Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

Millennial homeowners took advantage of April's drop in mortgage rates by quickly securing refinance loans, which closed faster than purchases for the first time since March 2016, according to Ellie Mae.

June 5 -

Homeowner remodeling spending should moderate across the majority of the nation's largest metropolitan areas as home price appreciation cools, according to the Joint Center for Housing Studies of Harvard University.

June 4 -

Wells Fargo hired two seasoned veterans for their mortgage technology and data security expertise amid a digital era for financial industries.

May 29 -

The exurbs were the only area that posted annual growth in new single-family home permits in the first quarter, highlighting an ongoing affordability battle for homebuyers and builders looking for land, according to the NAHB.

May 28 -

Calls for getting more women into leadership positions, and strategies for achieving that, dominated the LEAD conference in New York.

May 25 -

Generation X is in its prime earning years, but the financial profiles of those renting are distinctly different from those who own a house, according to LendingTree.

May 20 -

Mortgage activity plunged before the start of the year, but subprime originations dropped the least, according to TransUnion. Despite dwindling volume, borrower delinquency rates hit historic lows in the first quarter.

May 16 -

Affordability got better for mortgage borrowers at the start of 2019, but housing inventory constraints limited the degree of improvement, according to the National Association of Home Builders and Wells Fargo.

May 10 -

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

Consumer expectations of further mortgage rate drops leaves them seemingly in no rush to enter the purchase market which could be why their optimism on home buying is falling, a Fannie Mae report said.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

JPMorgan Chase's Corporate Client Banking and Specialized Industries Mortgage group is now accepting electronic promissory notes as collateral to fund warehouse loans.

May 2 -

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

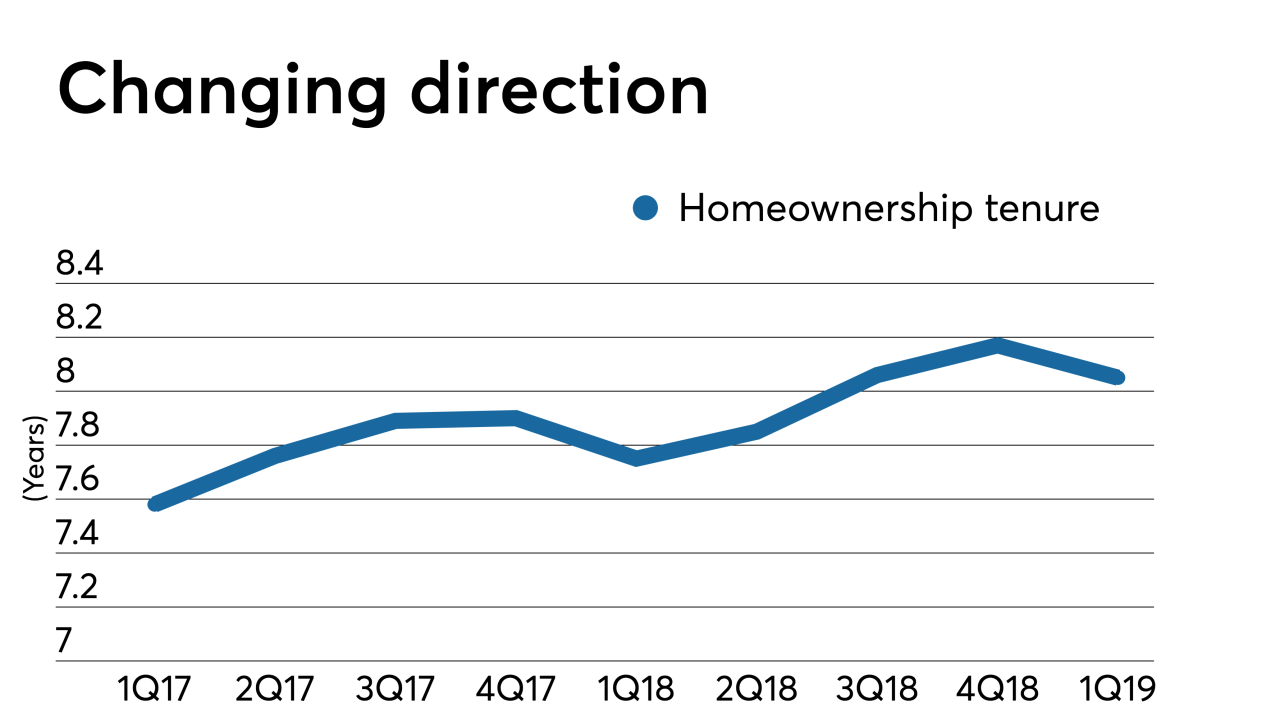

Remodeling activity stepped up in recent years as homeowners stayed put for nearly twice as long as before the housing bubble burst, but several forecasts point to a potential slowdown on the horizon, which is a welcome sign for the mortgage business.

April 30 -

Homeownership tenure took a dip at the start of the year as the housing market cooled off. And while improved affordability helps, consumers are still staying put for nearly twice as long as they were before the crisis.

April 26 -

Plenty of homeowners succumbed to foreclosure when the housing bubble burst, but the effects on Hispanic and black communities in particular were heightened, with many still suffering, according to Zillow.

April 25 -

Quicken Loans parent company Rock Holdings is strengthening its investments in the Canadian market by acquiring a majority stake in Lendesk, a Vancouver-based mortgage fintech.

April 24 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

The mortgage industry identified two technology initiatives it claims have the greatest potential to improve processes and be the most broadly adopted over the next two years, according to Fannie Mae.

April 23