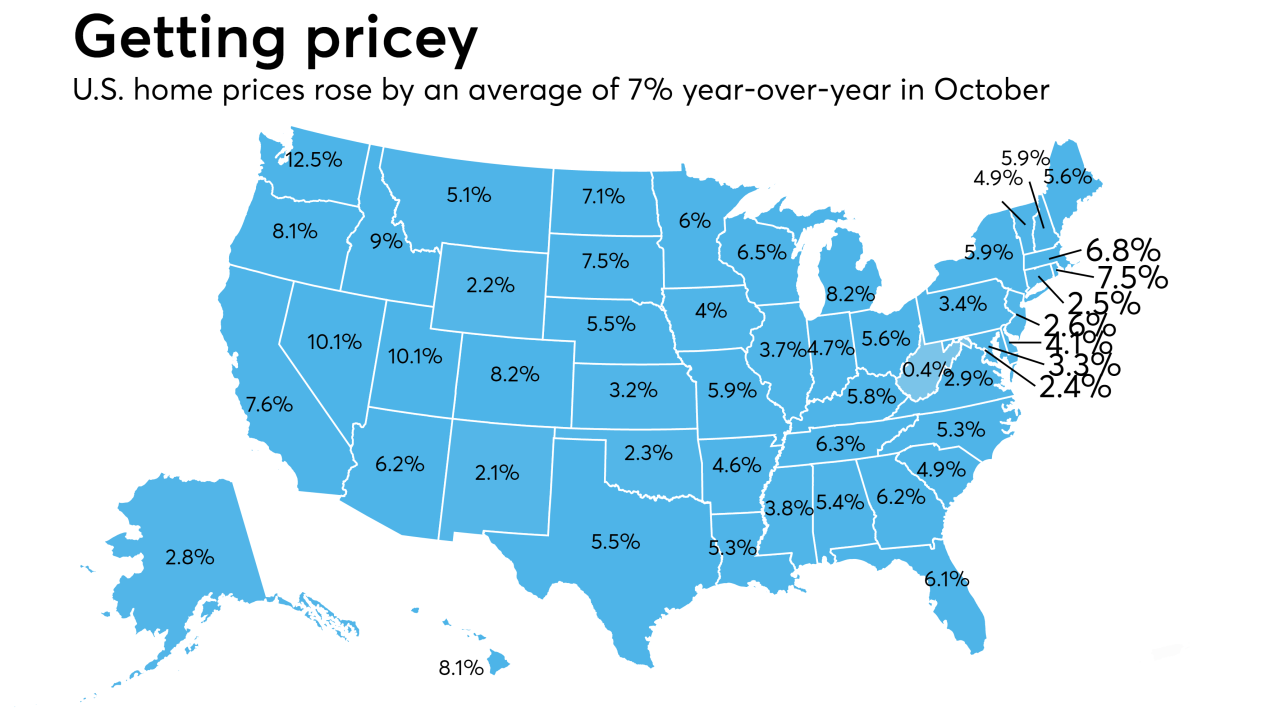

Home prices in October increased by 7% year-over-year for the second consecutive month, according to CoreLogic.

December 5 -

Newfi Lending is now approved by Fannie Mae as a seller/subservicer and by the Federal Housing Administration as a "Full Eagle" Mortgagee.

December 4 -

Here's a look at the 10 cities where strong employment and for-sale inventory are expected to keep housing markets bustling with activity during the normally slow year-end months.

November 30 -

After 10 years of operation, RoundPoint Mortgage Servicing Corp. has launched a retail mortgage lending division.

