-

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

By Glen FestMay 14 -

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

By Glen FestMay 8 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

By Glen FestApril 30 -

A renovated office complex in Florida and a recently built Great Wolf Lodge resort in Orange County make up two of the largest loans in Wells Fargo's latest conduit.

By Glen FestApril 25 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

By Glen FestApril 23 -

Investors include New Orleans sports franchise owner Gayle Benson, placing the hotel under local ownership for the first time since it was built in 1976.

By Glen FestApril 16 -

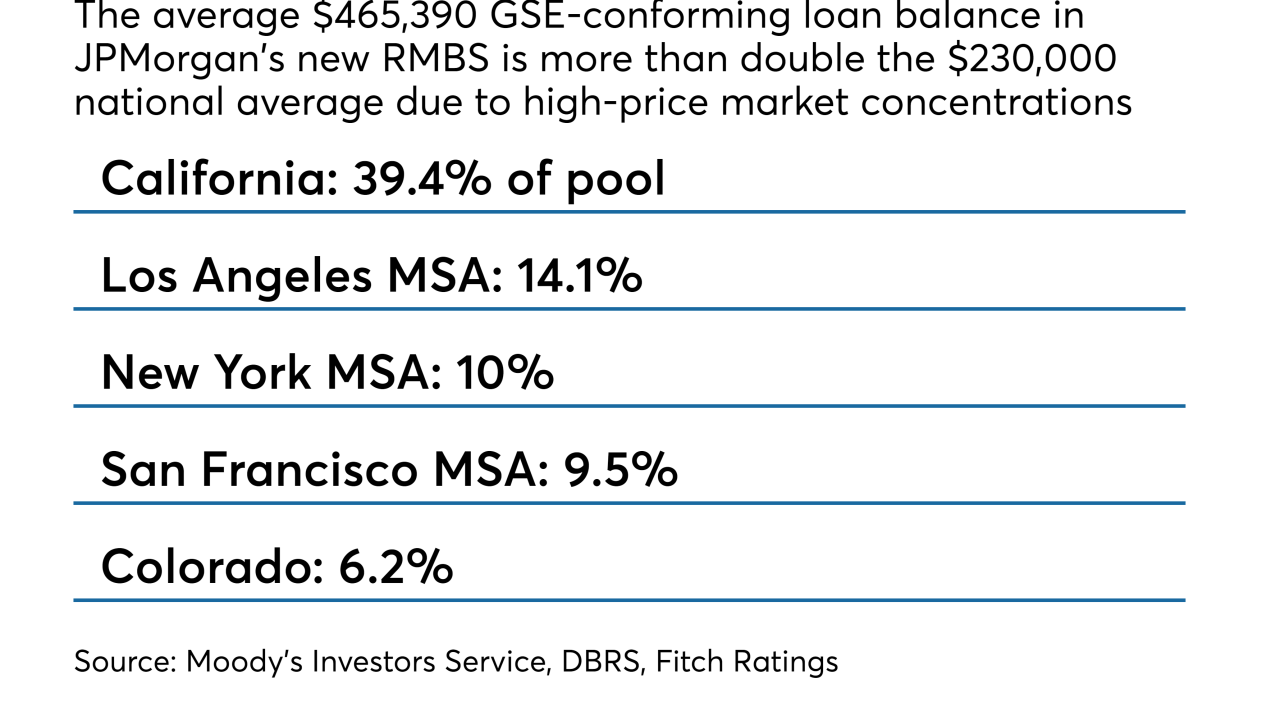

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

By Glen FestAugust 15 -

TPG Capital is including its newly acquired first-lien interest in a Microsoft-leased office campus in Redmond, Wash., in a portfolio of suburban office properties it is financing through a new two-year commercial loan.

By Glen FestAugust 13 -

The $109.3 million CLEAN 2018-1 is also the first deal to be marketed as a Rule 144A transaction under securities regulation making it available to wide base of institutional investors.

By Glen FestJuly 10 -

The Sunshine State accounts for 10.5% of the $147.3 million transaction, which is also Renew's first under its new chief executive (and former chief financial officer) Kirk Inglis.

