-

Blackstone's real estate affiliate and property management firm SITE Centers Corp. acquired the 12 centers across seven states in 2014.

By Glen FestJune 21 -

The unrated notes being issued by the FREMF 2019-KG01 Mortgage Trust are backed entirely by workforce housing loans for green-friendly upgrades of older apartment buildings that fulfill affordable housing needs in communities.

By Glen FestJune 21 -

The loan covering single-tenant distribution/fulfillment centers is the largest obligation in the transaction being rated by four agencies.

By Glen FestJune 20 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

By Glen FestJune 14 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

By Glen FestJune 12 -

The pool of 497 loans includes first-lien fixed- and adjustable-rate mortgages for single-family homes and multifamily properties, primarily underwritten to self-employed borrowers.

By Glen FestJune 10 -

The transaction, cooperatively sponsored by the insurer's residential mortgage lending group of five home-loan entities, is among the smaller of AIG’s recent prime jumbo pools that have been as high as $429 million.

By Glen FestJune 7 -

The investment research firm plans to merge DBRS' ratings business with its existing Morningstar Credit Ratings Service.

By Glen FestMay 29 -

Kroll Bond Rating Agency assigned the AAA to HERO Funding 2018-1 due to higher-than-expected prepayment rates on residential PACE levies.

By Glen FestMay 23 -

The $161.5 million transaction backed by leasehold interests in the Jimmy Buffett-themed luxury hotel will include a $49.3M cash-out payment to the Denver-based PE firm.

By Glen FestMay 20 -

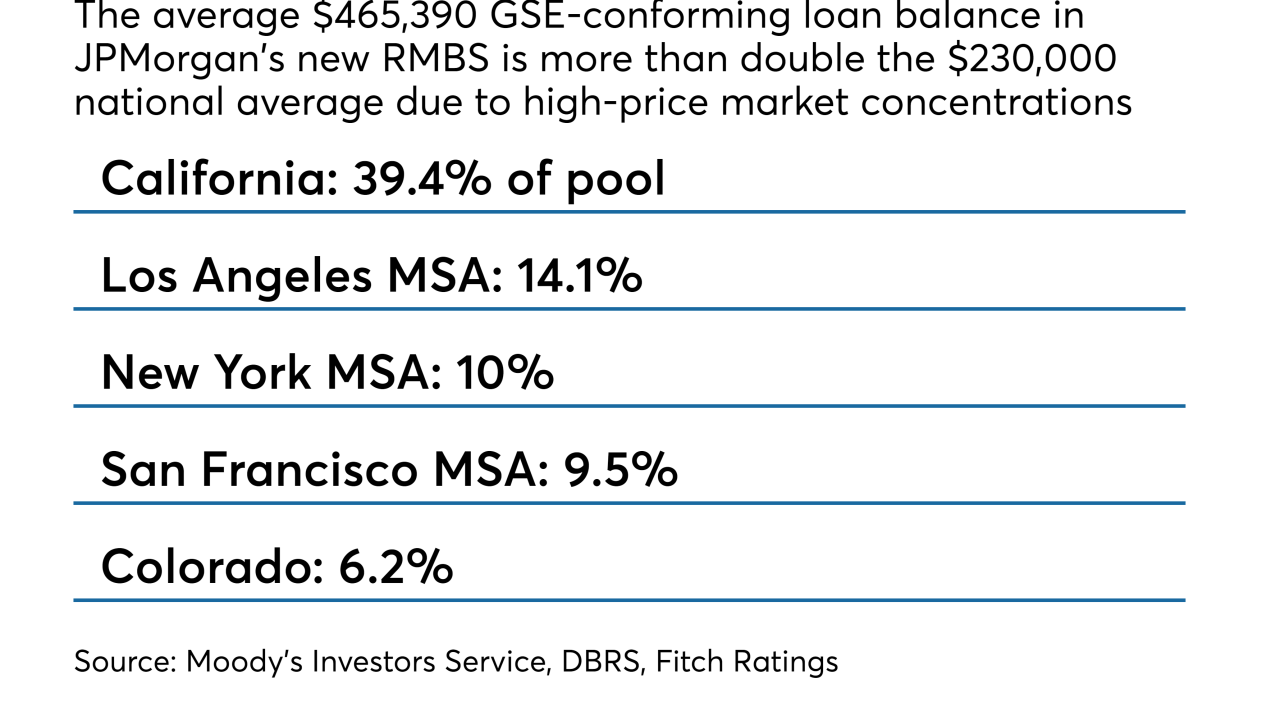

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

By Glen FestMay 14 -

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

By Glen FestMay 8 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

By Glen FestApril 30 -

A renovated office complex in Florida and a recently built Great Wolf Lodge resort in Orange County make up two of the largest loans in Wells Fargo's latest conduit.

By Glen FestApril 25 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

By Glen FestApril 23 -

Investors include New Orleans sports franchise owner Gayle Benson, placing the hotel under local ownership for the first time since it was built in 1976.

By Glen FestApril 16 -

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

By Glen FestAugust 15 -

TPG Capital is including its newly acquired first-lien interest in a Microsoft-leased office campus in Redmond, Wash., in a portfolio of suburban office properties it is financing through a new two-year commercial loan.

By Glen FestAugust 13 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

By Glen FestJuly 10 -

The Sunshine State accounts for 10.5% of the $147.3 million transaction, which is also Renew's first under its new chief executive (and former chief financial officer) Kirk Inglis.

By Glen FestJune 11