November 30 -

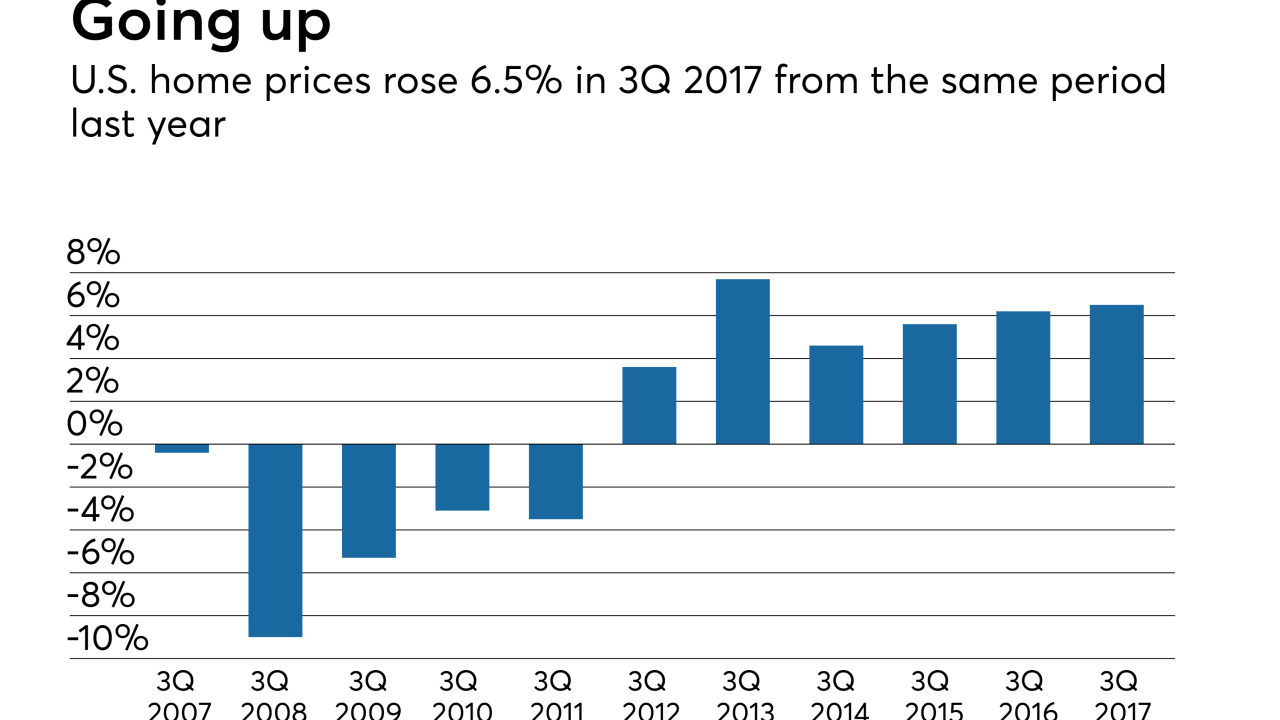

Home prices rose again in the third quarter, where they showed little evidence of slowing down, according to the Federal Housing Finance Agency.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

Developer confidence in multifamily production weakened in the third quarter to its lowest reading since 2011, according to the National Association of Home Builders.

November 27 -

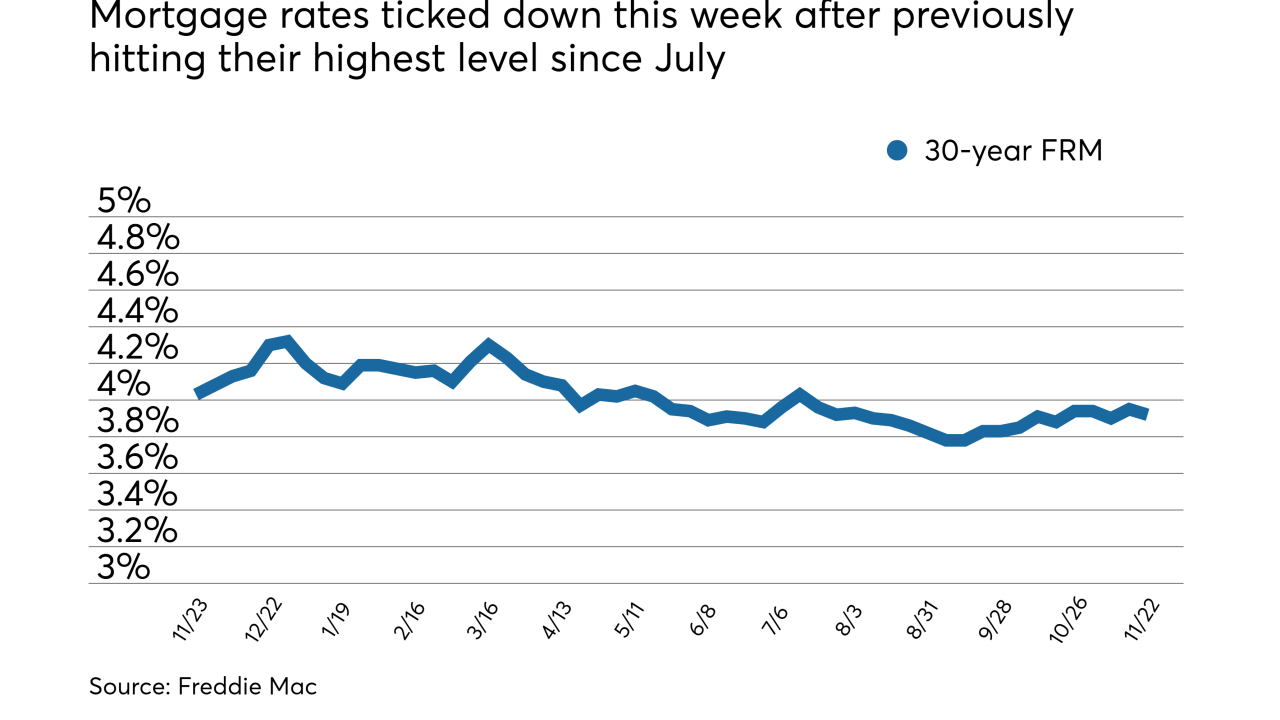

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

The housing market has been underperforming its potential since May, and October's performance gap was the largest it's been since November of last year, according to First American Financial Corp.

November 21 -

Mortgage Contracting Services will acquire Carrington Home Solutions' property preservation division in a deal expected to close by the end of the year.

November 20 -

Built Technologies successfully completed a capital raise, enabling the three-year company to expand its software offerings for both commercial and residential construction lenders.

November 20 -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

There were 1.4 million fewer properties seriously underwater in the third quarter, marking the largest year-over-year drop since the second quarter of 2015, according to Attom Data Solutions.

November 16 -

Many have speculated that low refinance rates have been preventing homeowners from selling, but this factor is less consequential than expected, according to ValueInsured.

November 15 -

Appraiser and homeowner opinions on home values continue to converge, with the gap between the two viewpoints narrowing for the fifth consecutive month.

November 14 -

Home prices have returned to the boom levels of 10 years ago, which originally signaled the bursting of the housing bubble and the onset of the Great Recession, but today's market is notably different, according to realtor.com.

November 13 -

After nearly five years of being the nation's least affordable housing market, San Francisco was surpassed by another California city as the national median home price increased, according to the NAHB/Wells Fargo Housing Opportunity Index.

November 10 -

With home values projected to rise in every major U.S. metro in 2018, a 20% down payment will cost thousands of dollars more, according to Zillow.

November 9