By Glen FestJune 11 -

The increase in the delinquency rate for securitized CRE loans for March ended an eight-month streak of declines.

By Glen FestApril 3 -

The non-bank lender's $299.8 million prime, high-balance deal is no surprise; it follows a warehouse securitization last year. Angel Oak is also in the market with a $238.8 million deal.

By Glen FestMarch 28 -

Acting commissioner Dana Wade said the agency is "vigilantly" watching whether it needs to take action on PACE assessments placed on mortgages after they are endorsed by the agency.

By Glen FestFebruary 27 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

By Glen FestFebruary 8 -

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

By Glen FestJanuary 12 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

By Glen FestDecember 28 -

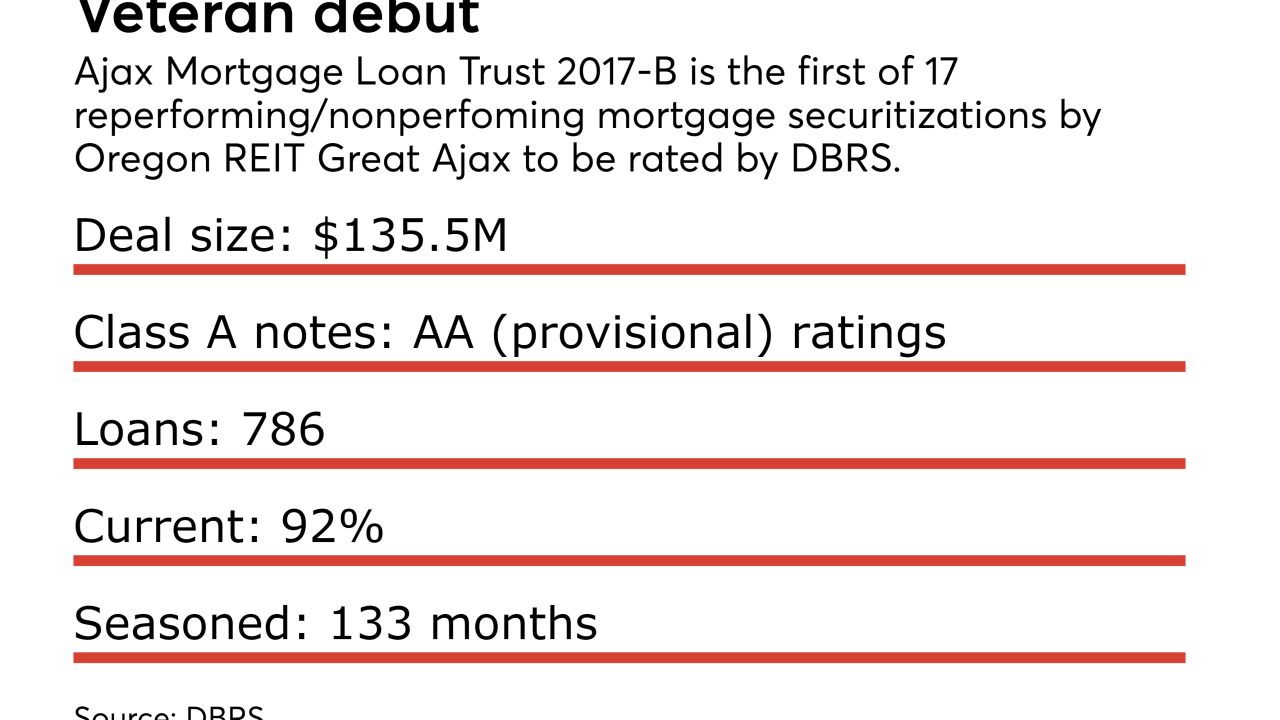

The real estate investment trust has already completed 16 unrated offerings of bonds backed by legacy loans that were once delinquent; those prior deals were backed by more deeply distressed loans.

By Glen FestDecember 15 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

By Glen FestDecember 12 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

By Glen FestDecember 11 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

By Glen FestDecember 7